In the second part of our series, Nick Wright explains HMRC’s current attitude to providing statutory clearance for transactions.

In my article, Understanding the statutory clearance process, I used case law to explain the factors that will influence whether HMRC will grant a statutory clearance.

Two examples of transactions that seem to present particular challenges in justifying the commercial reason to the current HMRC Clearance and Counteraction Team are:

- the insertion of personal (or family) investment companies under a share exchange transaction; and

- demergers prior to a sale.

Before I look at some specific examples, I’ll provide a quick recap on the clearance process and the ability to have a decision reviewed by the tribunal.

The clearance process

In most cases involving statutory clearance applications, HMRC has a specified time limit within which it must respond – typically 30 days.

It is worth bearing in mind that this is a time limit to respond, which could be with either acceptance, refusal or to ask further questions it believes pertinent in allowing it to form a decision.

Unsurprisingly, given this is a statutory time limit, HMRC usually adheres to these requirements, although we have experienced a rare case where this has not been so.

In fact, in recent times some clearances are being returned extremely quickly. Recent experiences include a s1044, Corporation Tax Act 2010, company purchase of own shares clearance being returned in two days and a s138, Taxation of Chargeable Gains Act 1992 (TCGA 1992), share exchange clearance within five days!

HMRC refusal and the tribunal process

If HMRC refuses clearance for a transaction, it is possible for the taxpayer to request the case to be passed to the tribunal. The process is simpler than one might expect in that it does not involve anybody attending court to give their opinion, but simply requires HMRC to pass all correspondence to date to the tribunal for it to review and provide its opinion.

As no further evidence is provided in this process (and as the tribunal does not necessarily have cases such as those outlined in my earlier article at its disposal), it is essential to outline as much detail as possible, including any case law that may be relevant, in correspondence to HMRC so that the tribunal can take these issues into account.

Note that the tribunal is not bound by the standard 30-day time limit for a response. Despite this, the judges are fully aware that their decision can often be critical in a commercial transaction proceeding and, in our experience, often provide a response on a timely basis.

