HM Treasury published the Whole of Government Accounts (WGA) 2021/22 on 26 March 2024, just under two years after the balance sheet date. This is a significant improvement from the 27 months it took to publish the 2020/21 edition, but is still a lot longer than the nine or 10 months HM Treasury is aiming for in the medium term, or the four months or less that it generally takes listed companies to publish their consolidated financial statements.

WGA are consolidated financial statements for more than 10,000 or so organisations in the UK public sector, including central government departments, devolved administrations, regional and local authorities, the Bank of England and other public corporations, government agencies, schools, hospitals, police and fire services, transport authorities and other public bodies. They are prepared in line with international generally accepted accounting practice – International Financial Reporting Standards – different to the statistical standards used by governments to report fiscal numbers in National Accounts.

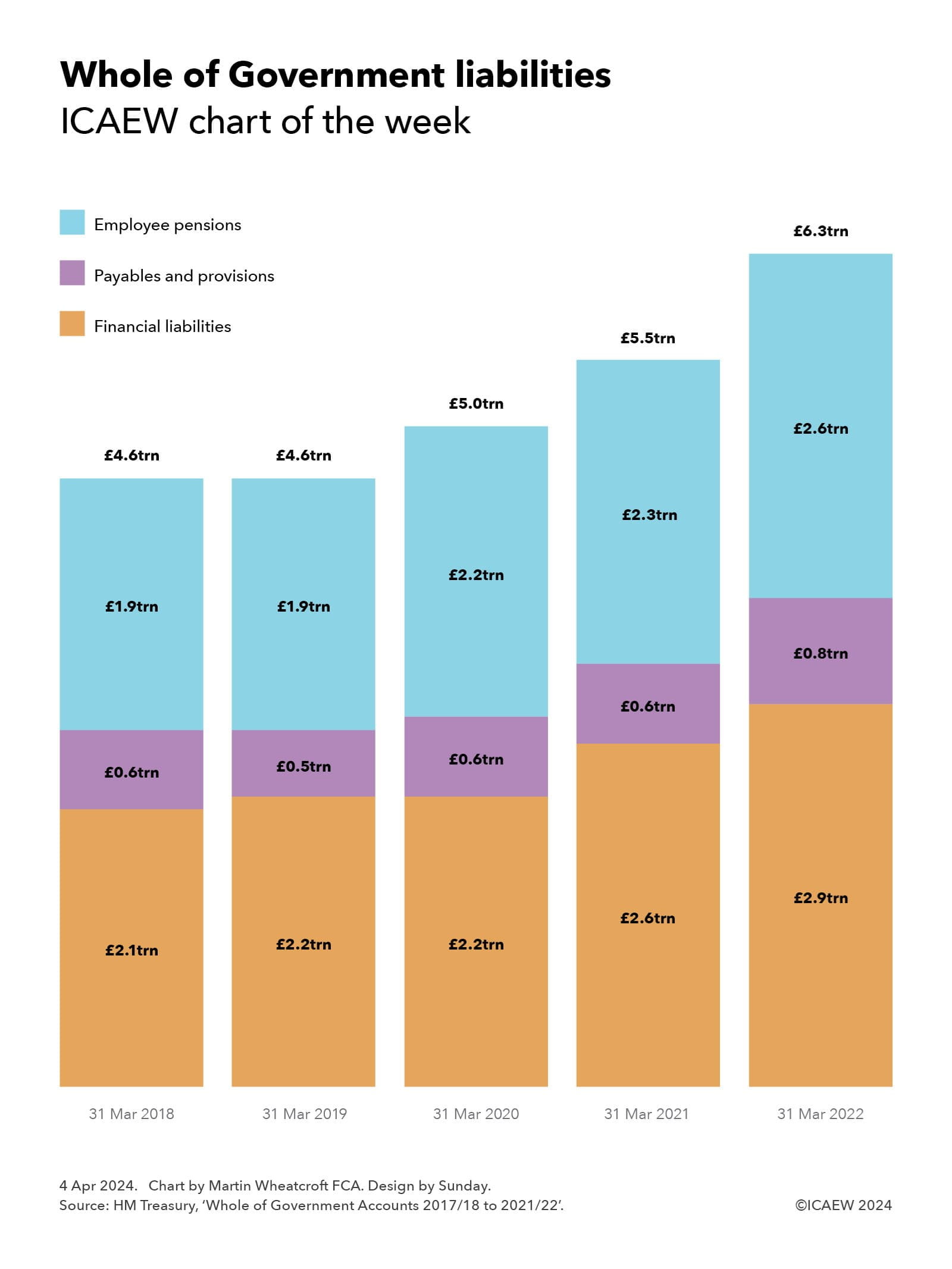

Our chart illustrates how the liability side of the balance sheet has grown over the five-year period, from £4.6trn on 31 March 2018 and 2019 to £5trn on 31 March 2020, £5.5trn on 31 March 2021 and £6.3trn on 31 March 2022.

This reflects how debt liabilities increased from £2.1trn to £2.9trn over that time, with huge sums borrowed in 2020/21 and 2021/22 during the coronavirus pandemic.

The other big liability in the balance sheet is the net pension obligation for public sector employees, which was £1.9trn on 31 March 2018 but had risen to £2.6trn by 31 March 2022, with falling discount rates a key factor in that rise. The latter comprises liabilities of £2.5trn for unfunded pension schemes and net liabilities of £0.1trn (£0.5trn liabilities less £0.4trn in assets) for local government and other funded pension schemes.

The balance sheet does not include the much larger commitment to pay the state pension, which as a welfare benefit is accounted for when incurred.

Total liabilities of £6.3trn on 31 March 2022 are equivalent to £93,000 per person in the UK, comprising £43,000 in financial liabilities, £11,000 in payables and provisions, and £39,000 in for public sector employee pensions.

Not shown in the chart is the asset side of the balance sheet, with assets of £2.4trn on 31 March 2022 or £36,000 per person, comprising fixed assets of £1.4trn (£20,500 per person), investments of £0.5trn (£7,000), receivables and other of £0.2trn (£3,500) and cash and other financial assets of £0.3trn (£5,000). This results in an overall net liability position of £3.9trn or £57,000 per person on 31 March 2022.

The good news is that HM Treasury is working hard to reduce the delays in producing the WGA, which means it shouldn’t be too long before we discover what is in the 31 March 2023 balance sheet. This is expected to show an improvement, as although the government has continued to borrow, pushing up financial liabilities, the net present value of pension obligations and provisions should fall significantly as discount rates have risen sharply since March 2022