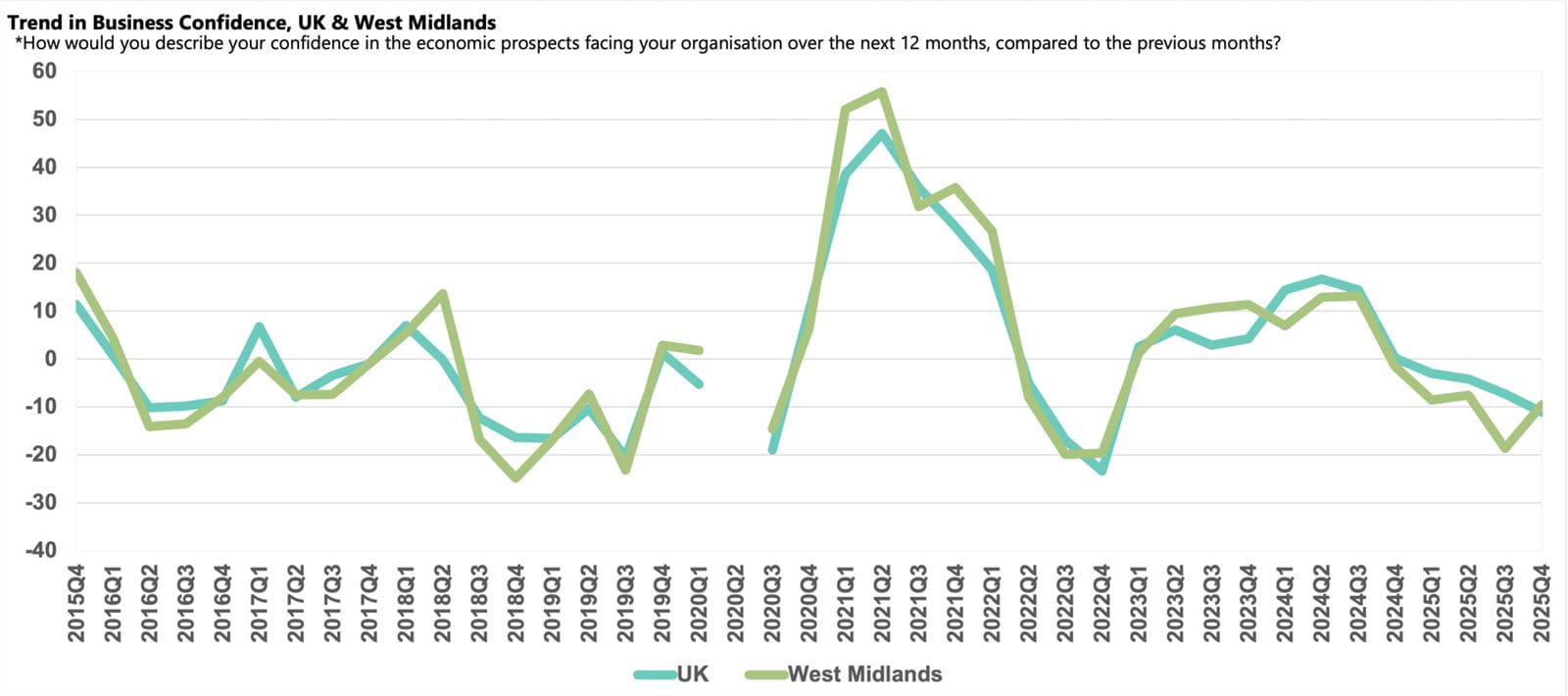

Q4: Sentiment rises sharply in the West Midlands but confidence remains in negative territory.

The latest national Business Confidence Monitor (BCM) shows that business sentiment slipped deeper into negative territory amid uncertainty about the Budget and rising concern about both the tax burden and regulations. However, companies are optimistic that domestic sales and exports growth will improve over the next 12 months.

The survey results are based on 1,000 telephone interviews among ICAEW Chartered Accountants covering a range of UK sectors, regions and company sizes, ensuring a representative picture of the UK economy. The latest quarterly findings are based on the period 8 October to 11 December 2025.

- Confidence improved in Q4 2025, overtaking the national average, but it remains in negative territory and down significantly on its historical norm.

- The tax burden was the most widespread growing challenge for businesses but was less prevalent in the West Midlands compared to any other region.

- Domestic sales growth outpaced all other regions and businesses expect strong growth over the year ahead, however, the export outlook is subdued.

- Companies increased their staff levels and salaries rose at a sharper pace than any other region in year to Q4 2025 and businesses expect this trend to continue.

- Input price inflation remains high and, while these pressures are expected to dissipate, cost growth is set to continue to outpace the UK average next year.

- Both capital investment and R&D budget growth increased from the previous quarter, however businesses plan to moderate the rate of expansion of both.

Business confidence in West Midlands

Sentiment in the West Midlands improved in Q4 2025, with the Business Confidence Index rising from -18.7 in the previous quarter to -9.6, climbing above the national average (-11.1), but remaining significantly below the historical average of +4.2.