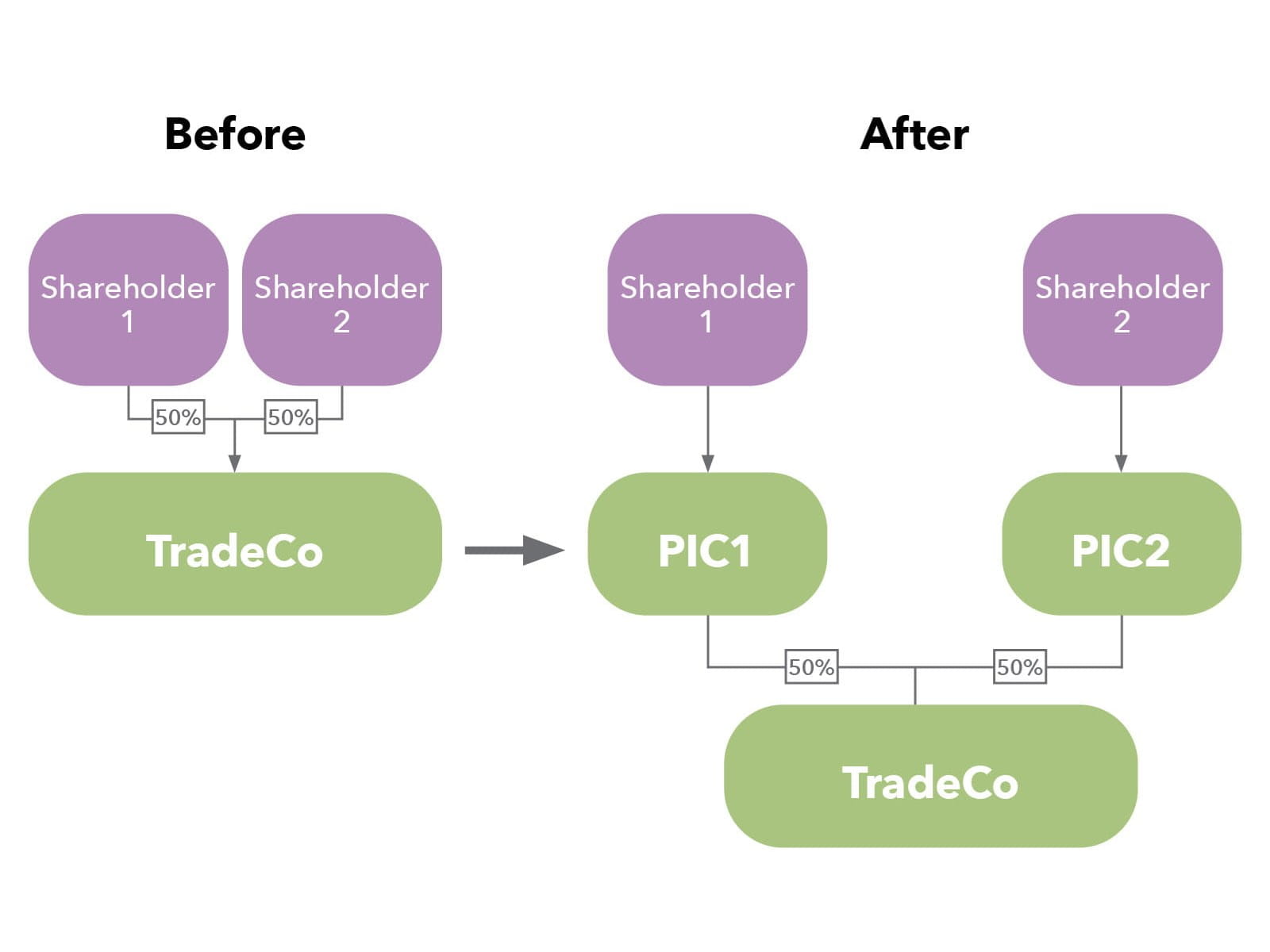

Personal investment companies

A personal or family investment company being inserted in between the existing shareholders and the existing company or group is a relatively common structure that can have commercial benefits (eg, if some shareholders require funds personally while others do not want the cash personally, holding shares via investment companies could reduce the risk of shareholder dispute).

However, there is an obvious tax benefit for the party not extracting funds personally in that their personal investment company (PIC) will not pay tax on the dividend income until extracted personally. HMRC also raises concerns that the extraction of funds out of the existing company means those funds are no longer available for use in the business.

Typically, clearance under s138, TCGA 1992 and s701, Income Tax Act 2007 (ITA 2007) are relevant in creating such a structure.

Brebner is of particular importance here on the basis that the effect of the transaction may be some shareholders deferring the tax liability on dividends, but if this is not a main purpose (eg, reducing the risk of shareholder disputes is the overriding purpose) then this should not prevent clearance being granted. So the key to HMRC granting clearance is that there needs to be a sufficient and robust commercial reason(s) for creating such a structure.

Snell is also an important consideration in that, there may be genuine commercial reasons for inserting a PIC. However, we also need HMRC to be comfortable that the avoidance of capital gains tax, corporation tax and/or income tax is not one of the main purposes.

