HMRC published its annual data analysing the tax gap on 22 June 2023. The tax gap is the difference between what HMRC expects the total tax take for 2021/22 to be, and the actual tax received. Headline figures show that in percentage terms, the tax gap has not changed.

In percentage terms, the tax gap has gradually reduced since 2005, and has remained static since last year. However, in real terms the tax gap has hovered around the same level over the years. In 2021/22 the overall tax take was larger than the previous year, perhaps unsurprisingly given climbing inflation from mid-2021. With the total tax liability of the UK estimated to be £739bn, this translates to a larger real tax gap of £35.8bn.

It is worth noting that the tax gap figures for 2020/21 have been revised in HMRC’s recent report. Due to the COVID-19 pandemic, the figures first published were subject to greater uncertainty.

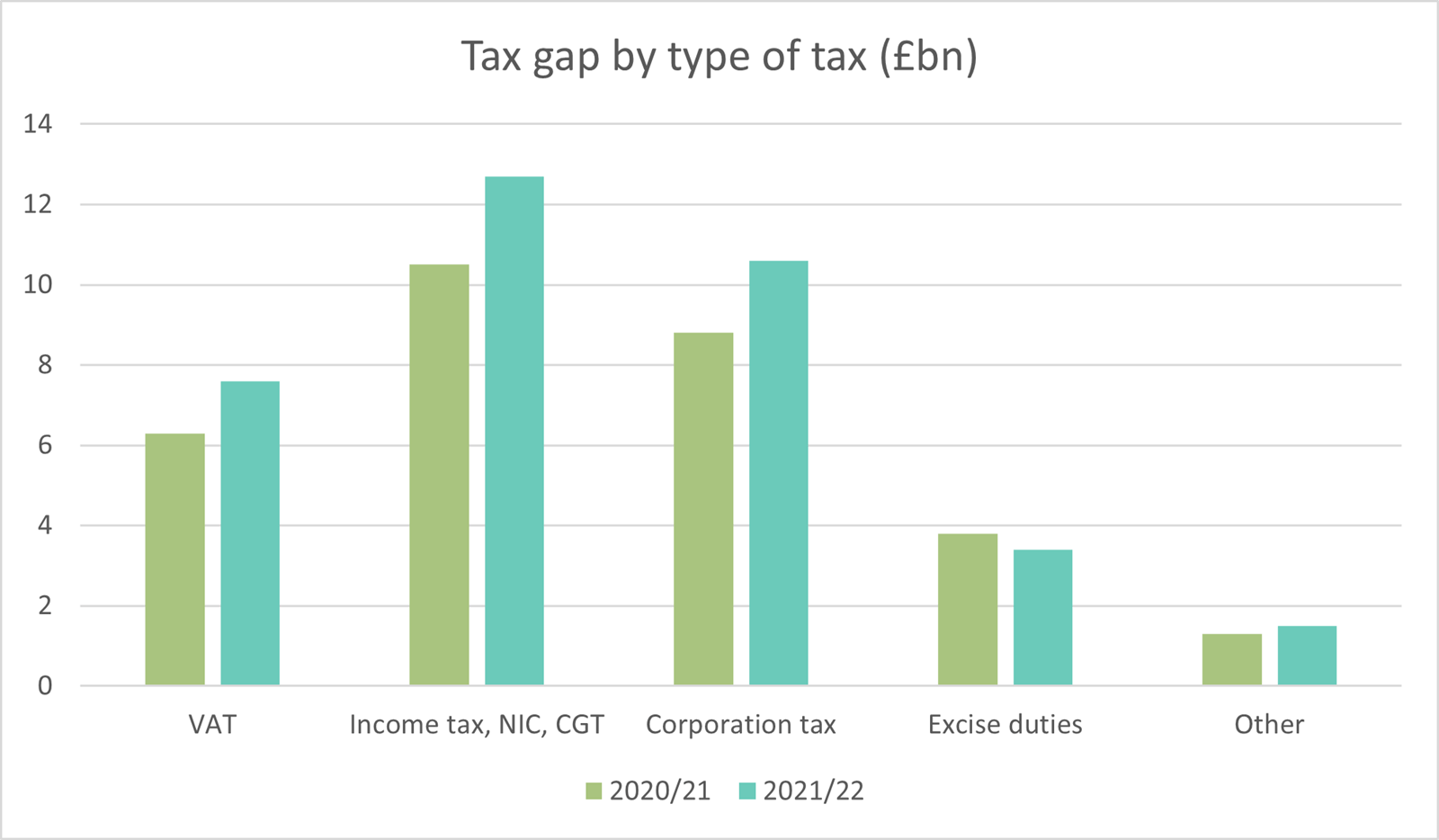

Tax gap by type of tax

The tax gap for excise duty has shown a reduction in both real terms and percentage terms.

All other tax groups have experienced an increase in the tax gap in real terms, again reflecting the larger overall tax take. The tax gaps for VAT, personal income taxes and corporation tax have all shown a slight percentage increase from last year.

