Introduction

This helpsheet has been issued by ICAEW’s Technical Advisory Service to help ICAEW members determine which accounting standard should be used when preparing the accounts of a small self-administered pension scheme (SSAS pension scheme) and whether they need to be audited.

Small self-administered pension schemes

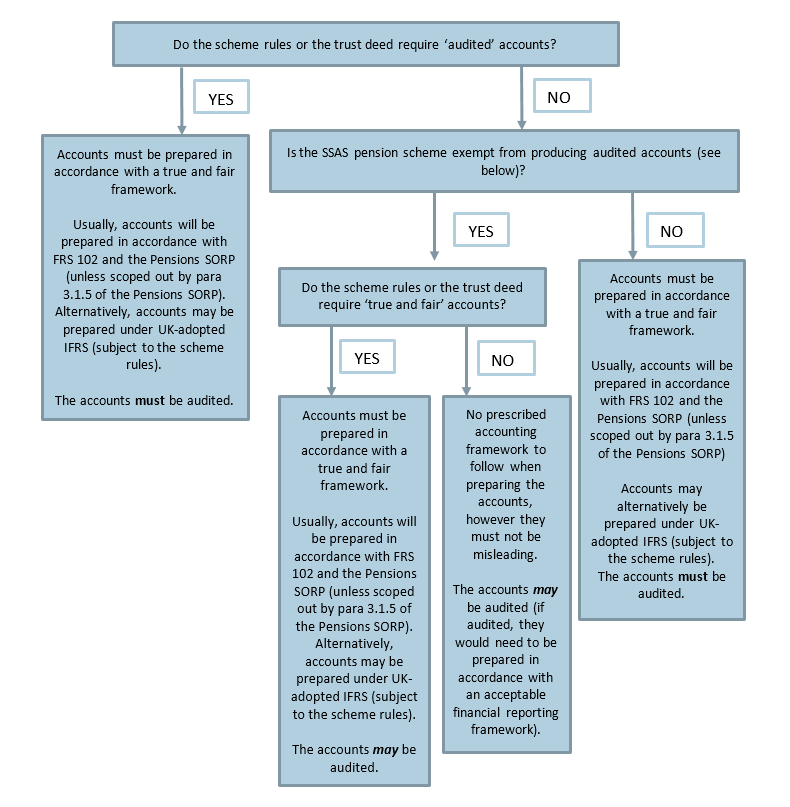

When determining whether a SSAS pension scheme needs to prepare accounts under FRS 102 (or UK-adopted IFRS if preferred), members should refer to the following flowchart.

Exemption from producing audited accounts

Regulations 3(1)(a) to (o) of The Occupational Pension Schemes (Scheme Administration) Regulations 1996 (SI 1996/1715) contain a number of exemptions from the requirement to produce audited accounts. The most common exemption relevant for SSAS pension schemes is detailed in Regulation 3(1)(h), which states that a pension scheme is exempt from producing audited accounts if all of the following criteria are met:

- the scheme must have less than 12 members; and

- all members must be trustees; and either

- the provisions of the scheme provide that all decisions which fall to be made by the trustees are made by unanimous agreement by the trustees who are members of the scheme; or

- the scheme has a trustee who is independent in relation to the scheme for the purposes of section 23 of the 1995 Act (power to appoint independent trustees), and is registered in the register maintained by the Authority in accordance with regulations made under subsection (4) of that section.

The other exemptions from the requirement to produce audited accounts as detailed in Regulation 3(1) are as follows:

| (a) | a scheme which is- (i) provided for, or by, or under an enactment (including a local Act); and (ii) guaranteed by a Minister of the Crown or other public authority; |

| (b) | [revoked]; |

| (c) | an occupational pension scheme which provides relevant benefits and which on or after 6th April 2006 is not a registered scheme; |

| (d) | [revoked]; |

| (e) | unfunded occupational pension schemes; |

| (f) | occupational pension schemes with less than 2 members; |

| (g) | [revoked]; |

| (h) | [see above]; |

| (hh) | [revoked]; |

| (i) | Occupational pension schemes with a superannuation fund such as is mentioned in section 615(6) of the Taxes Act; |

| (j) | [revoked]; |

| (k) | [revoked]; |

| (l) | [revoked]; |

| (m) | the AWE Pension Scheme established by a deed made on 29th March 1993; |

| (n) | [revoked]; and |

| (o) | the Babcock Naval Services Pension Scheme, established by a deed made on 29th August 2002. |

If in doubt seek advice

ICAEW members, affiliates, ICAEW students and staff in eligible firms with member firm access can discuss their specific situation with the Technical Advisory Service on +44 (0)1908 248 250 or via webchat.

© ICAEW 2026 All rights reserved.

ICAEW cannot accept responsibility for any person acting or refraining to act as a result of any material contained in this helpsheet. This helpsheet is designed to alert members to an important issue of general application. It is not intended to be a definitive statement covering all aspects but is a brief comment on a specific point.

ICAEW members have permission to use and reproduce this helpsheet on the following conditions:

- This permission is strictly limited to ICAEW members only who are using the helpsheet for guidance only.

- The helpsheet is to be reproduced for personal, non-commercial use only and is not for re-distribution.

For further details members are invited to telephone the Technical Advisory Service T +44 (0)1908 248250. The Technical Advisory Service comprises the technical enquiries, ethics advice, anti-money laundering and fraud helplines. For further details visit icaew.com/tas.

Download this helpsheet

PDF (173kb)

Access a PDF version of this helpsheet to print or save.

Download-

Update History

- 01 Nov 2018 (12: 00 AM GMT)

- First published

- 28 Mar 2024 (12: 00 AM GMT)

- Changelog created. Converted to new template. Links updated. Helpsheet has not had a full review

- 11 Dec 2024 (12: 00 AM GMT)

- Flowchart updated to match content. Helpsheet has not had a full review