Insertion of PICs – a tribunal case example

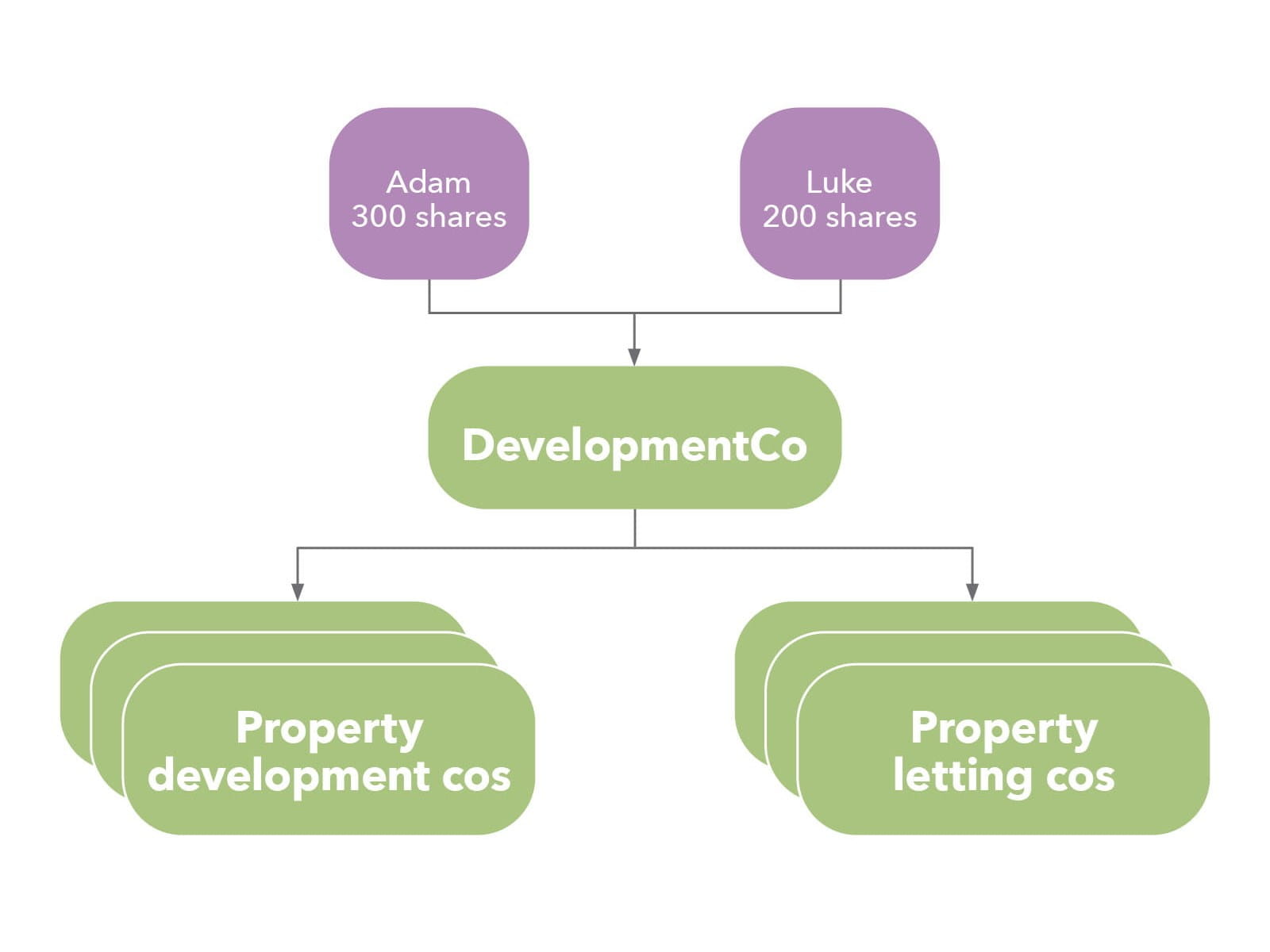

A recent example of a clearance application adjudicated by the tribunal is that of DevelopmentCo. DevelopmentCo was the holding company of a property development group. DevelopmentCo had numerous subsidiaries largely undertaking commercial property development activities but also some operating serviced property lets.

