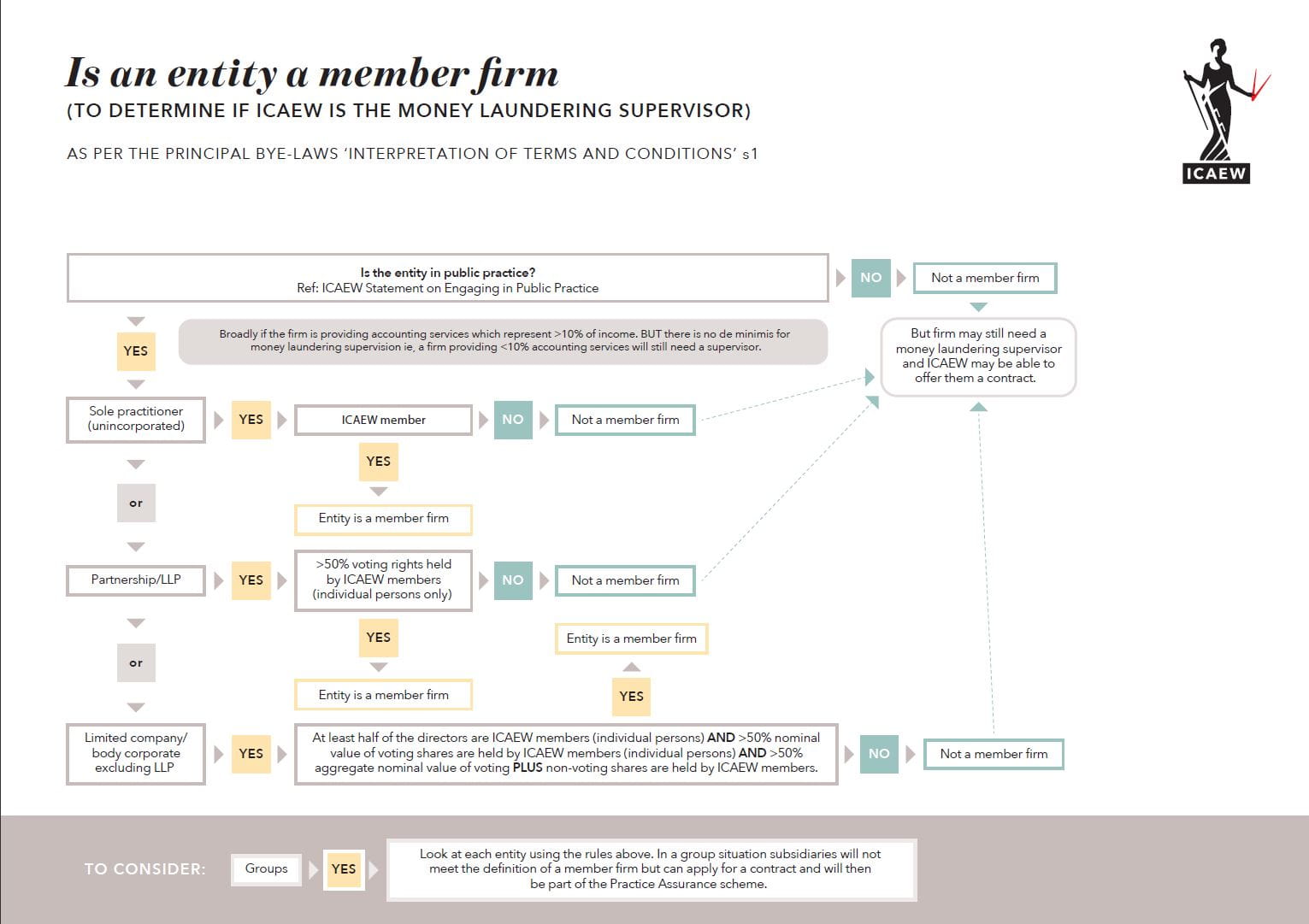

If the voting rights or shares in an accountancy practice (regulated or unregulated) are held by a corporate body, you need to carefully assess if it meets the ICAEW member firm definition set out in the Principal Bye-laws.

An ICAEW member firm is:

- a member engaged in a public practice as a sole practitioner; or

- a partnership engaged in public practice of which more than 50 per cent of the rights to vote on all, or substantially all, matters of substance at meetings of the partnership are held by members; or

- a limited liability partnership engaged in public practice of which more than 50 per cent of the rights to vote on all, or substantially all, matters of substance of the partnership are held by members; or

- any body corporate (other than a limited liability partnership) engaged in public practice of which 50 per cent or more of the directors are members; and more than 50 per cent of nominal value of the voting shares is held by members; and more than 50 per cent of the aggregate in nominal value of the voting and non-voting shares are held by members.

Please note: new guidance came into effect on 1 January 2024. You can view the guidance here: ICAEW Statement on Members Engaging in Public Practice.

ICAEW member firms are automatically subject to Practice Assurance and money laundering supervision by ICAEW.

There are some common situations where firms find that they do not qualify as a ‘member firm’ under the Principal Bye-laws, including where a firm is a subsidiary of another corporate entity, irrespective of the ownership and activities of its parent.

If your firm is not a member firm under the definition in the Principal Bye-laws, we may still be able to supervise you for anti-money laundering under a contractual arrangement. If you think you might need a contract, please complete the application form.