The latest official data reveals that the UK economy contracted by 0.1% in May, following a growth of 0.2% in April as the extra bank holiday for the coronation curbed output in the month. The three-month-on-three-month growth measure, a better measure of the underlying trend, shows that the economy recorded no growth in the three months to May.

While the economy may have rebound in June, the significant squeeze on activity from high inflation, stealth tax hikes and rising interest rates means the Prime Minister may struggle to meet his pledge to get the economy growing.

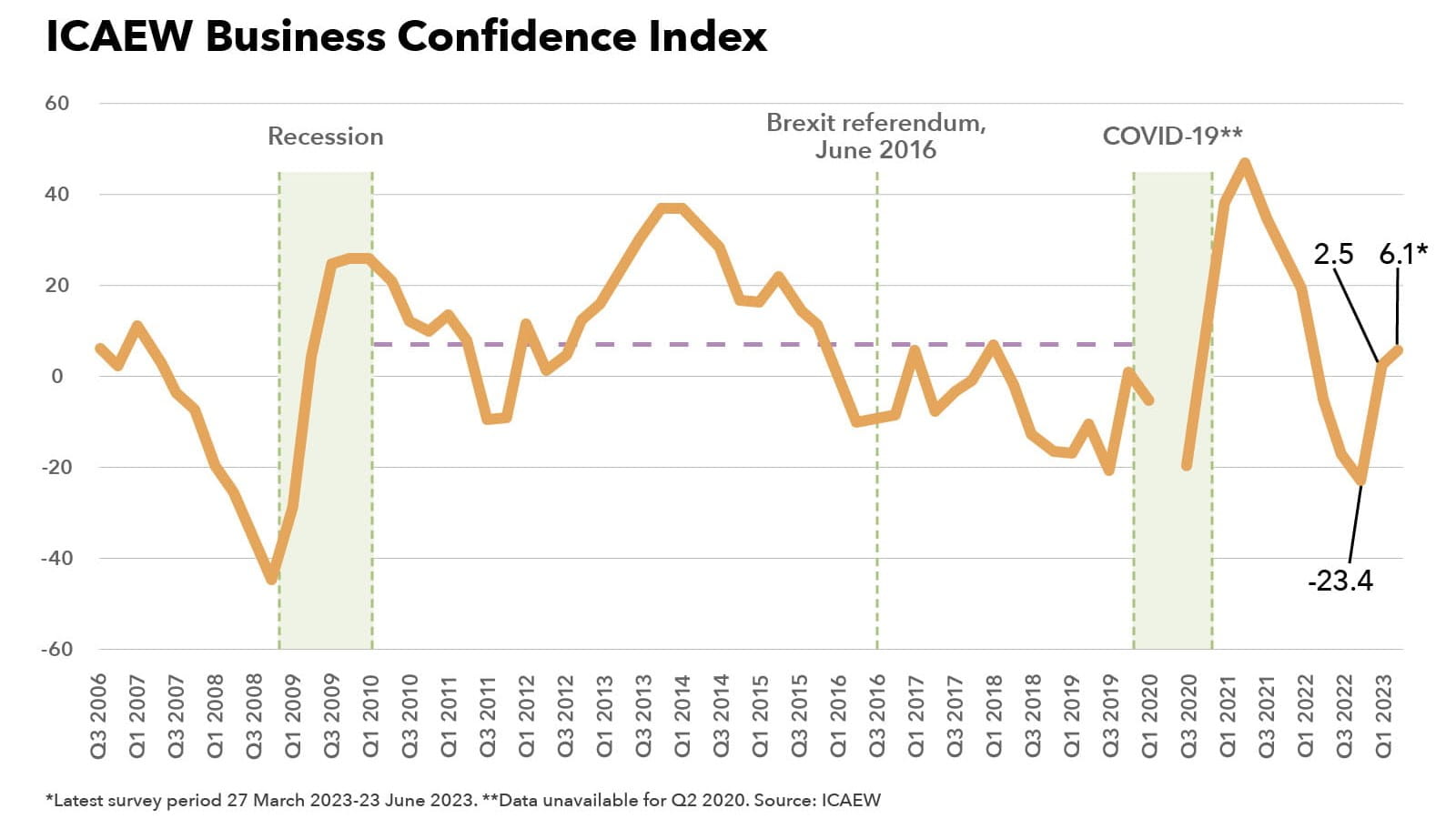

Business confidence remains below pre-pandemic average

Sentiment tracked by ICAEW’s Business Confidence Monitor put confidence at 6.1 on the index for Q2 2023 (see chart, above), a significant improvement on the previous quarter (2.5), but below the pre-pandemic average of 7.2 across 2010-19. Domestic sales growth has slowed to its lowest level since Q3 2021, impeding confidence. Growth in capital investment spending also slowed and is expected to moderate further in the year ahead, reflecting fragile business confidence.

ICAEW’s latest BCM also revealed that there was significant variation in confidence across sectors. Transport firms were the most confident in Q2 amid improvements in the global availability of ships, increased road haulage capacity and rising demand for air travel. Energy, water and mining firms were the second most confident, benefiting from the easing in the global energy crisis. In contrast, confidence was negative in the property and retail and wholesale sectors, reflecting their direct exposure to rising interest rates and, for the former, a weakening housing market.

UK inflation drops to 12-month low

UK Consumer Price Index (CPI) inflation stood at 7.9% in June 2023, the lowest rate since March 2022 and down from 8.7% in May. However, inflation is still almost four times the Bank of England’s 2% target. A 22.7% fall in petrol and diesel prices at the pumps compared to May 2022 was the main driver behind the fall in the headline rate.

While the marked easing in firms’ pricing expectations in the latest BCM suggests that inflation will continue dropping back, the impact of historically high wage costs points to the headline rate remaining stubbornly above the Bank of England’s 2% target well into 2024.

As a consequence, the Bank of England raised UK interest rates by 25 basis points to 5.25%. While the end of this rate hiking cycle is close, concerns over stubborn inflation mean that unless the economy slips into a prolonged recession it may take more than a year before rates start falling again.