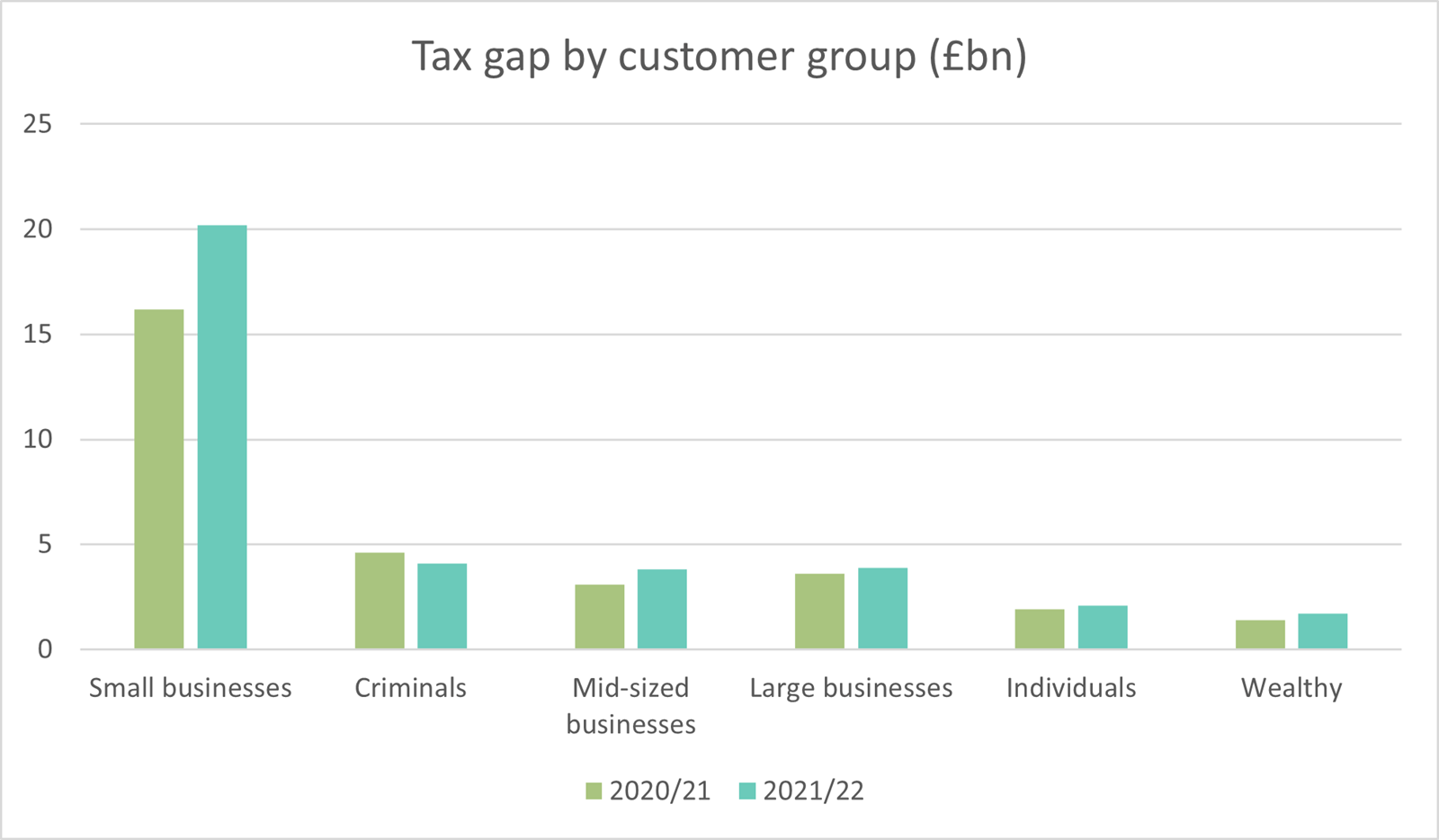

Tax gap by customer group

The small business share of the tax gap has increased in percentage terms, now representing 56% of the estimated tax gap for 2021/22. This figure has grown steadily from 40% in 2017/18, to more than half the tax gap. Some of this, for instance the gap in small business corporation tax, has been driven by an increase in data from HMRC’s compliance activity over the past year.

However, despite the upwards trend in the small business tax gap, the income tax self assessment gap is on a downwards trend. This may add to the questions about HMRC’s business case for the introduction of making tax digital income tax self assessment (MTD ITSA). HMRC hopes that MTD’s requirement for quarterly updates and digital record keeping will lead to a reduction in errors and failure to take reasonable care. However, HMRC’s random enquiry program appears to be revealing higher levels of non-compliance in corporation tax. The reasons for this trend are not clear and require further investigation.

The figures for most other customer groups largely held steady compared to the previous year, with small decreases in percentage terms in the tax gap attributable to large business and criminals.

