UK economic output dropped by 0.5% in July, according to Office for National Statistics (ONS) figures, as unseasonably wet weather and strike action weighed on activity. This follows growth of 0.5% in June. The three-month-on-three-month growth measure, a better indicator of the underlying trend, shows a slightly more positive picture, with the economy growing by 0.2% in the three months to July.

Key sectors contracted in July

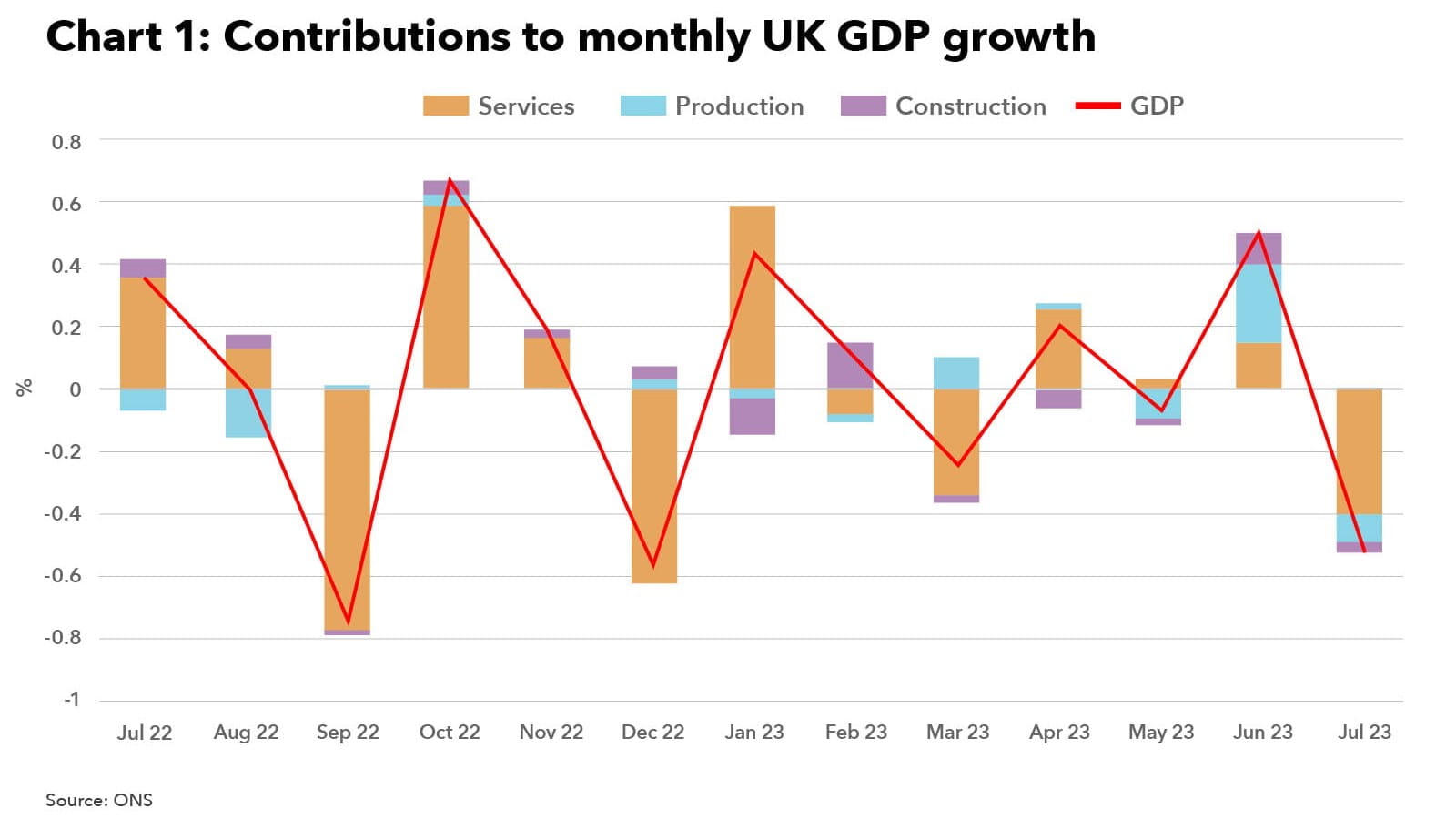

Output from all of the main sectors – services, industrial production and construction – fell in July, the first month since June 2022 that all three sectors contributed negatively to overall GDP (see Chart 1). Services output fell by 0.5% and was the largest contributor to the fall in monthly GDP as industrial action by healthcare workers and teachers had a negative impact on the sector. Industrial production declined by 0.7% as manufacturing output fell back following its rebound from the effect of May’s extra bank holiday. Meanwhile, construction output dropped by 0.5% as poor weather impacted output.

