The number and monetary value of claims for tax relief for research and development expenditure increased in the year to March 2020, according to the latest statistics from HMRC. ICAEW’s Tax Faculty takes a closer look at the data.

The latest HMRC data on enhanced tax relief claims for qualifying research and development (R&D) expenditure confirm that UK companies are continuing to increase investment in R&D.

Large companies claim under the research and development expenditure credit (RDEC) scheme, while a separate scheme operates for small and medium-sized enterprises (SMEs). SMEs can benefit from either a larger expense deduction, or, if loss making, a payable tax credit.

The latest figures cover the period to March 2020 and show a 16% increase in the number of claims, primarily attributable to an increase in SME claimants. The value of the tax relief claimed has also increased by 19% compared with a 15% increase in R&D expenditure subject to the claims.

R&D investment trends

Even though R&D tax relief has been around since 2000/01, there are a surprising (and growing) number of new claimants each year. The latest figures highlight a 25% increase in claimants for the SME scheme in the year to 2018/19 and a 7% increase in RDEC claimants.

The amount of R&D expenditure upon which tax relief is claimed has shown a sharp increase since 2014. This is attributed in part to the removal of the minimum expenditure threshold of £10,000 from April 2012.

Total R&D expenditure vs R&D claim expenditure

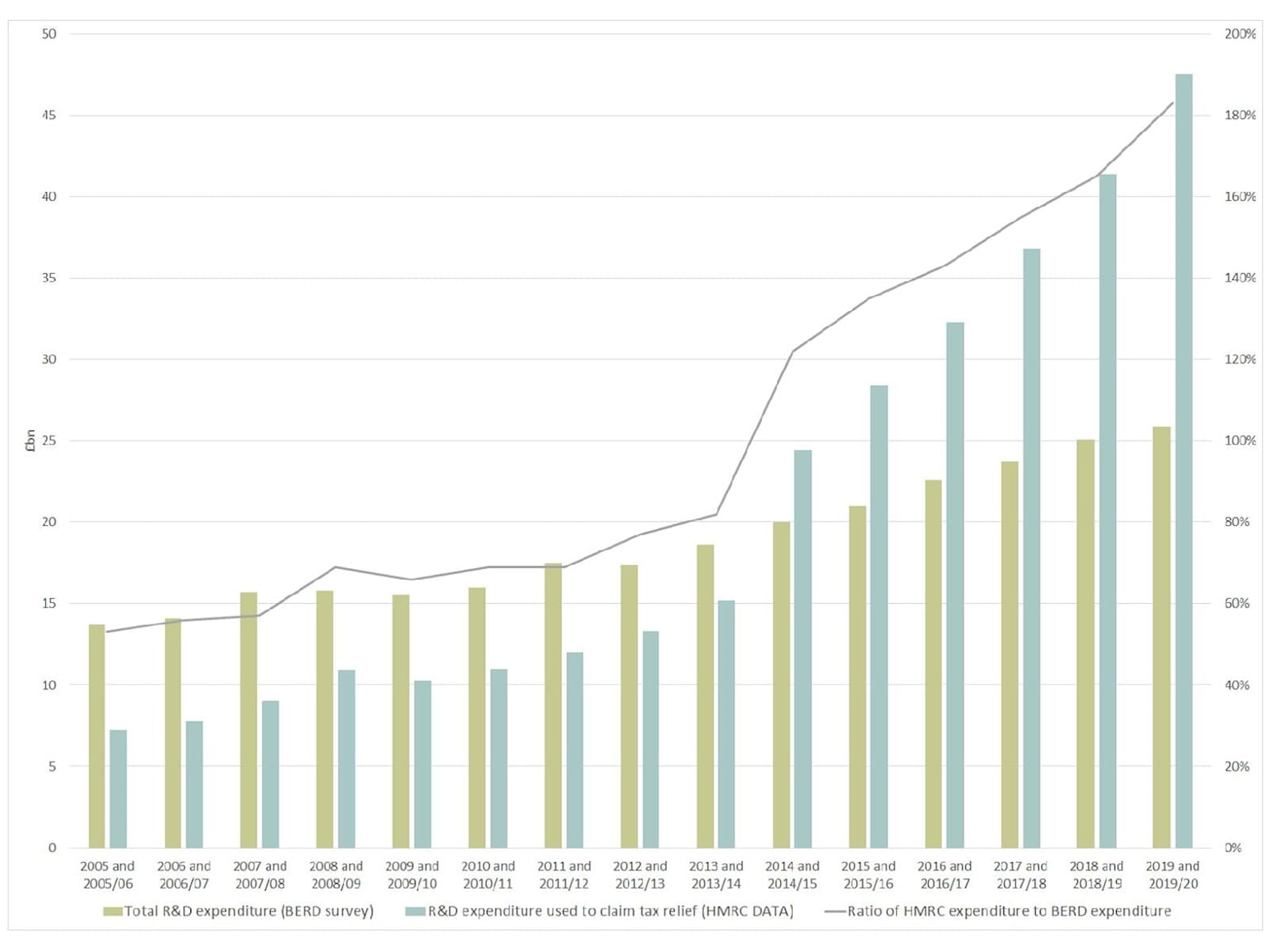

One of the more enlightening sets of figures in the R&D statistics produced by HMRC is a comparison of total R&D expenditure businesses said they had incurred as collated in an annual survey of approximately 5,400 businesses engaged in R&D (BERD) with the R&D expenditure used to claim tax relief collated by HMRC.

The BERD survey only captures UK expenditure and is compiled on a calendar year basis, so is different from data collected by HMRC. The response rate to the latest BERD survey is also lower owing to the coronavirus pandemic.

Both measures show increased R&D expenditure, but the ratio of R&D expenditure on which tax relief is claimed to total R&D expenditure as captured by the BERD survey, has increased from 53% in 2005 to 183% in 2019, rising sharply from 2012 onwards – as can be seen below.

In other words, the amount of expenditure on which companies are claiming relief is now on average 83% higher than the total amount of R&D expenditure captured by the survey. It is unclear how much of the expenditure claimed for is enquired into by HMRC.

More support on tax

ICAEW's Tax Faculty provides technical guidance and practical support on tax practice and policy. You can sign up to the Tax Faculty's free enewsletter (TAXwire) which provides weekly updates on developments in tax.

Sign up for TAXwireJoin the Tax FacultyData predates restriction to SME claims

These figures predate changes included in Finance Act 2021, aimed at preventing the abuse of R&D tax relief schemes by placing a cap on the amount of payable R&D credit for SMEs from 1 April 2021.

The cap limits the amount of payable R&D tax credit that an SME can claim to £20,000 plus 300% of its total PAYE and national insurance contributions liability for the period. However, the cap does not apply to those companies who:

- have employees creating, preparing to create or managing intellectual property; and

- do not spend more than 15% of their qualifying R&D expenditure on subcontracting R&D to, or the provision of externally provided workers by, connected persons.

The faculty reminds members that ICAEW has produced supplementary guidance alongside professional conduct in relation to taxation (PCRT) concerning R&D tax credit services.

Tax Faculty

This guidance is created by the Tax Faculty, recognised internationally as a leading authority and source of expertise on taxation. The Faculty is the voice of tax for ICAEW, responsible for all submissions to the tax authorities. Join the Faculty for expert guidance and support enabling you to provide the best advice on tax to your clients or business.