This page brings together the latest guidance and a number of resources to help you decide when to submit a SAR and to increase the quality of the SAR.

What is a suspicious activity report and what are your obligations

A suspicious activity report (SAR) is a piece of information that alerts law enforcement of potential money laundering or terrorist financing. The UK Financial Intelligence Unit (UKFIU), sited within the National Crime Agency (NCA), receives, analyses and distributes the financial intelligence gathered from SARs. The information is then disseminated to law enforcement agencies who investigate and decide what further action to take. The SARs database is one of the largest source of financial intelligence available for UK enforcement.

If you suspect that money laundering may be taking place, you are legally obligated under the 2017 Money Laundering Regulations to submit a SAR to the National Crime Agency. A high quality SAR can provide crucial intelligence for law enforcement and can help to prevent a wide range of serious and organised crime and terrorist activities. Investigations are often based on multiple SARs, and although you may feel that your report in isolation does not provide much information, it could be the missing piece of a much larger puzzle.

How to submit a SAR

Submit your SAR online via the NCA website. You’ll receive a confirmation email and your report will be processed in about five to seven working days.

The NCA specifically recommends that you submit your SAR electronically if you’re requesting a defence against money laundering (DAML).

Resources to support firms using the SAR portal

In November 2025, the UKFIU published updated guidance on the following topics.

- Chapter 1: Using the SAR portal

- Chapter 2: Submitting a SAR

- Chapter 3: Understanding DAMLs and DATFs

Access the UKFIU Guidance Library for more information:

Note: reporters are reminded that it is essential they keep their main party contact details up to date on the SAR portal. The SAR portal allows users to update personal and organisational contact information via the “Account Settings” section, in the top, right-hand corner of the home page for the SAR portal.

When to submit a SAR

As soon as you know or suspect a person is engaged in money laundering or dealing with criminal property you must submit a SAR.

You’ll need to decide whether you’ve formed a suspicion before you’re obliged to make a SAR. The threshold for suspicion is currently low. The leading test comes from R v Da Silva [2006] EWCA Crim 1654. You have a reportable suspicion if you think there’s a possibility, which is more than fanciful, that the relevant facts exist. In Da Silva, it was noted that “a vague feeling of unease would not suffice”.

Factors to consider when deciding to make a report are included in Appendix D of Anti-money laundering guidance for the accountancy sector – the Treasury-approved official Guidance for accountancy firms.

If you are unsure, we as your AML supervisor can provide guidance. If you are an ICAEW member firm you could contact the technical and ethics helpline or the anonymous AML helpline.

Once you’ve formed your suspicion, it’s good practice to document your reasons.

You can submit multiple SARs on the same issue as and when new information comes to light. Examples of SARs submitted by accountants that have resulted in action are available on the ICAEW website.

If you are unsure as to whether the privilege reporting exemption applies to your suspicion or confidentiality applies to your client relationship, read this article on confidentiality.

How to submit a good quality SAR

A detailed SAR helps the NCA to quickly identify whether your client is a person of interest and to fill in existing intelligence gaps. The bulk of analysis focuses upon searches of key words in the free text so consider this in your typology. The data matching process relies on having basic quality standards of information:

- Data fields

- Include as much information as possible

- Dates of birth provide vital information for identifying individuals. Try and include as much identifying information as possible to include full name, gender, nationality, and address with postcode.

- Use the word ‘’UNKNOWN’’ if you are unable to complete a field. Do not leave it blank

- Try and complete the source type field

- If you have submitted previous SARs then include SAR reference numbers

- Reason for suspicion

- Limited to 8,000 characters; approximately 1,500 words

- Start with the glossary code. The SAR glossary codes are always prefixed with XX. The glossary code should be included in the reason for suspicion text space. You can use more than one glossary code. The NCA user guide for current glossary codes can be found here.

- Provide a brief summary to highlight key elements of suspicion

- Avoid acronyms and jargon

- Do not write in capitals. Limit the use of capitals to when punctuation requires, and use punctuation.

