Damon Wright and Jade Els summarise the VAT issues identified with the platform economy and the changes proposed from 1 January 2025 aimed at resolving those issues.

With the proliferation of technology and digitalisation, there has been a rapid transformation of the economy. Increasingly, computer systems are allowing businesses and consumers to interact in new ways, and in relation to new or different services. This has resulted in the significant growth of intermediaries in various supply chains, often referred to as the platform economy.

The platform economy has been causing myriad problems for tax authorities around the world as they try to keep up with changes that they did not have in mind when taxes were designed. Perhaps the most affected tax is VAT, being a tax on consumption.

On 8 December 2022, the European Commission announced proposed changes to the EU VAT legislation for supplies via intermediaries (or platforms) in the supply of short-term accommodation and passenger transport. It is planned that this will be effective from 1 January 2025. Even though this is EU legislation, all businesses involved in the supply chain for the stated supplies are potentially affected.

For those businesses directly impacted, it could mean:

- digital reporting requirements in relation to relevant sales across EU state borders;

- VAT registration and accounting requirements for relevant intermediaries in the platform economy ultimately having a knock-on effect of supplies made within the supply chain;

- an extension of the sales captured by the one-stop-shop for VAT;

- a need to review pricing models due to the deemed suppliers’ obligation to account for VAT on the supplies.

All businesses involved in the supply chain for the supply of short-term accommodation and passenger transport are potentially affected

The platform economy

Various sectors exist within the platform economy. In July 2022, the European Commission published a report, VAT in the digital age. Volume 2 focused on the VAT treatment of the platform economy. It covered the following sectors:

- E-commerce – providing a marketplace for goods. Examples include Amazon and Marketplace.

- Transport services, including ride on demand, ride sharing, car sharing, delivery services and trip booking. Examples include Uber and GetAround.

- Accommodation – examples include Airbnb and Couchsurfing. The accommodation sector contains four sub-sectors including:

- residence renting;

- B&B and hotel accommodation;

- home sharing; and

- home swapping.