The shareholdings and group structure were as follows:

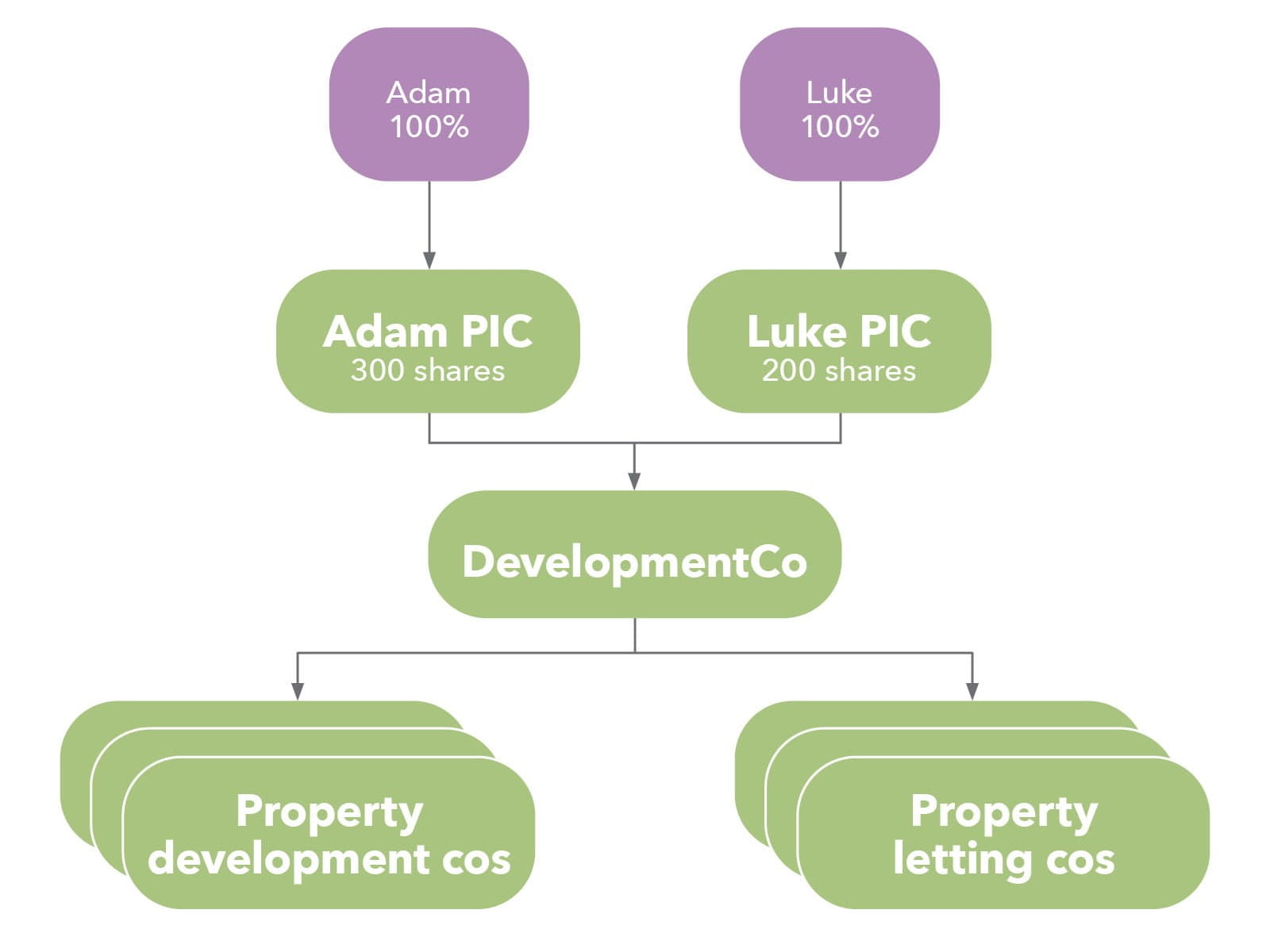

The transaction

The intention was to insert two personal investment companies in between Adam and Luke’s shareholdings via share-for-share exchanges under s135, TCGA 1992 such that the ultimate structure would be as follows:

Commercial reason

The commercial reasons outlined to HMRC for the above restructure were as follows:

- Extracting cash into the PICs to protect the cash against potential disputes from creditors.