- Structure the report in a logical format

- If there is a large amount of information; break it up into manageable paragraphs

- Summarise your suspicion; chronologically

- Separate bank account/transaction information and use standard sort code account format 012345 12345678.

- Wherever you can try to answer the following questions; who? What? Where? When? Why? How?

- If you have other identifying information provide it here; for example occupation; car details; passport, NI number; telephone numbers.

ICAEW has set out some practical hints and tips for effective reporting.

Suspicious Activity Reports webinar

ICAEW's anti-money laundering supervision team were joined by the National Crime Agency and other AML professionals for this live webinar event. The webinar discussed money laundering risks, SARs and the law, SARs and the role of the MLRO. It also featured case studies and a live Q&A.

SARs Q&A video

Following on from the Suspicious Activity Reporting webinar, Michelle Giddings, ICAEW Professional Standards' Head of AML, and Angela Foyle, Partner at BDO and Chair of the AML Committee of Accountancy Europe discussed some of the questions raised during the event.

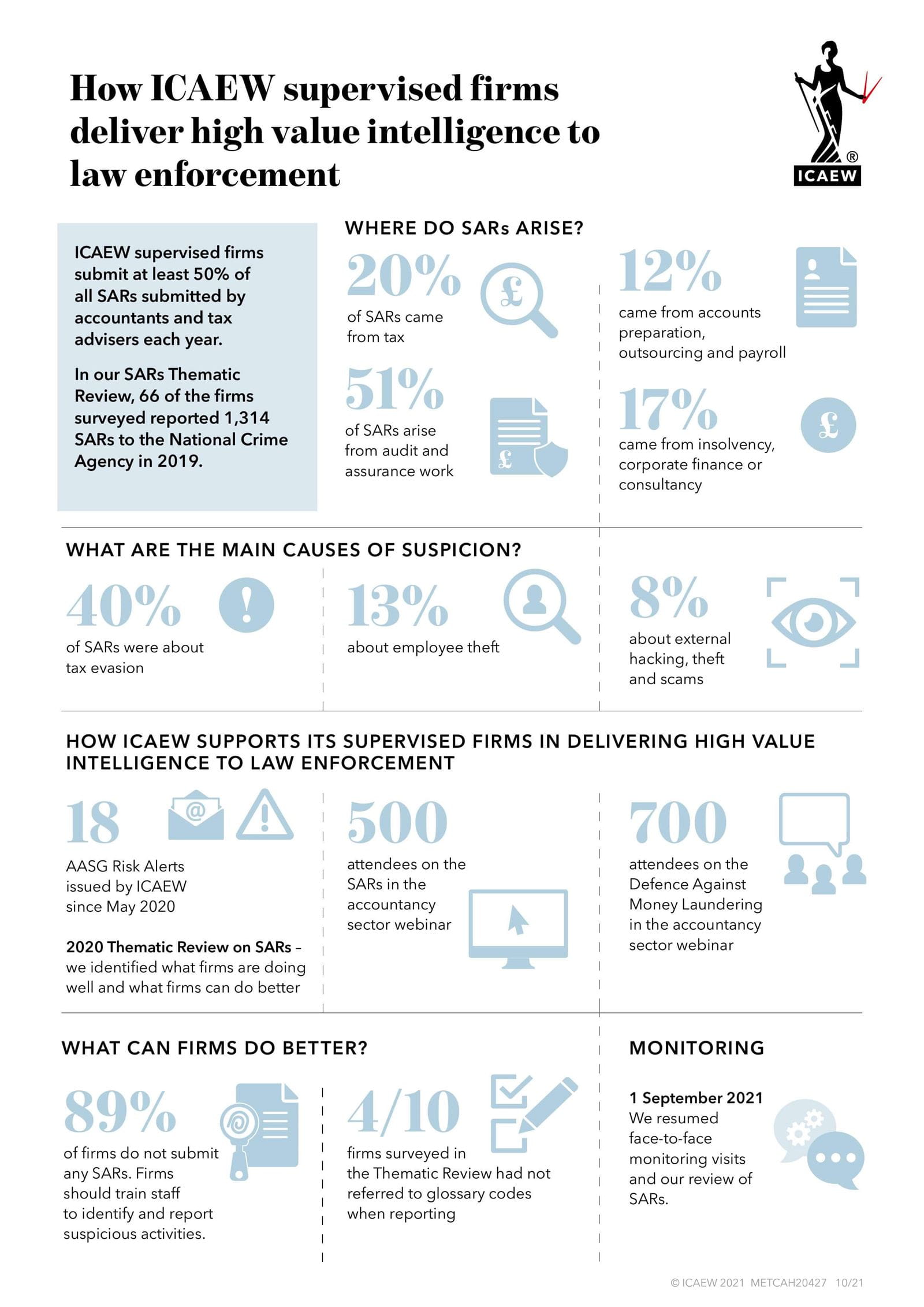

Suspicious Activity Reporting Infographic

How ICAEW supervised firms deliver high value intelligence to law enforcement.

Defence against money laundering - DAML

If a person has suspicion that property they intend to deal with is criminal in some way, and that by dealing with it, they risk committing an offence under POCA (2002), they can request a DAML.

SARs disclosures in civil litigation cases

The Government has published Circular 004/2021 ‘Money laundering: the confidentiality and sensitivity of suspicious activity reports (SARs) in the context of disclosure in private civil litigation. It sets out the Governments position on the use of SARS in private civil litigation matters and provides guidance to help protect reporters of SARs, the subject of SARs and the integrity of the SARs regime. Firms should consider how they can apply the guidance to protect themselves and to maintain the wider effectiveness of the SARs regime.

Red flag indicators

Accountants should be alert to the following information on the NCA website:

The government Flag it up campaign lists flags to be alert to when dealing with both new and existing clients:

- Transactions: Are transactions unusual because of their size, frequency or the manner of their execution, in relation to the client’s known business type?

- Structures: Do activities involve complex or illogical business structures that make it unclear who is conducting a transaction or purchase?