UK’s stronger recovery from COVID-19 could make recession more likely

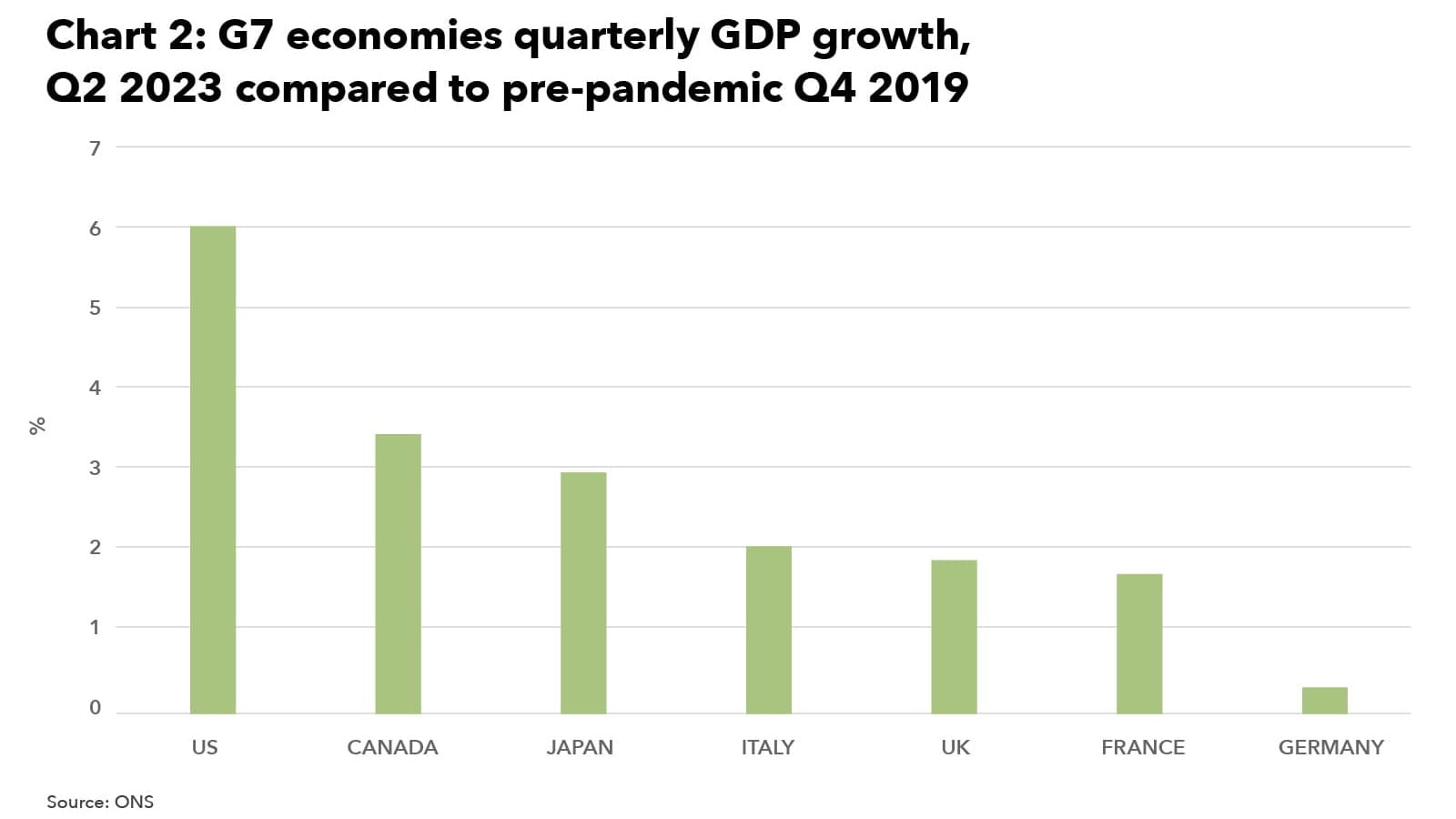

Revised historic figures from the Office for National Statistics (ONS) show that in Q2 2023, UK GDP was 1.8% above its pre-pandemic level in Q4 2019, compared with its previous estimate of 0.2% lower. The ONS revises GDP figures over time as it receives more information about how the economy performed. The latest update means that among G7 nations, the UK’s recovery from COVID-19 is now stronger than Germany and France (see Chart 2). While this looks positive, these historic revisions could make a recession more likely because the UK can no longer rely on a boost from a post-pandemic catch-up in GDP growth.