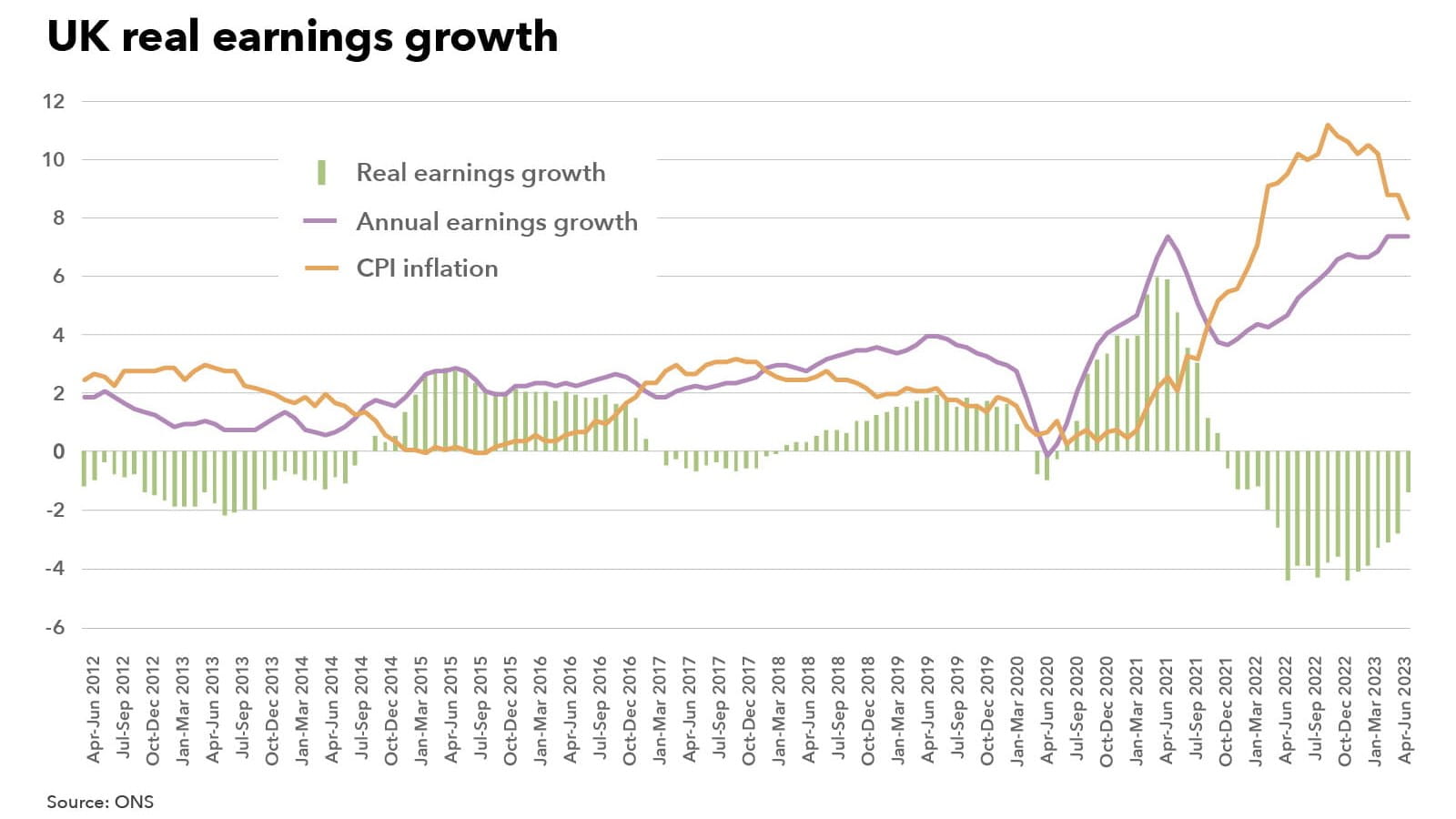

Labour market cooling despite record wage growth

Regular pay growth (excluding bonuses) was 7.3% in the three months to May 2023, the joint highest on record. However, due to continued high inflation, wage rises are lagging behind price rises (see chart, above), maintaining the squeeze on real household incomes and consumer spending.

There are signs that the UK labour market is starting to loosen with the unemployment rate rising from 3.8% to 4.0% in the three months to May 2023. Similarly, the number of job vacancies, a good indicator of demand for workers, fell by 85,000 in the three months to June 2023, the 12th successive fall. The squeeze on economic activity from the lagged impact of interest rate hikes could see labour market conditions weaken further in the next year.

