Bryan Crawford considers the capital allowances actions that advisers should be taking when advising non-taxpaying sellers or buyers of commercial property.

With falling capital values, cash flow pressures and regulation changes looming for EPC ratings, many large commercial property funds have decided to rationalise their portfolios in the last year with often varied and complex capital allowances results for the buyers involved.

Aside from the most common type of capital allowances claim for second-hand property – plant and machinery allowances (PMAs) for fixtures – we are now starting to see residual claims for structures and building allowances (SBAs). SBAs present very different practical challenges if a buyer is to inherit the balance of any qualifying expenditure.

In this article I explore some of the practical difficulties in more detail and provide some planning tips for advisers to make the most of the opportunities and hopefully avoid some of the pitfalls.

Commercial property standard enquiries

Commercial property standard enquiries (CPSEs) are the starting point in most commercial property sales to determine whether the seller is entitled to claim allowances and, if they are, what capital allowances have been claimed (see Q33 of the CPSE).

In Scotland, the equivalent of CPSEs are due diligence questionnaires (DDQs). While DDQs do not cover the same level of detail for capital allowances, they are also the starting point for most analysis.

Buying a commercial property from a landlord who is a taxpayer should be straightforward. If they have claimed capital allowances, there should be confirmation in the CPSE. This is followed by a ‘commercial negotiation’ to set the PMA fixtures disposal value via a s198, Capital Allowances Act 2001 (CAA 2001) election (or s183/s199 for long leases) and allowances statement(s) to enable the transfer of entitlement for the balance of any SBAs associated with building or structural works.

In practice, the ‘commercial negotiation’ for PMAs can sometimes feel like a game of cat and mouse, with the seller trying to keep details to a minimum to preserve PMAs and warrant a nominal £2 election (£1 for each pool).

Although either party can refer the calculation of a ‘relevant apportionment’ to the tribunal where they are unable to agree a s198 value, such referrals are rare (see s187A(7), CAA 2001). Doing so requires details of past PMA claims and the current deal for the tribunal to make a judgement on.

With the introduction of SBAs for new building or structural works under a contract on or after 29 October 2018, we are now starting to see more claims for both new builds and conversion or refurbishment works. Because construction works can be phased and properties multi-let, a property can have multiple construction contracts and more than one ‘allowances statement’.

If a buyer is unable to obtain a valid allowances statement or statements from the seller (or other past owner), the SBA claim is restricted to nil.

TIP |

Always check the planning history and any available construction documentation to inform discussions on what works the seller has carried out on the property and when. Taxpaying sellers that are entitled to claim PMAs or SBAs who have not optimised their position can be open to a ‘cooperation clause’ in the deal where the costs/benefits can be shared. |

Understanding the two-tier claim system

One feature of SBAs that is different to PMAs is the importance of the entitlement position of the seller(s).

A critical principle of the PMA fixtures legislation is that sellers who are entitled to claim must do so for any allowances to be passed to a buyer via a s198 election. If the seller is not entitled to claim on expenditure they have incurred, the buyer may be entitled to claim PMAs utilising a ‘just and reasonable apportionment’ valuation for the qualifying items involved.

In contrast, the entitlement position of the seller is of limited relevance to the administration of SBAs (see HMRC manuals CA94650). A seller that incurs qualifying construction expenditure who is not within the charge to UK tax (eg, government bodies, the Crown, pension funds and non-UK tax resident persons with no UK income) may still need to create an allowances statement for a buyer to benefit from SBAs. This imbalance creates a challenge.

A frequent CPSE response from a pension fund adviser in relation to capital allowances is, “The seller is a pension fund so cannot claim capital allowances.” This does not help or even answer the CPSE being asked, namely:

Q.33.10 In relation to capital allowances on structures and buildings (SBAs):

- Does the Property qualify for SBAs?

- If the answer to (a) is yes, then please state: the total qualifying expenditure for SBAs; the dates when such expenditure was incurred and by whom; the amounts of SBAs that have been claimed to date, by whom and when; the current residue of qualifying expenditure; together with all supporting evidence as required by the relevant legislation; and please provide an "allowance statement" as mentioned in section 270IA of the CAA.

The determination of a property qualifying for SBAs in 33.10(a) is not linked to the landlord’s ability or entitlement to claim but actual use; and specifically, ‘non-residential use’. So, the answer might be “not applicable” depending on the type/dates of construction expenditure. But the fact the seller is a pension fund is irrelevant. This raises some important practical challenges.

A co-operation clause with a seller familiar with capital allowances claims is not unusual. However, the insertion of a similar clause with a non-taxpayer is likely to be met with understandable resistance.

TIP |

Plan, be realistic and open. The calculation of PMAs through entitlement due diligence and specialist valuation is well understood and the seller’s co-operation is mostly light touch for things like details of works and any contributions. Much of the information needed for a PMA claim will either be in a deal room or in the public domain. However, claims for SBAs are a very different matter. These must be based on the actual construction costs. This requires the seller to be prepared to provide access to detailed information such as financial ledgers, construction documentation, costs, and property/finance teams. The seller(s) must also be happy with any allowances statement prepared as it is their responsibility for provision/maintenance. |

Case study: commercial office park

Below is a recent transaction example for a freehold office acquisition with comparable CPSE response to demonstrate.

