In ICAEW REP 42/23, ICAEW’s Tax Faculty expresses broad support for drink deposit return schemes (DRS) but stresses that the schemes should not create an excessive administrative burden on businesses affected by the schemes.

The faculty considers that the draft VAT provisions that will apply to DRS across the UK create an unnecessary financial and administrative burden on producers.

How the DRS works

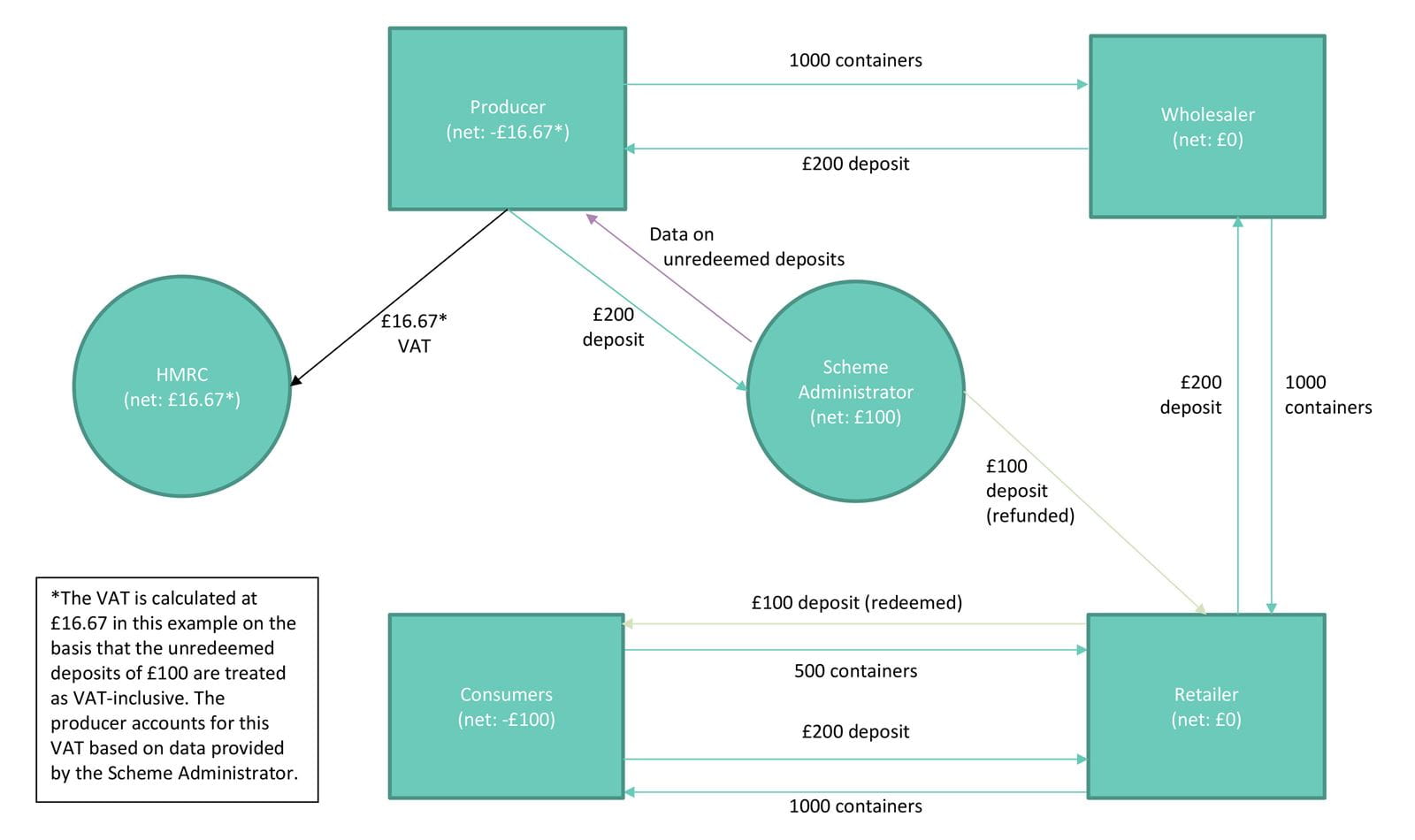

When producers place qualifying drinks onto the market, they will pay the deposit amount to the DRS scheme administrator. They will charge the same deposit to the wholesaler or retailer to recoup their cost. This deposit will be charged throughout the supply chain until it is charged to the end consumer.

Consumers can redeem their deposit when returning the container to a return point. Retailers can then claim back the deposits they refund from the scheme administrator.

Producers are any businesses that own any brand of drink within containers included in the DRS. Importers have the same obligations as domestic producers.

The scheme administrator is the body responsible for the day-to-day management of the DRS.

The scheme administrator will collect returned cans and empty bottles from return points. They will also pay the handling fee and reimburse return points for the deposits they refund.

A diagram illustrating the flow of containers and deposits can be found in Appendix 1 of ICAEW REP 42/23.

Current VAT proposals

Under the draft regulations, the deposit amount will not be subject to VAT throughout the supply chain.

Instead, only the producer is liable for output VAT, and only on the unredeemed deposits – the deposits paid by consumers for drink containers that are not returned for recycling.

This VAT will become due via a ‘scheme adjustment’ made at the end of each VAT quarter. The faculty understands that it would not be charged (or invoiced) by the producer.

The unredeemed deposits accrue to the scheme administrator. Therefore, the producer will owe output VAT on an amount it has not collected, leaving the producer out of pocket.

Furthermore, the scheme adjustment will be dependent on data provided by the scheme administrator. Therefore, the accuracy and timeliness of the producer’s VAT returns will be wholly reliant on the scheme administrator to provide the correct data at the correct time and in the correct format.

ICAEW’s recommendations

The DRS is intended to be a revenue neutral scheme. This is supported by the tax information and impact note on the draft VAT regulations, which states a negligible impact to the Exchequer.

As drafted, the VAT provisions will generate VAT revenue for HMRC, which does not seem correct. ICAEW therefore recommends that the DRS falls wholly outside the scope of UK VAT.

Should HMRC continue to pursue the route of requiring output VAT on unredeemed deposits, the faculty recommends that the liability for this output VAT falls on the scheme administrator rather than the producer.

The Tax Faculty

ICAEW's Tax Faculty is recognised internationally as a leading authority and source of expertise on taxation. The faculty is the voice of tax for ICAEW, responsible for all submissions to the tax authorities. Join the Faculty for expert guidance and support enabling you to provide the best advice on tax to your clients or business.

More support on tax

ICAEW's Tax Faculty provides technical guidance and practical support on tax practice and policy. You can sign up to the Tax Faculty's free enewsletter (TAXwire) which provides weekly updates on developments in tax.

Sign up for TAXwireJoin the Tax Faculty