You are on your way to becoming an ICAEW Chartered Accountant with the Level 7 Accountancy Professional Apprenticeship.

Together, the ACA and the Level 7 Accountancy Professional Apprenticeship will enable you to develop the knowledge, skills and behaviours that you need to start your career and that employers are looking for. Your apprenticeship will involve completing the ACA qualification with additional apprenticeship-specific requirements over 36-48 months (depending on your prior knowledge and experience). Here is all the information you need.

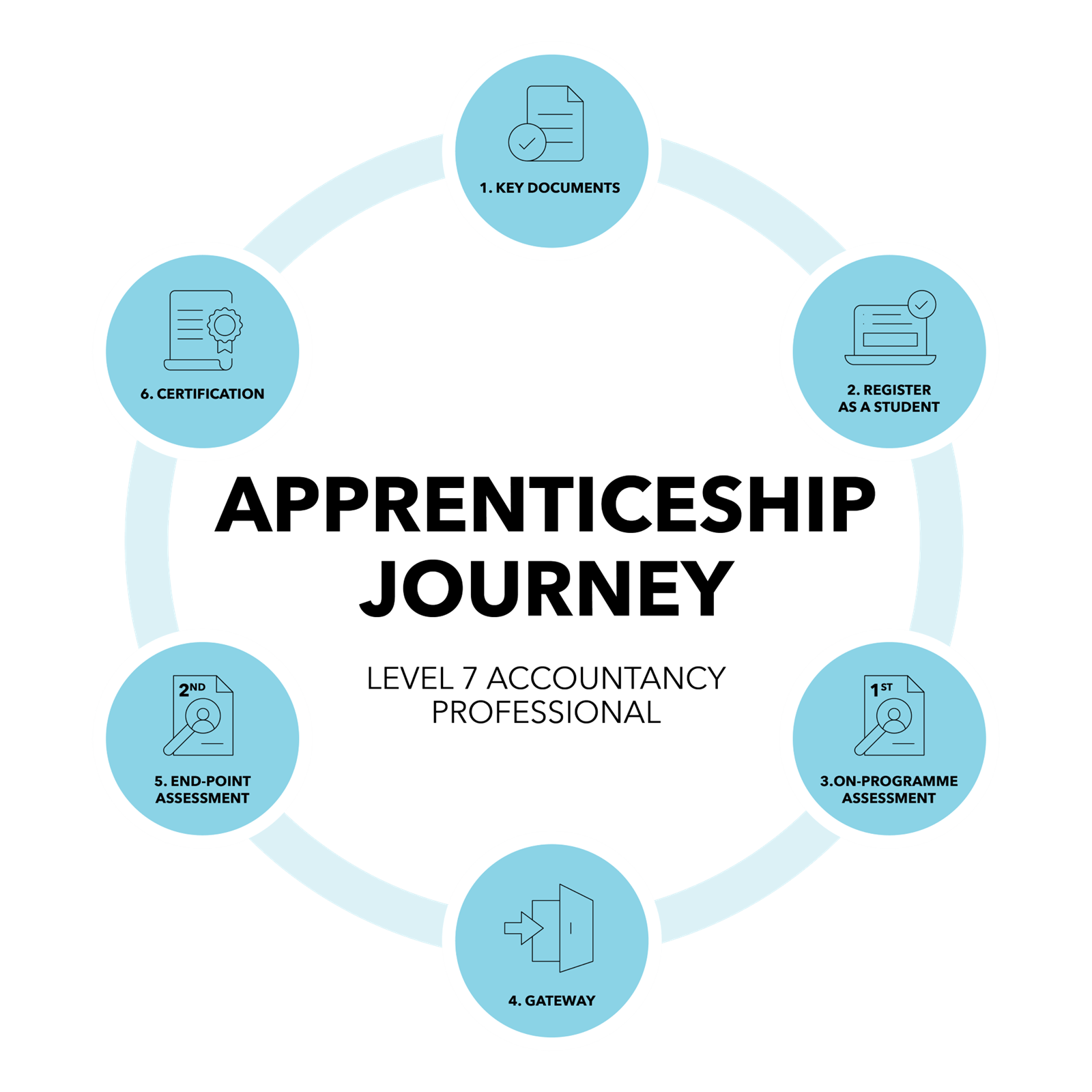

Your journey

The Level 7 Accountancy Professional Apprenticeship involves progressing and completing six stages.

1. Key documents

You will be given the following documents:

- employment contract; and

- commitment statement and apprenticeship agreement.

Once you, your employer and training provider have signed the commitment statement and apprenticeship agreement, your training provider will register you as an apprentice with the education and skills funding agency (ESFA).

Your employer will also give you a training agreement; this relates to the ACA element of the apprenticeship. It will confirm the start and end date and length of time of your training agreement, as well as outlining the support your employer will provide.

| Support from your employer | Support from your training provider | Support from us |

|

Your employer will provide financial support and cover the costs for your training throughout your apprenticeship. Studying for the ACA means your employer will support you professionally, helping you to develop the skills needed to become an ICAEW Chartered Accountant. |

Your training provider will support and guide you in developing the knowledge, skills and behaviours necessary for achieving the Level 7 Accountancy Professional Apprenticeship. They should be your first port of call for any apprenticeship specific queries. |

We provide a variety of resources as you progress through the ACA qualification, including exam resources, student benefits, how to guides, webinars and more. Our dedicated student support team is also on hand to help you with your ACA-specific enquiries, call +44 (0)1908 248 250 or email. |

2. Register as a student

It’s really important that you register with us as a student and correctly select the type of student you’re registering as. It means you will be able to apply for and sit your end-point assessment and ensures that you are awarded your apprenticeship certificate when you qualify.

