Last week’s chart of the week looked at the pre-Budget forecast for debt and the very low level of headroom the Chancellor had against his primary fiscal rule of seeing debt falling by the final year of the forecast period.

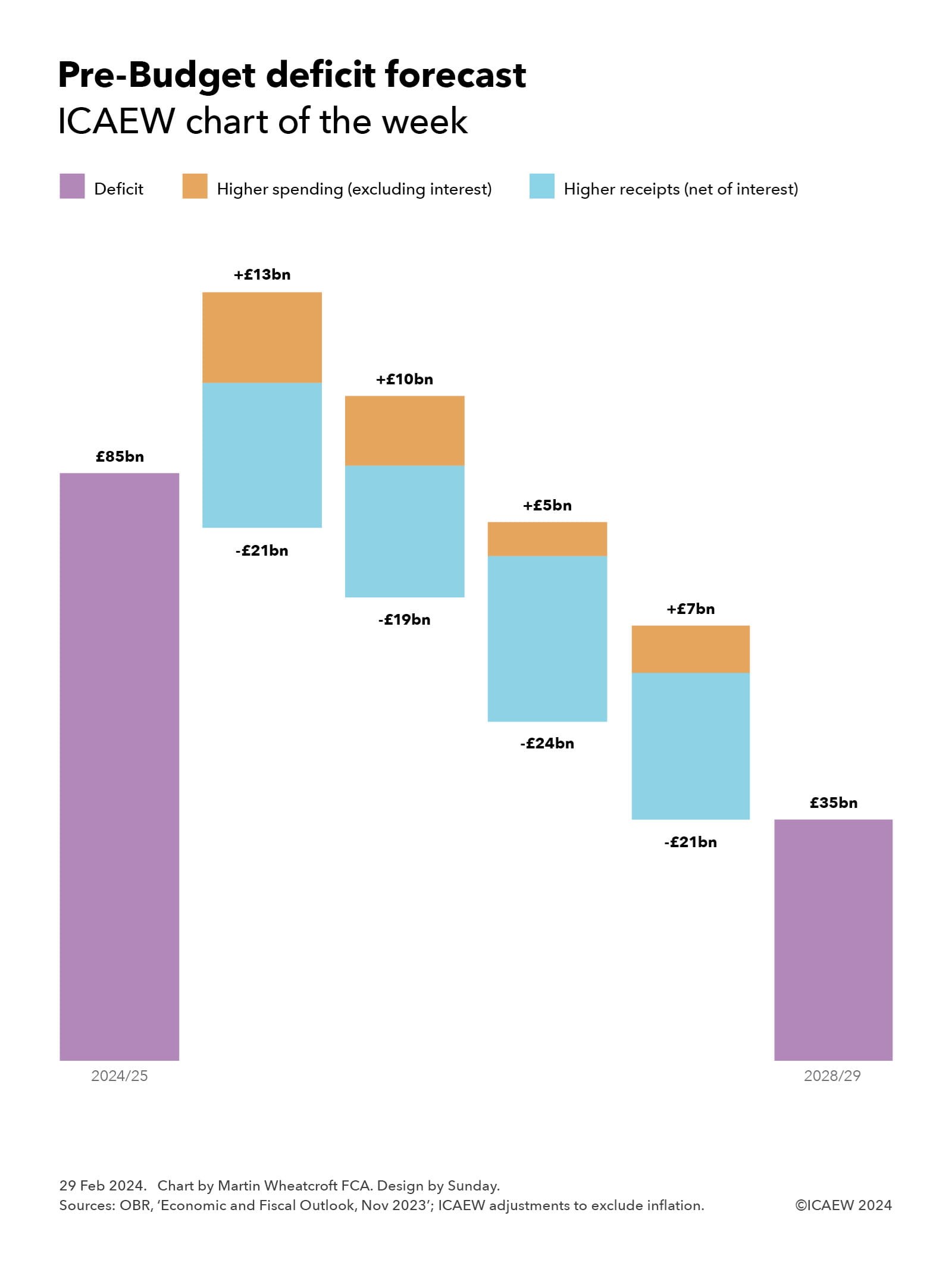

Our chart this week is on the ‘P&L’ side of the equation, illustrating how the Chancellor’s plan at the time of the Autumn Statement 2023 was to bring down the deficit by constraining growth in public spending to less than the level of growth in tax and other receipts.

The starting point is the deficit of £85bn for the financial year ending March 2025 (2024/25) forecast by the Office for Budget Responsibility last November, with spending (excluding interest) expected to increase by less each year than receipts (net of interest): by £13bn and £21bn respectively in 2025/26, £10bn and £19bn in 2026/27, £5bn and £24bn in 2027/28, and £7bn and £21bn in 2089/29, to reach a projected deficit of £35bn in 2028/29.

If achieved, this would see the deficit reduce to the equivalent of 1.6% in 2027/28 and 1.1% of GDP in 2028/29, the first time the deficit would come in below 2% of GDP since 2002/03, a quarter of a century earlier.

Although the increases in taxes and other receipts may seem substantial, they are broadly in line with the projected growth in the size of the economy, with ‘fiscal drag’ from the freezing of several key tax allowances mitigating the effect of tax cuts announced last November. Meanwhile, planned spending increases are relatively small in the context of the overall public finances, equivalent to real terms rises in public spending excluding interest of 1.1%, 0.8%, 0.4% and 0.5% respectively.

This relatively low level of increase in spending may seem surprising in the context of demographic changes that are pushing up spending on pensions, health and social care, a deteriorating international security situation, the severe financial difficulties facing many local authorities, and the pressure many other public services are under, not to mention the need to increase investment in infrastructure if the economy is to return to growth.

The Institute for Fiscal Studies has questioned whether the Chancellor’s spending plans are realistically achievable, given that they imply significant cuts in the budgets of unprotected departments over the course of the forecast period. These are unlikely to be deliverable in practice.

A modest boost to public finances reported in the current financial year, together with moderating interest rate expectations, are expected to provide the Chancellor with capacity to cut taxes while still meeting his fiscal rules. But debt investors will be wondering how much an incoming government – irrespective of which party wins power – will actually be able to raise taxes to fully cover expected spending-plan revisions. Not raising taxes sufficiently in the first Budget after the election would likely lead to the next government needing to borrow even more at a time when the Bank of England is flooding debt markets with gilts as it unwinds quantitative easing.

For more information about the Spring Budget 2024 and ICAEW’s letters to the Chancellor and HM Treasury, click here.