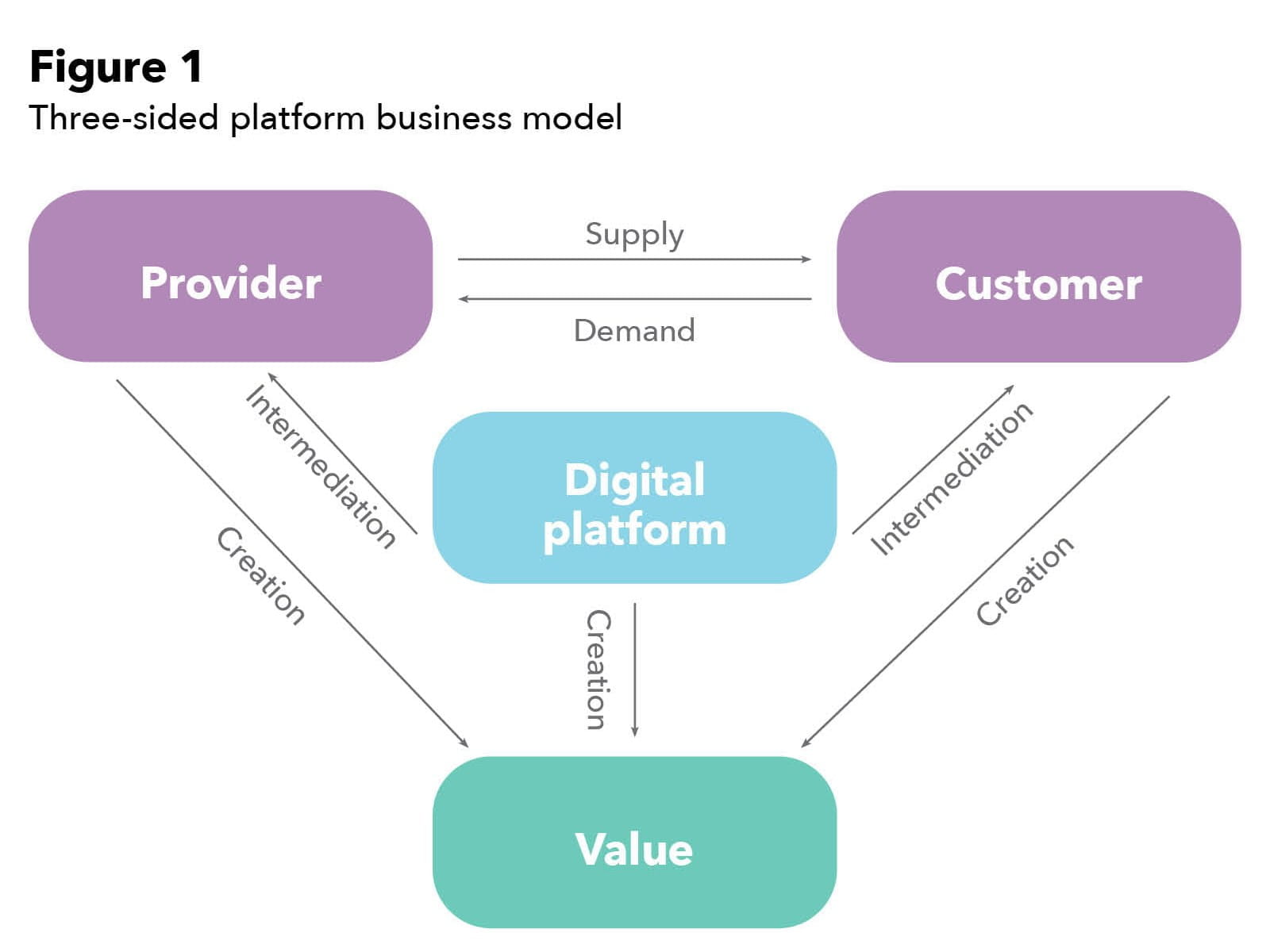

As shown by figure 1 below, the report concludes that the introduction of intermediaries in the supply chain results in common business models whereby there is a transaction between:

- The provider and the platform

- The customer and the platform

- The customer and the provider

The report identified that the existing EU VAT rules are unclear and not harmonised. Particular problems relate to:

- the taxable status of the provider;

- the nature of services and place of supply; and

- reporting and record keeping obligations.

Difficulties in enforcing VAT compliance in the platform economy is perceived by stakeholders as a major area requiring legislative intervention.

The platform economy also creates a lack of VAT equality and neutrality. The VAT treatment of supplies of goods or services via traditional channels or digital platforms is unequal. Furthermore, small business exemptions create a lack of cross-border equality and neutrality.

Other measures in the EU that are relevant to the platform economy that need to be taken into consideration include the VAT e-commerce package, DAC7, the Digital Services Act, the Digital Markets Act, etc.

Main existing legal issues

The VAT in the digital age report sets out the main legal issues relating to the VAT Directive and that are transposed into national legislation.

The taxable person status of the provider and the user

Determining the status of the parties involved in the transactions is crucial for the assessment of these transactions. The taxable status problem refers to the difficulty in determining the taxable status of the platforms’ users and, specifically, of providers. This is crucial for determining the tax obligations of the provider of services or goods underlying the platform’s facilitation.

The difficulty in determining the status of the provider stems from problems with the concept of ’economic activity’, as set out in Article 9(1) of the VAT Directive. Establishing that the provider is a taxable person will not only mean that the platform should issue an invoice for its facilitation services but may also affect where these services should be taxed. In cross-border transactions, the taxable status of the provider defines who is liable to pay VAT and whether the reverse charge mechanism applies.

The nature of the service and the resulting place of supply

The nature of the service provided by the platform is different to typical intermediation. This is because it is typically provided via automated means, over the internet. As a result, it may not traditionally fit into the definition of “services” in the VAT Directive.

Form of consideration

The consideration in the platform economy may be indirectly linked to a service or have a non-monetary character. This makes it challenging to define the consideration for VAT purposes.