- Ensuring significant cash balances did not show on the balance sheet of DevelopmentCo, which was readily available for customers and competitors to view at Companies House. As part of this, the PICs were intended to be incorporated as unlimited companies to reduce public exposure to the accounts and the perceived negative publicity associated with publicly available accounts.

- The differing views of the shareholders in relation to the future investment strategy of the company and diversification. The cash being held within their own PICs would mean that the directors can have complete control and flexibility in relation to these decisions.

- The PICs would assist in succession planning of the company as each director would have more flexibility in relation to passing shares to family members without diluting the other shareholder.

HMRC’s view

HMRC’s decision letter stated that it was concerned that the exchanges may not meet the bona fide commercial purpose test. HMRC viewed the avoidance of negative publicity as a personal and not commercial reason.

Furthermore, as no plans had been identified in relation to the investment activities of the PICs, HMRC did not consider this sufficient to constitute a commercial reason.

Analysis

Clearly, a number of the cases outlined in my previous article are relevant here.

Arguably there are commercial reasons for both the existing group (in protecting against potential disputes and adverse publicity for the company) and the PICs (in enabling them to use the funds for their own business activities).

While there may be a personal benefit in some of the commercial purposes provided, the tribunal has established in numerous unpublished cases that a personal purpose can also be a commercial purpose. Furthermore, those decisions make it clear that the reasons do not have to be related to other commercial ventures of the shareholders but can, for example, relate to the destination of the profits of the company.

Although HMRC seems to take a negative view of cash extraction as a commercial purpose, it is a fairly common business model to hold valuable assets, including cash, in holding companies outside of the trading businesses. The difference in this case being that this was to be held in two separate PICs. Drawing on Snell the shareholders have a right to choose the way in which they achieve this commercial aim meaning the use of separate holding companies should not automatically result in this being considered a personal reason.

Additionally, HMRC argued that the shareholders could simply extract the cash personally and reinvest the funds as desired. Given the significant reduction in free cash resulting from this structure it would clearly not be a commercial answer.

Ensuring cash balances were not in the public domain, while may have some personal purpose, is clearly a commercial one as it can improve the management’s position in relation to trade negotiations and project financing.

In relation to providing the shareholders with the flexibility to invest the surplus cash as they see fit, not only does the structure ensure that tensions between them will be minimised, thus providing a commercial purpose for the existing group but there is also a commercial purpose for the PICs themselves.

HMRC has raised queries on numerous occasions as to the activities of the PICs following a restructure of this nature. While it seems reasonable to question what activities are intended in establishing the facts as to the commercial purpose, the fact that the activities have not yet commenced should not restrict the clearance decision. Take, for example, a property investment business being run through the PIC. HMRC cannot expect the shareholder to already be making offers on properties without having the company in existence and the structure in place. If that were the case, most of those offers would be rejected given they would not be in a position to proceed.

Following the above analysis, clearance was granted for the desired transaction on the basis that it did satisfy the bona fide commercial reason test.