This uplift in confidence is likely underpinned by strong domestic sales growth over the past year with businesses expecting them to accelerate further over the next 12 months. The survey results also show that a smaller proportion of companies viewed the tax burden as a rising challenge compared to the previous quarter. Alongside this, the resolution of the cyber-attack on Jaguar Land Rover (JLR) has allowed production to resume, lifting the strain on supplier’s cash flow, while the uncertainty surrounding US tariffs continued to dissipate.

Domestic sales and exports growth

Businesses in the West Midlands reported that annual domestic sales growth edged up to reach 4.0% in Q4 2025, the sharpest increase of any UK region and markedly above the region’s historical norm (3.1%). This strong domestic performance is likely aided by Business Services which also recorded strong growth at the national level. Companies in the region expect domestic sales growth will continue to gain momentum and hit 5.7% over the next 12 months, significantly above the national projection (4.2%).

In contrast, the issues with production at JLR have likely impacted export sales in Q4 2025 with businesses reporting a slowdown in annual growth to 1.5%, dropping below both the national and historical averages (both 2.5%). However, businesses in the West Midlands expect export sales growth to rise to 2.7% in the coming year, above the historical average, but somewhat weaker than the UK forecast (4.1%).

Business challenges

The tax burden remains the primary concern for businesses in the West Midlands, despite a drop in citations from the historical high recorded in the previous quarter. April’s increase in National Insurance Contributions continues to be a significant issue, with over half (54%) of businesses surveyed in the West Midlands reporting the tax burden as a growing challenge in Q4 2025. This proportion is more than three times the region’s historical norm (17%) but less widespread compared to the national average (64%).

Meanwhile, like most other regions, the Employment Rights Bill achieving Royal assent has resulted in increased concern over regulatory requirements, with 53% of businesses in the West Midlands citing these issues as a growing challenge in Q4 2025. This proportion is a seven-year high for the region and larger than the UK average (51%).

While customer demand was a less prevalent growing challenge in the West Midlands compared to the UK as a whole (41%), the issue is still among the most widespread challenges, reported by 38% of businesses in the West Midlands in Q4 2025. Meanwhile, reports about government support which spiked to a survey record of 25% in the previous quarter dropped back to 12% this quarter, with the previous rise believed to be linked to the JLR cyber-attack.

Labour market

Businesses located in the West Midlands recorded the fastest annual employment increase in the UK in Q4 2025, with growth of 2.9%. This rise is over three-times the national average (0.8%) and the strongest expansion since Q1 2023. Looking ahead, companies in the region plan to slow the rate of increase to 2.4% over the coming year, but the projected increase is still more than double the historical average (1.0%) and a stronger outlook than in any other region.

After rising in each of the two previous quarters, annual wage growth eased slightly to 3.6% in Q4 2025. However, the uplift in salaries remained above the national average (2.9%) and was stronger than reported in any other region. Businesses expect salary inflation to increase further over the coming year to 3.9%, a stronger outlook than any other region and nearly double the region’s historical norm (2.1%).

As employment growth remains resilient in the West Midlands, businesses continue to be concerned over skills supply issues, with a quarter citing the availability of non-management skills as a growing challenge, above the historical average (20%) and more widely stated than in most regions. Similarly, 18% of companies reported the availability of management skills as a rising issue, also higher than found in most other regions.

Input and selling prices, and profits growth

The West Midlands recorded the sharpest input price inflation of all UK regions over the year to Q4 2025, at 5.2%, nearly double the region’s historical norm (2.9%). Over the coming year, businesses in the region anticipate input cost inflation will ease slightly to 3.4%. However, this increase is still among the sharpest projected increases in the UK, exceeding the national average of 3.0%.

Despite input costs inflation continuing to rise, businesses reduced the rate at which they raised their selling prices to 2.4% in the year to Q4 2025. While the rate in the West Midlands is broadly in line with the national average (2.3%), it remains significantly above the region’s historical norm (1.6%). Looking ahead, businesses in the region intend to lift their prices at a softer rate over the next year, with a planned increase of 1.9% which is marginally below the national average (2.2%).

Businesses reported an uplift in annual profits growth to 3.0% in Q4 2025, surpassing both the national average (2.7%) and the region’s historical average (2.8%). Profits growth expectations among companies in the West Midlands, at 5.4%, are significantly stronger than the national average (4.3%) over the next 12 months.

Investment

Businesses in the West Midlands increased their capital investment growth by 3.1% in the year to Q4 2025, a significantly faster pace than the national average (2.0%). However, companies plan to slow the rate of expansion in the year ahead to 1.7% which is below the historical average (1.9%), although marginally ahead of the 1.6% growth expected across the UK.

The growth in R&D budgets in the region had been on a broadly downward trend since Q3 2024. However, there was an uptick in Q4 2025, with budgets expanding by 2.4%, markedly above the national average of 1.6%. However, businesses in the region plan to reduce budget growth significantly in the year ahead to 1.5%, and below the region’s historical average of 1.7%.