Other legal issues

Other issues include:

- the deduction of input VAT and the adjustment of deduction; and

- the special schemes for SMEs that remove the need for VAT registration for micro taxpayers to simplify their compliance.

Specific objectives

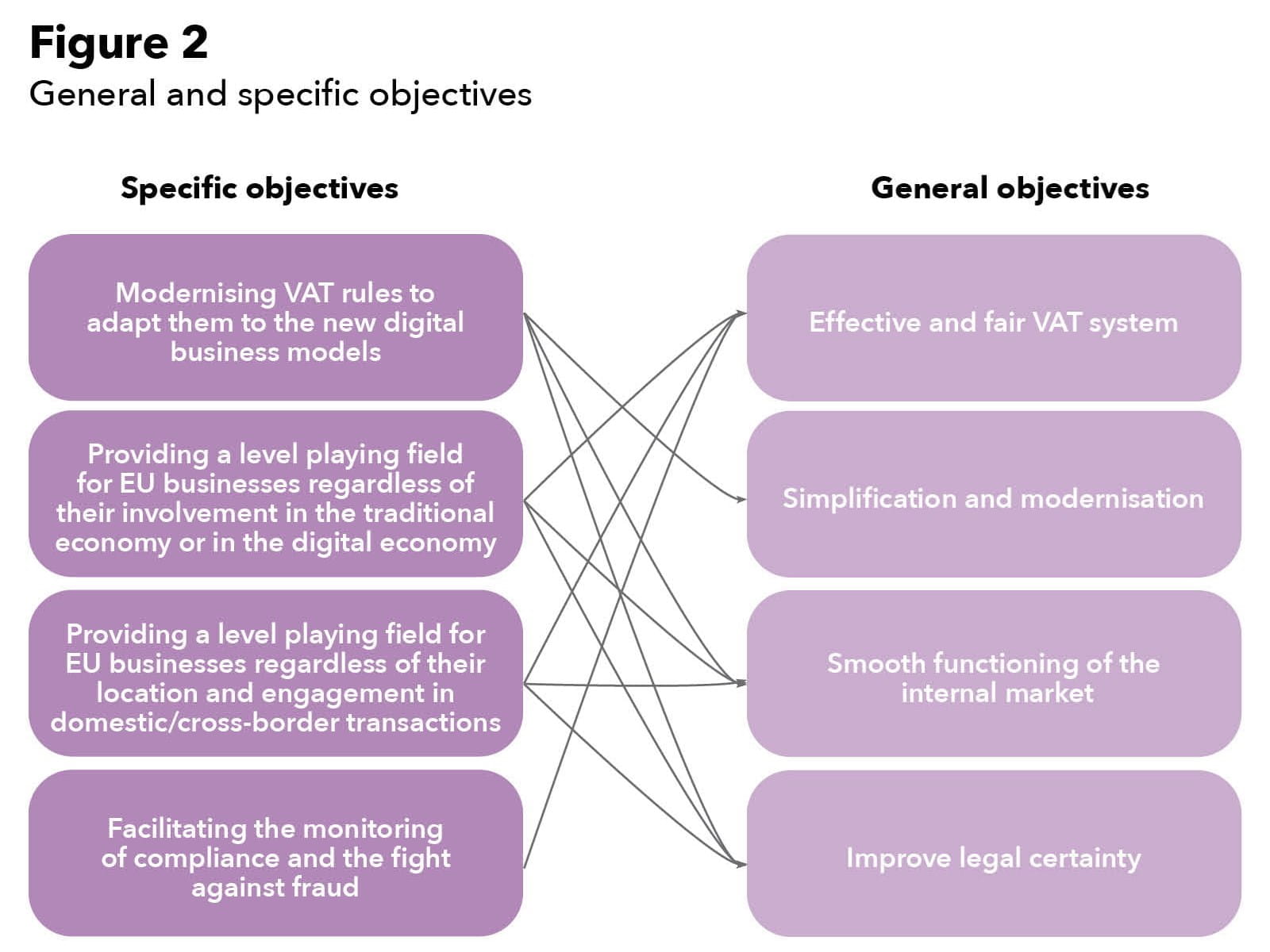

Figure 2 sets out the specific objectives of the VAT in the digital age study and report, mapped against the general objectives.