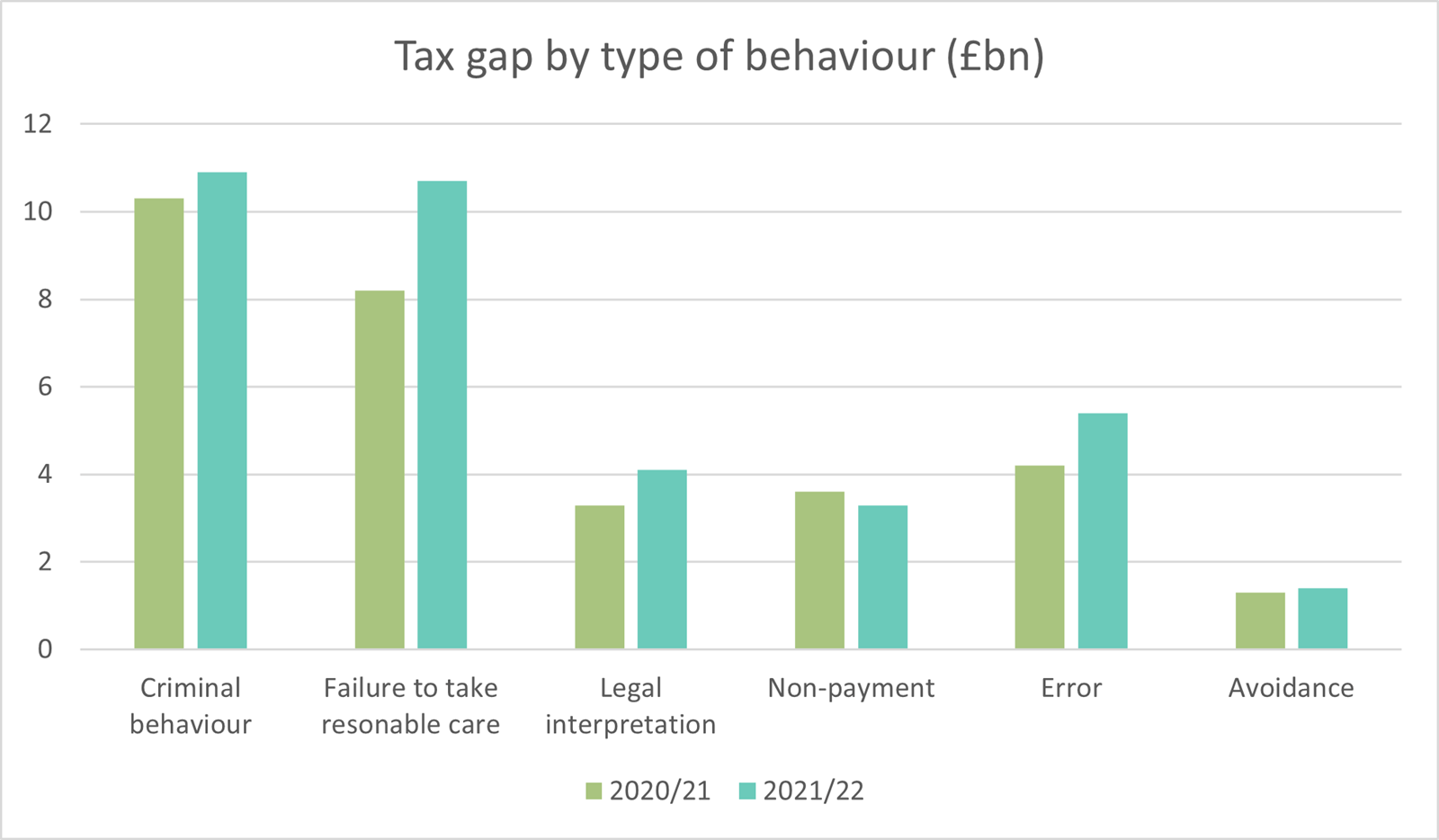

Tax gap by behaviour

What ICAEW views to be criminal behaviour is subdivided by HMRC into evasion, criminal attacks, and the hidden economy (in table 3 below, these have all been combined). Between them, they account for 30% of the tax gap. This is a drop in percentage terms from 33% in the previous year, although in real terms the tax gap rose by £600m across criminal behaviours.

Failure to take reasonable care also makes up 30% of the tax gap.

Only one behaviour has seen a reduced tax gap from last year: non-payment. This may be a symptom of taxpayers moving to more business-as-usual cashflows following the COVID-19 pandemic, or an increase in enforcement by HMRC’s debt management team.

Help HMRC improve ‘Measuring tax gaps’

HMRC is inviting users of the ‘Measuring tax gaps’ publication to complete a survey. Survey responses are anonymous.

Read more:

The Tax Faculty

ICAEW's Tax Faculty is recognised internationally as a leading authority and source of expertise on taxation. The faculty is the voice of tax for ICAEW, responsible for all submissions to the tax authorities. Join the Faculty for expert guidance and support enabling you to provide the best advice on tax to your clients or business.

More support on tax

ICAEW's Tax Faculty provides technical guidance and practical support on tax practice and policy. You can sign up to the Tax Faculty's free enewsletter (TAXwire) which provides weekly updates on developments in tax.

Sign up for TAXwireJoin the Tax Faculty