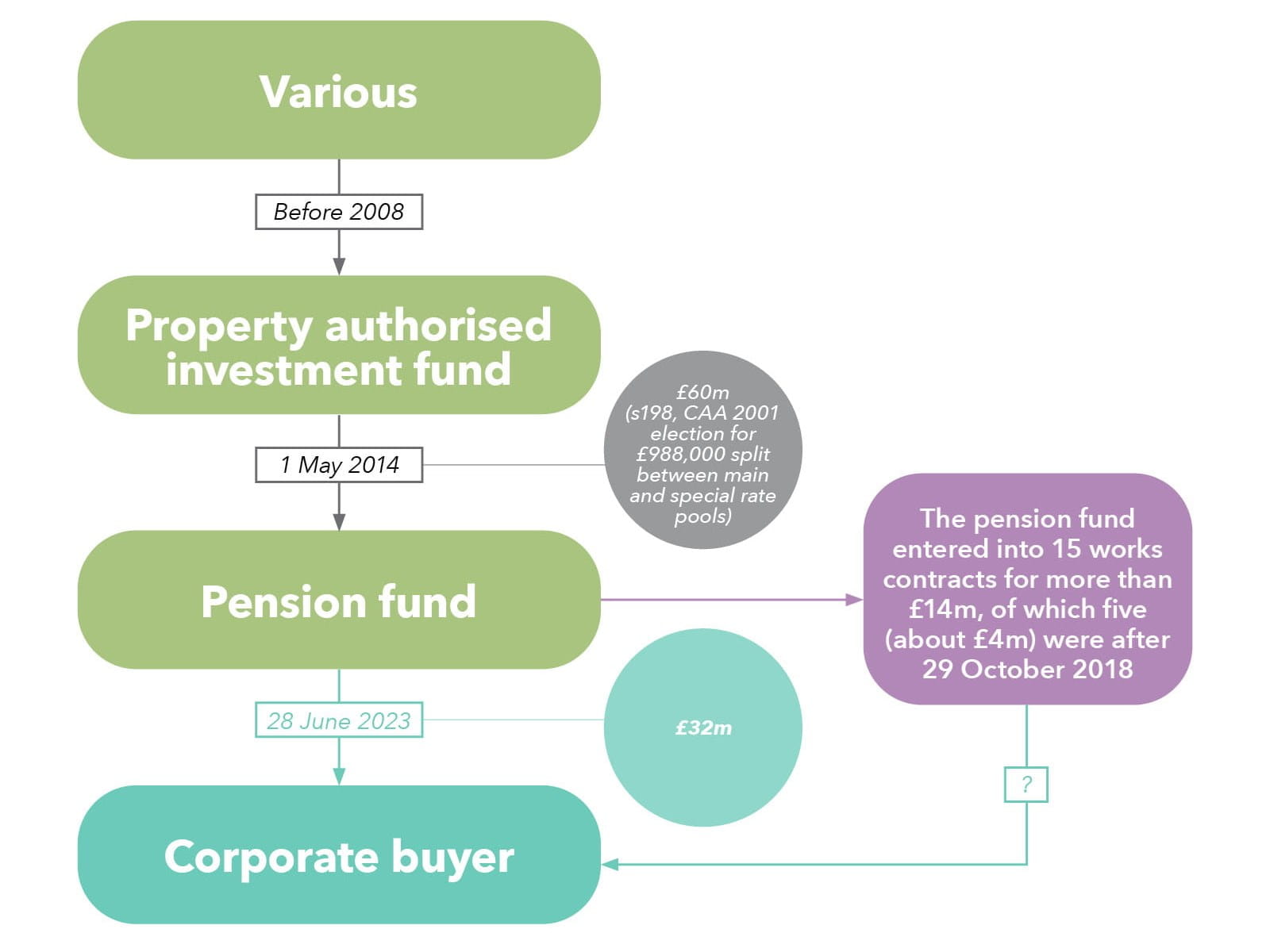

The corporate buyer (a UK taxpayer) in principle is entitled to:

- A just and reasonable apportionment of the £32m purchase price, restricted to reflect the value of PMA items installed by the pension fund seller, retained PMA from the s198 election and any original ‘integral features’ installed before 1/6 April 2008 for which the property authorised investment fund (PAIF) was not entitled to claim. This is expected to produce a fixtures claim in the region of £6m (ie, a potential corporate tax saving over time of up to £1.5m, assuming a corporation tax rate of 25%).

- Any SBAs included in a valid allowances statement provided by the seller, which could transfer SBAs in the region of £2m, (£4m less plant and machinery, non-qualifying expenditure and expired SBAs) deductible at c.3% per annum in five different amounts over 29 and 32 years.

This is a two-tier claim. The valuation for (1) may help inform (2) but it cannot be used for it. A construction analysis for (2) may help with cost benchmarking for (1) but it will be incomplete and contain items like demolition, alterations and repairs that are not relevant. The claim for (1) can be prepared independently and without the oversight of the seller whereas the claim for (2) requires the seller’s co-operation and support.

In this example, the seller had no understanding of its role in passing on SBAs with an inherent potential tax saving of up to £500,000 (£2m, at an assumed corporation tax rate of 25%).

TIP |

Capital allowances remain one of the few mechanisms for commercial property owners to legitimately reduce their tax bills. Losing them is a missed opportunity. If you are selling a property, particularly for a non-taxpayer or specialist fund with recent construction works, do not forget about SBAs. Ahead of a sale, think about creating allowances statement(s) and gathering the supporting evidence. |