Demerger on divorce – tribunal’s view

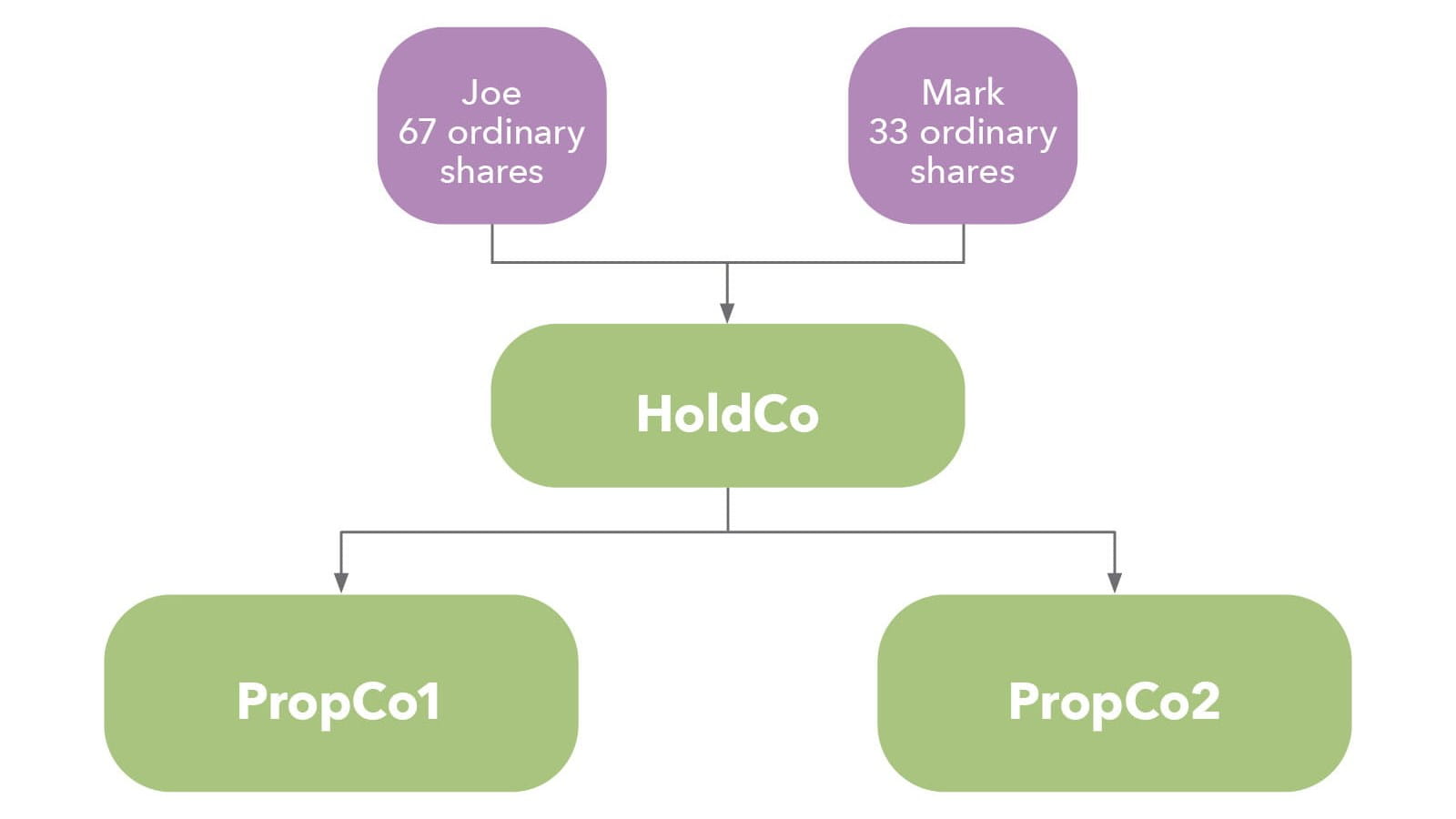

Another case highlighting some of HMRC’s current practice on clearance applications involved a property investment group that was to be split up as a result of one shareholder’s divorce.