Options for reform

The VAT in the digital age report considered five options for meeting these objectives:

Option A

This option would involve no legislative change of VAT directive and implementing regulation, with the likely evolution in member states introducing their own rules and guidelines on the VAT treatment of the platform economy.

Option B

Making policy changes to the existing VAT treatment without introducing a new specific VAT regime. This could be done by requiring the provider to confirm its status and the nature of the services as well as clarifications required for the platforms. A rebuttable presumption may be required in respect of these points.

Option C

Having the deemed supplier role apply to platforms facilitating the supply of all accommodation and transport services for monetary consideration.

Option D

Having the deemed supplier role apply to platforms facilitating the supply of certain accommodation and transport services for monetary consideration.

Option E

Having the deemed supplier role apply to platforms facilitating the supply of all services for monetary consideration.

EU commission proposals

On 8 December 2022, proposed changes were announced by the European Commission. These are expected to be effective from 1 January 2025, following adoption by the member states at the Council of the EU.

The changes are primarily based on Option D above. Depending on the VAT status of the underlying supplier, the platform will be the deemed supplier for certain supplies; namely short-term accommodation rental and passenger transport.

This will be combined with changes to the core exemptions in the EU VAT Directive 2006/112 to clarify that short-term accommodation rental is excluded from the land and property exemptions. This will mean that it is a taxable supply.

The changes will be implemented by amending the following Articles in Directive 2006/112:

- Article 28a – introducing the deemed supply of the underlying service by the intermediary;

- Article 46a – confirming that supplies by an intermediary to a non-taxable person are not electronically supplied services meaning that they are taxed where the underlying supply takes place;

- Article 135(3) – excluding the supply of short-term rental accommodation from the land exemptions, thereby making it a taxable supply;

- Article 136b – confirming no entitlement to VAT recovery by the ‘supplier’ to the platform where it is a deemed supply;

- Article 172a – confirming that the deemed supply does not impact the VAT recovery entitlement for the platform as a deemed supplier;

- Article 242a – introducing new reporting requirements for platforms where they are not the deemed supplier;

- Article 306 – confirming that the tour operators margin scheme does not apply to the deemed supplies.

The effect of the proposals

The changes will apply where electronic interfaces (platform economy) allow consumers to book accommodation or transport services where the intermediary is not itself the principal in the actual supply of those services.

The Commission’s report suggests that these changes could capture up to €6bn additional VAT each year. This could be from the underlying suppliers, intermediaries, or others in the supply chain. To capture this VAT, the proposal makes the intermediaries the ‘deemed’ supplier of the short-term rental accommodation or passenger transport.

The intermediary will be responsible for the collection and remittance of VAT on the payments received from consumers in cases where the actual underlying supplier will not be accounting for VAT on the full amount. This could either be because the underlying supplier is not VAT registered or required to be VAT registered or, because the underlying supplier is VAT registered under a small business/private person exemption. An example is where the underlying supplier is exempted from accounting for VAT under local EU Member State legislation (eg, the French VAT registration threshold for small bed and breakfast businesses).

In addition, intermediaries that are not ‘deemed’ to be making the supply will be responsible for collating and submitting to EU tax authorities' details of the underlying suppliers and the sales made. This might be because the underlying supplier is VAT registered – including suppliers of hotel and similar accommodation. This follows the rules for similar ‘platform’ based businesses involved in the supply of goods and is in line with DAC7 provisions.

This will affect both owners and suppliers as well as the intermediaries and platforms.

Damon Wright, Indirect Tax Director, and Jade Els, Indirect Tax Manager at Evelyn Partners LLP. Wright is a member of the Tax Faculty’s VAT and Duties committee.