Details of the proposed changes regarding continuing professional development.

ICAEW is introducing revised Continuing Professional Development (CPD) Regulations with effect from 1 November 2023. These regulations provide members with greater clarity on the amount of CPD they should undertake. The regulations also introduce a requirement for ICAEW member firms (including firms that use the description Chartered Accountants) and firms registered with ICAEW for regulated work, to ensure that all their ICAEW members and regulated individuals comply with the minimum CPD hours that apply for their role.

There were two consultations issued in 2022 that detailed the proposed revised CPD Regulations. These consultations noted increasing expectations from ICAEW’s oversight regulators that professional bodies take steps to ensure members are competent and up to date, with monitoring and disciplinary action for those who fail to undertake sufficient CPD.

In Ireland, ICAI introduced stricter CPD requirements in the April 2022 Irish Audit Regulations, following guidance published by IAASA.

Under the revised ICAEW CPD Regulations, all members and regulated individuals will sit in one of three categories for practice or business. The category for an individual who provides audit services depends on their role and client base.

The CPD Regulations explain that the ICAEW Practice Assurance Committee (PAC) will be the regulatory committee supervising the monitoring of CPD. If a failure to comply with the CPD Regulations is identified by the Quality Assurance Department, the undertaking to remedy the failure will be monitored by the PAC. Should there be a subsequent failure to comply with an undertaking, or no undertaking is provided, the PAC would refer the matter to the Conduct Department for investigation.

The Audit Registration Committee may issue regulatory penalties for breach of the Audit Regulations, and also issue undertakings on any areas deemed necessary, which could include CPD. The Audit Registration Committee will be informed by the PAC of any regulatory decisions that affect the licensing of RIs for audit.

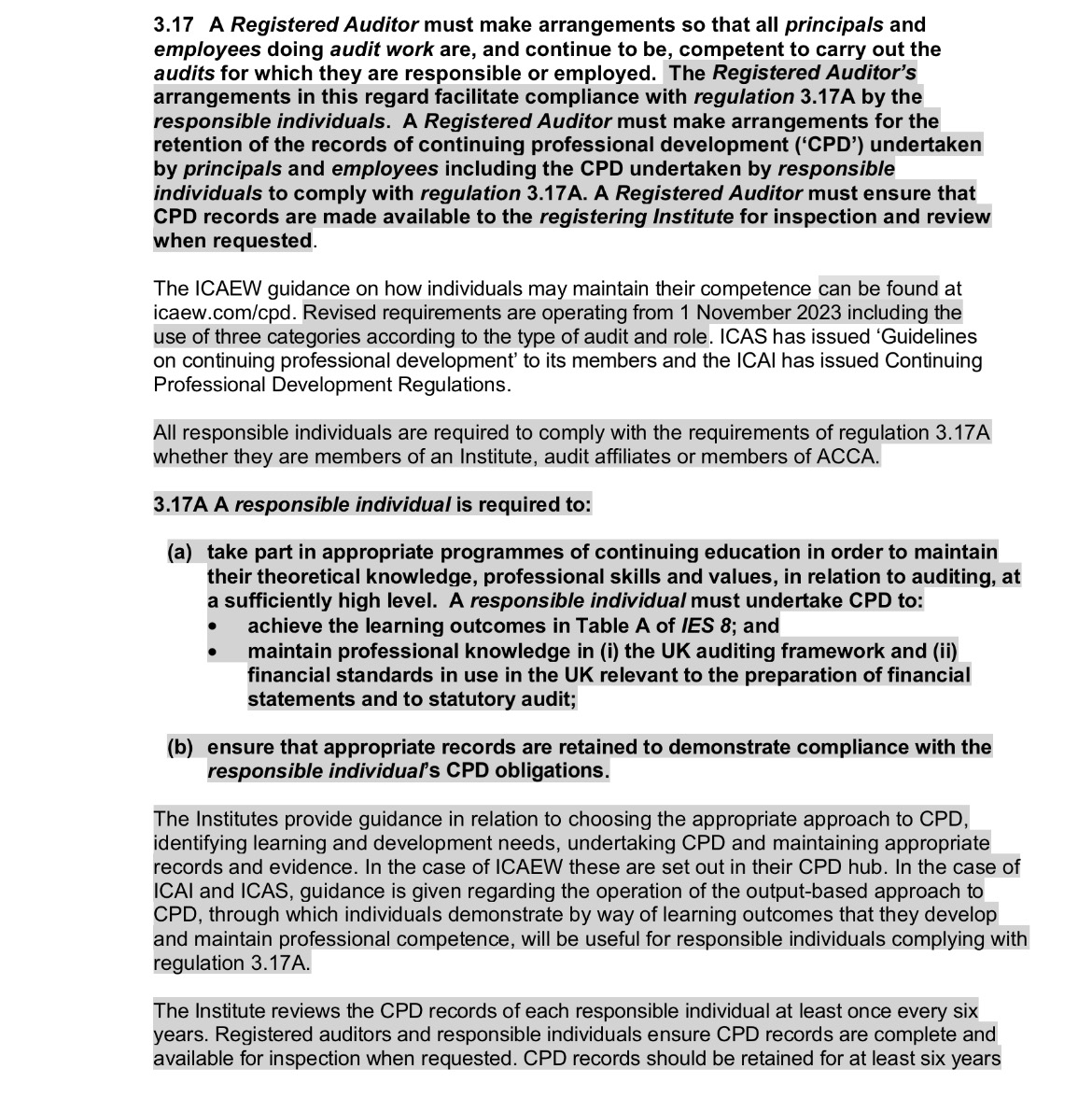

Regulatory changes – CPD

The following changes are proposed to the Audit Regulations, including a new regulation 3.17A (additions are highlighted in grey in the image provided):

Questions 8-9 (of 12, in total)

- Are the proposed revisions to the Audit Regulations in line with your understanding of the new CPD Regulations?

- Are there any practical difficulties in achieving the obligations set out in these revisions?