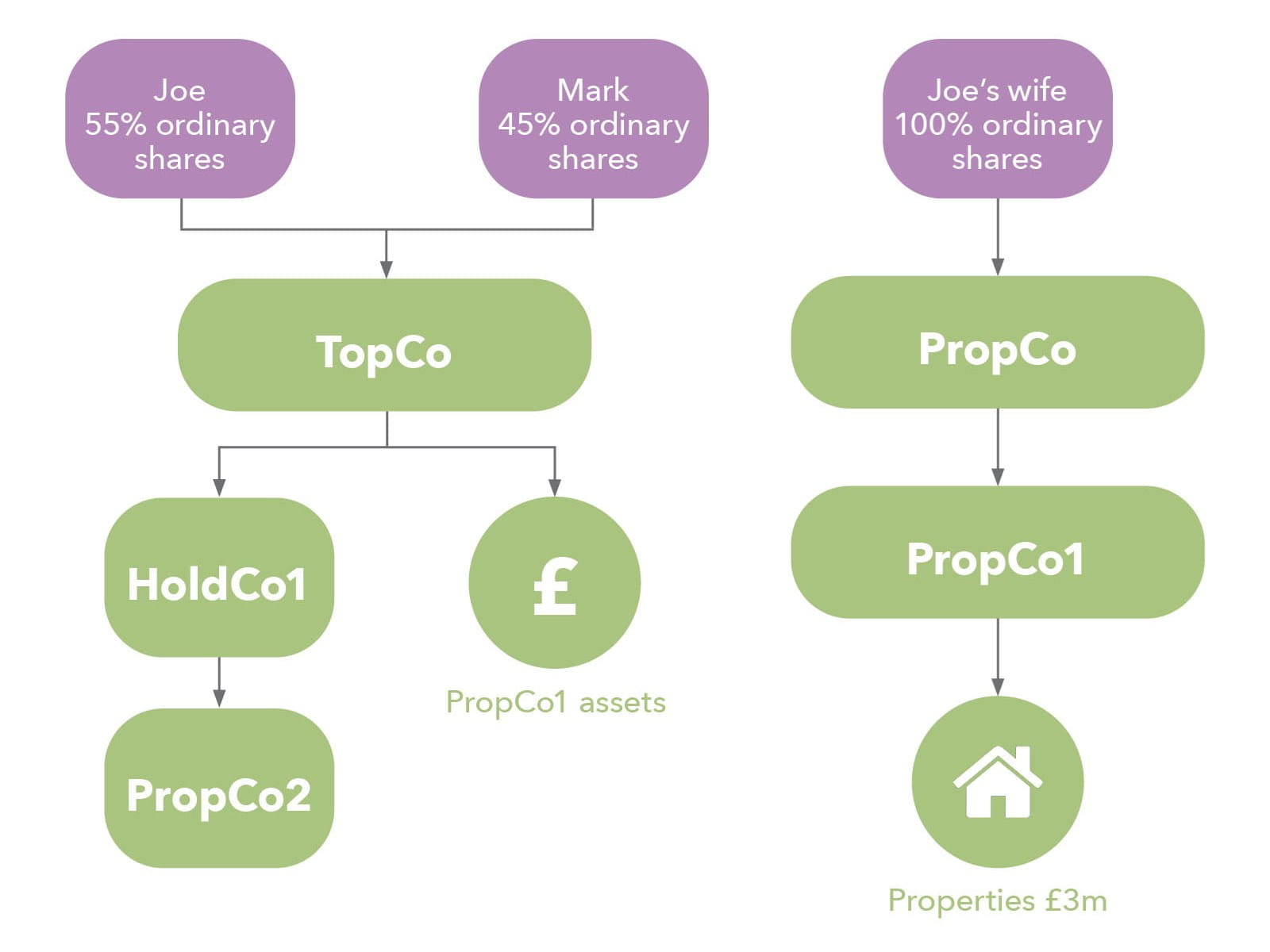

The original group structure was as follows:

PropCo1 held properties worth £5m while PropCo2 held properties worth £10m.

Joe was in the middle of a divorce. As part of the settlement, Joe agreed to his wife’s demands of two of the properties owned by PropCo1 that she could use as a source of income.

This was to be achieved by completing a capital reduction partition demerger to split the properties subject to the settlement into a separate group owned entirely by Joe, following which he would transfer those shares to his wife.

The final structure would therefore be as follows:

Commercial reason

The commercial reason here was quite simple: to meet the requirements of the settlement, Joe was required to transfer value to his wife.

Given the majority of their personal wealth was tied up in the shares of HoldCo, the non-business assets could not be used to provide Joe’s wife with half of the matrimonial value.