- Assets: Does it appear that a client’s assets are inconsistent with their known legitimate income?

- Resources: Are a client’s funds made up of a disproportionate amount of private funding, bearer’s cheques or cash, in relation to their socioeconomic profile?

- Identity: Has a client taken steps to hide their identity, or is the beneficial owner difficult to identify?

- Behaviour: Is the client unusually anxious to complete a transaction or are they unable to justify why they need completion to be undertaken quickly?

- Political Status: Is the client engaged in unusual private business given that they hold a prominent public title or function? Or do they have ties to an individual of this nature?

- Documents: Are information or documents being withheld by the client or their representative, or do they appear to be falsified?

- Geographical Area: Is the collateral provided, such as property, located in a high-risk country, or are the client or parties to the transaction native to or resident in a high-risk country?

- Choice of Professional: Have you, or other professionals involved been instructed at a distance, asked to act outside of your usual speciality, or offered an unusually high fee?

Resources/guidance

UKFIU SAR best practice guidance video series

Watch the UKFIU's short video series highlighting best practice for submitting Suspicious Activity Reports (SARs). Covering key topics such as glossary codes, reasons for suspicion and what happens after submitting a DAML or DATF, the videos are designed to support firms in improving the quality of their SARs.

The Metropolitan Police shared crime indicators with the accountancy Professional Body Supervisors at a recent workshop.

The NCA website includes numerous publications on how to submit a SAR and what constitutes a good quality SAR. The link to their guidance page is shown below.

- Introduction to SARs

- There is also a UKFIU helpline for those submitting SARs or SAR online enquiries

- 020 7238 8282 – voicemail service

- Email ukfiusars@nca.gov.uk

Further ICAEW guidance

- AML – the essentials, issue 20

- Suspicious Activity Reports – Thematic Review, guidance and information

Access best practice guidance on procedures for reporting suspicious activities and staff training. - SARS – Top tips for effective reporting

- SARs helpsheet

- Technical helpsheet which aims to help answer some common questions relating to tipping off

- Suspicious Activity Reports Case Studies

AMLbites: SARs

Watch our short training videos that cover some key topics around suspicious activity reporting.

Watch now