Labour market conditions weakening

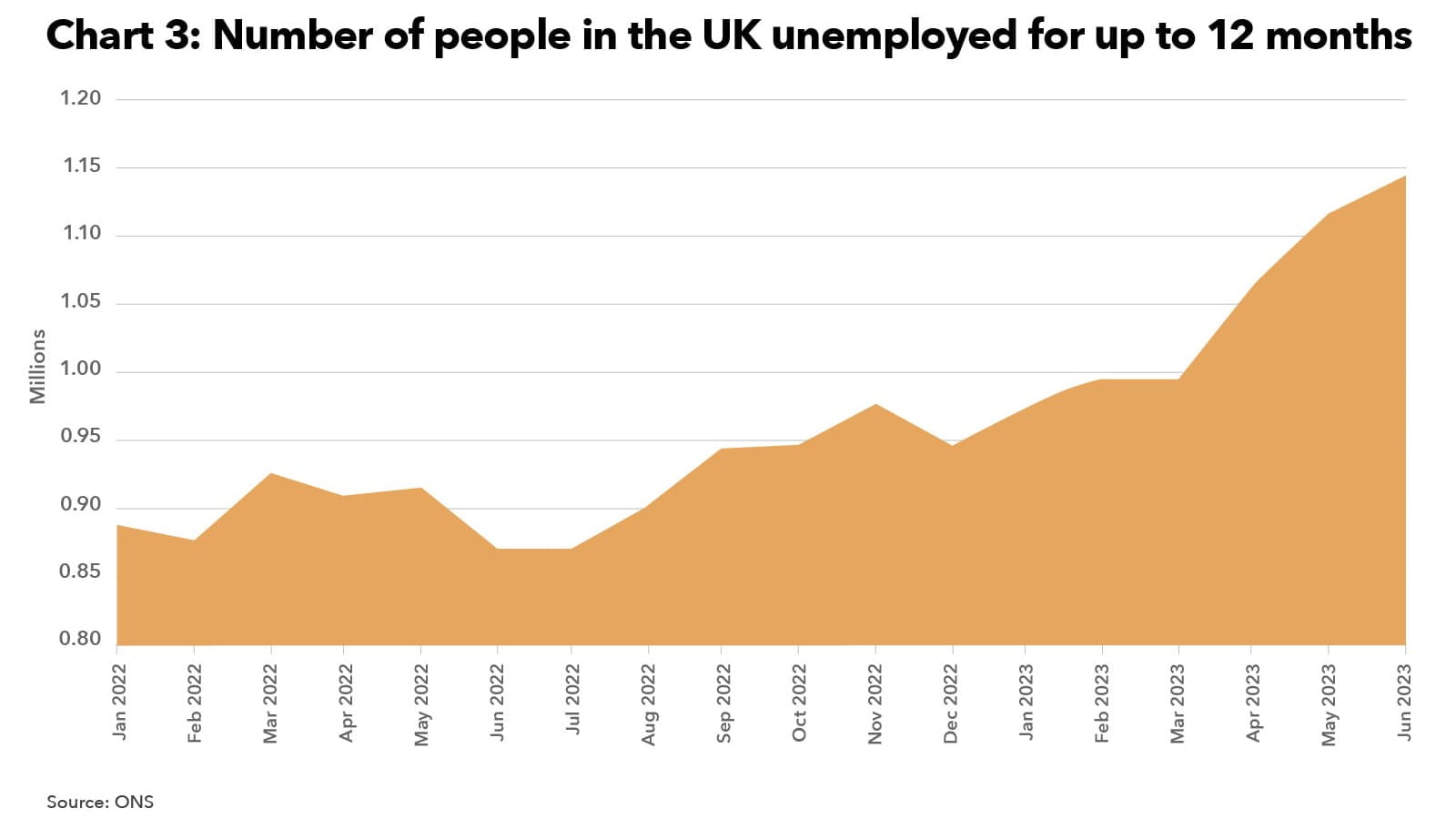

In the three months to July 2023, UK unemployment rose by 159,000, taking the jobless total up to almost 1.5m. This increase was largely driven by people unemployed for up to 12 months (see Chart 3). As a consequence, the unemployment rate rose from 3.8% to 4.3%, the highest in almost two years. The number of job vacancies, a good indicator of demand for workers, fell by 64,000 in March to May 2023 to 989,000, dropping below the one million mark for the first time since the three months to July 2021. Vacancy numbers fell in 13 of the 18 sectors, suggesting a broad-based easing in labour demand.

UK’s inflation tide is turning

UK CPI inflation stood at 6.7% in August 2023, according to ONS, the lowest since Russia’s invasion of Ukraine drove up energy costs and down from 6.8% in June. Significantly, core CPI inflation – a key gauge of underlying price pressures because it excludes volatile items such as energy, food, alcohol and tobacco – slowed to 6.2% in August, the lowest rate since March and down from 6.9% in July. Inflation’s current downward trajectory should gather momentum over the autumn as falling energy bills, a weakening economy and the lagged impact of interest rate rises pushes the headline rate noticeably lower.

Where next for interest rates?

At its latest meeting, the Bank of England kept interest rates on hold at 5.25%, the first time since November 2021 that the central bank has chosen not to raise rates. Unusually, the banks’ rate-setting Monetary Policy Committee (MPC) was split five-to-four on whether to hike rates, a sign that it really was a knife-edge decision. So how likely is another rate hike when the MPC announces its next decision on 2 November? Although the decision is finely balanced, it’s likely to require much higher than expected inflation or wage data this month to push the MPC to raise rates in November. However, while interest rates may have peaked, there is currently little prospect of them coming down anytime soon.

Implications for accountants, business owners and the economy

Taken together, the latest data releases add to growing evidence that higher interest rates are starting to hurt the UK economy. Looking forward, although lower energy bills will help support activity, the drag on incomes from high inflation, an onerous tax burden and the lagged impact of rising interest rates means the UK is walking an unenviable tightrope between feeble growth and a full-blown recession.

UK economy – what to watch for this month:

- Keep an eye out for ICAEW’s Resilience and Renewal: Building an Economy Fit for the Future, which is now live. Current live content covers productivity and investment, with further content covering skills and building a workforce available from Wednesday 18 October.

- ICAEW's Business Confidence Monitor (BCM) – one of the largest and most comprehensive quarterly surveys of UK business activity – covering the third quarter of 2023 will be launched on 25 October.

Further reading

- For more insights, analysis and resources for organisations facing rising costs of doing business, visit ICAEW’s Cost of doing business hub.

- ICAEW also works with caba to promote the mental health of Chartered Accountants and their families producing articles, guides, webinars, videos and events which can provide support during these difficult times.

Economy hub

Expert analysis on the latest national and international economic issues and trends, and interviews with prominent voices across the finance industry, alongside data on the state of the economy.