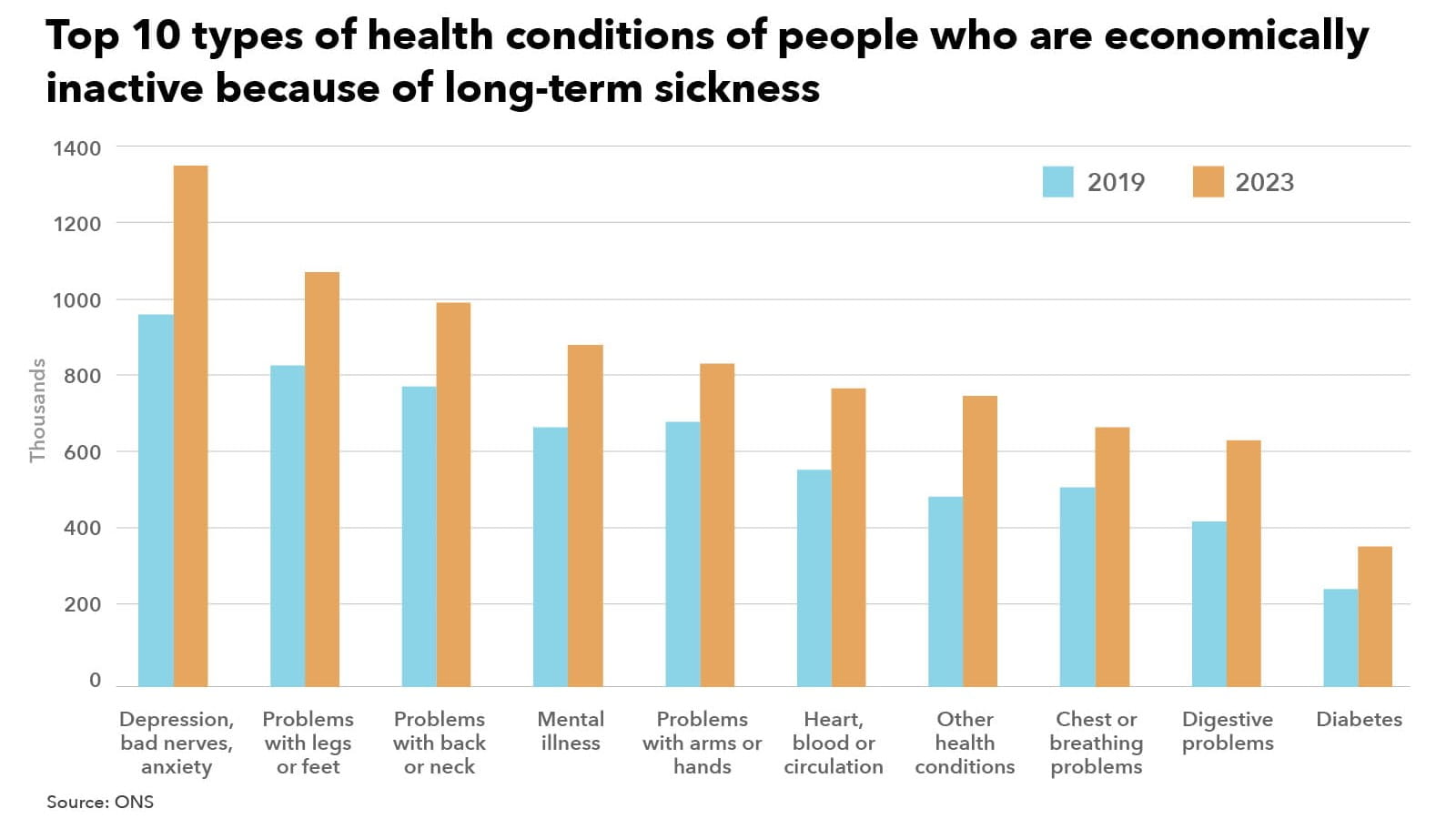

Mental health challenges drive increase in people too ill to work

The UK economic inactivity rate – the proportion of people who are neither working nor looking for work – was estimated at 20.8% in the three months to May 2023, 0.4 percentage points lower than the previous quarter, but 0.6 percentage points higher than before the pandemic.

The increase in economic inactivity since the start of the coronavirus pandemic had been largely driven by those who are long-term sick. More than 1.3 million (53%) of those inactive because of long-term sickness reported that they had depression, bad nerves or anxiety in Q1 2023 (see chart, above). Other health conditions, including long COVID, have risen by 53% since 2019.

Implications for accountants, business owners and the economy

Taken together, the latest data releases suggest that economic conditions in the UK remain weak as high inflation and rising interest rates hindered economic activity among businesses and consumers.

ICAEW’s BCM suggests a more challenging second half of 2023 for the UK, with mounting concerns over rising interest rates, a higher tax burden and waning customer demand all likely to weaken UK GDP in the months ahead.

UK economy – what to watch for

- The latest quarterly UK GDP data to be released on 11 August is likely to confirm that the economy effectively flatlined in the second quarter. Figures are also likely to show business investment fell amid tougher economic conditions.

- The latest official productivity estimate to be released on 15 August is likely to show that productivity in the UK remains anaemic, limiting future economic growth and living standards.

- Next official figures due out on 16 August should show another big fall in inflation, with lower energy bills – following the reduction in Ofgem’s energy price cap in July – likely to pull the headline rate below 7%.

Cost of doing business

Insights, analysis and resources for organisations facing rising costs of doing business amid a multitude of challenges, including energy prices, inflation, supply chain disruption and staff recruitment and retention.