Please note that, in order to study for the ACA you will need to meet our minimum entry requirements.

Apprenticeship-specific information

Remember to have your 10-digit unique learner number (ULN) to hand before you register. Your training provider will give you this number. It is apprenticeship-specific and you will be asked to provide these details during the registration process. Your ULN can also be found on certificates issued by certain awarding bodies. If you don’t provide this number when you register, that’s alright, just remember to tell us before applying for your end-point assessment. You will be able to do this via the apprenticeship portal within your ICAEW online training file.

ACA CTA Joint Programme

The Level 7 Accountancy Professional apprenticeship can be used to deliver training for the ACA CTA Joint Programme. Students wishing to register for the joint programme as part of the Level 7 apprenticeship should register with both ICAEW (as a Level 7 ACA student) and CIOT in the usual way.

3. On-programme assessment

The apprenticeship retains the key elements of the ACA, including exams, practical work experience, professional development, and ethics and professional scepticism.

During the on-programme assessment, you will need to study for 14 of the 15 ACA exams. (The last exam is the ACA Advanced Level Case Study, and you will do this as part of the end-point assessment). You will also have regular meetings with your training provider to discuss your skills development progress. They will confirm when these meeting will take place. These meetings, along with the six-monthly reviews with your employer, will help to identify any further training you need and whether you're ready to move on to the end-point assessment. The duration of the on-programme assessment stage of the apprenticeship is flexible and depends on your progress.

Throughout this time, you will also maintain and update your ICAEW online training file, gain practical work experience, and develop your ethical and professional development skills as part of the ACA. These elements are explained in detail within the ACA student guide and within the training agreement area on our website.

Off-the-job training

A key benefit of the apprenticeship is that your employer is required to provide you with 20% off-the-job training. This is any learning which is undertaken outside of the normal day-to-day working environment but within normal working hours. It is an essential element of your apprenticeship.

The training can take place at work or away from the office, as long as it isn’t part of your normal duties. Your employer may specify what off-the-job training should look like and involve. However, it will be your training provider who monitors the process and ensures that you spend enough time on this part of the apprenticeship.

Here are some examples which can count towards this requirement:

- ACA courses

- Mentoring

- Tuition provider skills days

- Learning (eg, IT systems and software)

- Online learning

- Internal training

- Induction to the role

- Students' Excel online training course

- Maintaining and updating your ICAEW online training file

- Ethics and professional scepticism training

Once your training provider and employer have agreed that you are provisionally competent in the apprenticeship requirements, and you have spent at least 12 months on the apprenticeship programme, you can move onto the end-point assessment.

4. Gateway

Your employer will agree when you’re ready to move onto the end-point assessment. This is known as the gateway review.

To pass the gateway review, your employer will agree that you:

- are, in their view, competent in the role and ready to do the end-point assessment;

- have achieved Level 2 or above GCSE Maths and English, or equivalent; and

- have completed a minimum of 12 months on the apprenticeship.

When you apply for the end-point assessment, there is a requirement within the application process where you will need to confirm that you have passed the gateway review.

You can only progress to the end-point assessment when you have passed this gateway review.

You also will need to enter your unique learner number (ULN) when you apply for the end-point assessment, if you have not entered it into your training file. We recommend entering your ULN via your training file.

The ULN can be obtained from your tuition provider.

5. End-point assessment

The end-point assessment consists of two parts:

ACA Advanced Level Case Study exam

The Case Study exam presents a complex business issue that will challenge your ability to solve problems, identify ethical implications and provide effective solutions. The exam is four hours long and has a 50% pass mark. You have an unlimited number of attempts at this exam. It is also fully open book, which means it replicates a real-life scenario where all the resources are at your fingertips.

Please note, you will only be able to attempt the Case Study exam once you have attempted (or received credit for) all of the other ACA exams, this will also be within the final year of your training agreement.

Project Report

This part of the end-point assessment is essential to the Level 7 apprenticeship. It assesses evidence of your competence in the skills and behaviours required to become a Level 7 Accountancy Professional. The Project Report will draw on the experience you gain during your apprenticeship, by seeking evidence to demonstrate the skills and behaviours you have developed and will focus on the final 12 months of your apprenticeship.

View this guide that takes you through a step-by-step process on how to book your end-point assessment.

6. Certification

Once you have successfully completed both elements of the end-point assessment, we will notify ESFA. You will then receive your apprenticeship certificate from the Institute for Apprenticeships (IfA).

You will be invited to apply for membership of ICAEW once you have completed all elements of the ACA qualification and once your employer has completed the final sign-off within your ICAEW online training file to confirm that you are fit and proper for membership.

At the end of your apprenticeship

Once all elements of the apprenticeship have been successfully completed, you will qualify as a Level 7 Accountancy Professional. Then, once all ACA requirements have been completed, you will become an ICAEW Chartered Accountant and will be able to use ‘ACA’ after your name.

Student support

Our dedicated student support team is on hand to help and advise you throughout your training.