Moreover, simply transferring some HoldCo’s shares was not acceptable given Joe’s wife would have almost certainly become a dissenting shareholder.

HMRC’s view

HMRC did provide clearance under s701, ITA 2007. Clearly it was satisfied that one of the main purposes of the transaction was not to obtain an income tax advantage. However, HMRC refused clearance under both s138 and s139, TCGA 1992 as it did not believe there was a bona fide commercial reason for the transaction on the basis that Joe’s divorce settlement was personal.

Analysis

The analysis of the PIC case above stated that reasons can be both personal and commercial and this is an important aspect for this transaction as well.

There is no doubt that there is a personal element to the transaction. However, designing the transaction in this way was a more desirable outcome than, say, having the ex-wife as a shareholder in order to pass this value to her.

The tribunal noted that it was perfectly reasonable to implement the requirement of the divorce settlement in a tax-efficient way, in line with the comments in Brebner.

It also agreed that both Snell and Clark were in point in that:

- the shareholders were entitled to pursue alternative transactions, (Snell); and

- there is no requirement for the commercial reason to relate to the trade of business of the company itself (Clark).

In reaching a decision, the tribunal concluded that the divorce agreement and proposed transactions were “bona fide” so the real question was whether they were commercial.

In considering this question, the tribunal concluded that the divorce agreement and proposed demerger were part of a wider arrangement that was being entered into to ensure Joe’s wife did not obtain shares in HoldCo. Therefore, it was sufficiently commercial, and clearance was granted for the demerger.

Pre-sale demergers

Another common reconstruction is to demerge certain parts of a company or group, prior to a sale to a third party. This is commonly property held in a company that is not to be the subject of the sale to the third party, but may also be another trade.

The simplest way to extract such assets would be as a dividend to the shareholder. This, of course, is likely to have significant income tax implications (plus possibly corporation tax, stamp duty, or stamp duty land tax (SDLT), etc). Often the tax savings can be hundreds of thousands if not millions of pounds.

Another option would be for the asset to be included as part of the consideration of the sale which, while it will usually ensure the disposal is treated as a capital gain, it may still incur other taxes such as SDLT and corporation tax.

Clearly, the fact these options are likely to be simpler than a demerger creates a perfectly reasonable question from HMRC of, “why complete a demerger?” and very commonly, “what other transactions were considered before deciding on this one?”.

As to what other transactions were considered, this is perhaps a less reasonable question given Brebner tells us the taxpayer is entitled to structure a transaction in the most tax-efficient manner.

However, whether any tax advantage is merely the effect, or a main object, is going to be a major consideration for HMRC in whether it believes clearance should be granted.

In terms of typical commercial reasons for undertaking a transaction such as this, it may be considered desirable in order to simplify the sales process – particularly if this is in advance of going to market. Ensuring the company is structured with only the assets that are to be subject to sale should simplify the process and improve the chances of a successful sale at the highest possible price. Alternatively, if a buyer is already lined up, it may be that they have expressed a desire for those assets to be removed before negotiations continue.

Of course, if a demerger is being carried out very early on (eg, a director/shareholder planning for retirement in a few years), it is possible that Snell will be relevant in that the intentions of a sale do not necessarily exist at the time of a demerger.

Seeking clarity

It is important to remember that for share exchanges and reconstructions, there are two parts to the test on which HMRC is requested to provide clearance – the bona fide commercial purpose and the tax avoidance motive. We need to satisfy HMRC on both points.

Case law is very useful in understanding what is required and, sometimes, it is necessary to point these out to HMRC when it is not forthcoming with a clearance. A particularly useful point is that a commercial purpose does not necessarily have to relate to the activities of the company(s) as highlighted in Clark. Also, the fact that a particular method of structuring a transaction results in a lower (or no) tax liability than alternatives, again, does not necessarily mean that tax avoidance is a main purpose of the transaction itself.

Nick Wright ACA CTA, Associate Director, Jerroms Miller Specialist Tax