The government has rejected several key recommendations made in an influential committee report aiming to tackle the ongoing crisis in local authority financial reporting and audit.

Published in November 2023, the Select Committee report Financial Reporting and Audit in Local Authorities made a total of 14 recommendations, ranging from short-term measures to clear the backlog of outstanding local audits to longer-term suggestions to make local authority accounts easier to understand.

In its response published earlier this month, the Department for Levelling Up, Housing and Communities (DLUHC) rejected three of the report’s recommendations and said it was keeping a further five under review, despite recognising “many astute recommendations about ways in which the value and effectiveness of local authority financial reporting and audit can be improved”.

Of the five recommendations accepted, the most significant is DLUHC’s agreement to introduce backstop dates for publishing audited local authority accounts in the interim and up to the 2027/28 financial year, with the aim of clearing the current backlog of overdue audits. It has also agreed to work with the Chartered Institute of Public Finance and Accountancy (CIPFA) to review unnecessary disclosure requirements not mandated or intended by the existing legislation, which would help make local authority accounts more understandable to users.

The Committee’s inquiry was conducted against the backdrop of a local audit crisis, which resulted in only 1% of English councils publishing their 2022/23 financial statements by the 30 November 2023 target date. By the end of last year, there was a backlog of 771 overdue audits.

Meanwhile, the report highlighted “fundamental weaknesses” in local authority accounts that “are hampering the efforts of members of the public and other stakeholders to use them in holding local authorities to account”. The report warned that financial statements are “unnecessarily complicated” and “impenetrable” to most readers, and consequently undermining public trust in local authority finances.

The three recommendations rejected by the government include a proposed new arms-length body to manage, oversee and regulate local audit, in line with previous recommendations made by the Redmond Review. Instead, DLUHC’s response says it is sticking with the plan to house the local audit system leader within the Auditing, Reporting and Governance Authority (ARGA), to be established through primary legislation “when parliamentary time allows”.

Alison Ring OBE FCA, ICAEW Director for Public Sector and Taxation, comments:

“We are pleased that the government is introducing measures to clear the huge backlog of unaudited accounts. We are also pleased that the government agrees with the Committee about the need to set out the purposes of local authority accounts as a first step in streamlining financial statements so that they can be made understandable to users.

“However, we are disappointed that the government has not accepted, or still has under review, several of the recommendations. We believe they should reconsider their rejection of a summarised statement of service information and costs that would be useful in explaining council finances to local residents, and we are very concerned about the continued delays in putting the shadow local audit system leader on to a statutory footing.”

In addition to the 14 recommendations to government, the Select Committee report outlined five purposes of local authority accounts, notably that they should:

- be a credible public record;

- allow funders to hold authorities to account for use of funds;

- allow stakeholders to make conclusions on authorities’ value for money;

- allow officers and councillors to make informed decisions; and

- allow stakeholders outside the authorities to make informed decisions.

Problems in local financial reporting and audit have been the focus of the government since 2019, when Sir Tony Redmond was commissioned to conduct an independent review of the local audit framework. Despite a further package of measures introduced in December 2021 to support the timely completion of local government audits, the crisis has continued to worsen significantly.

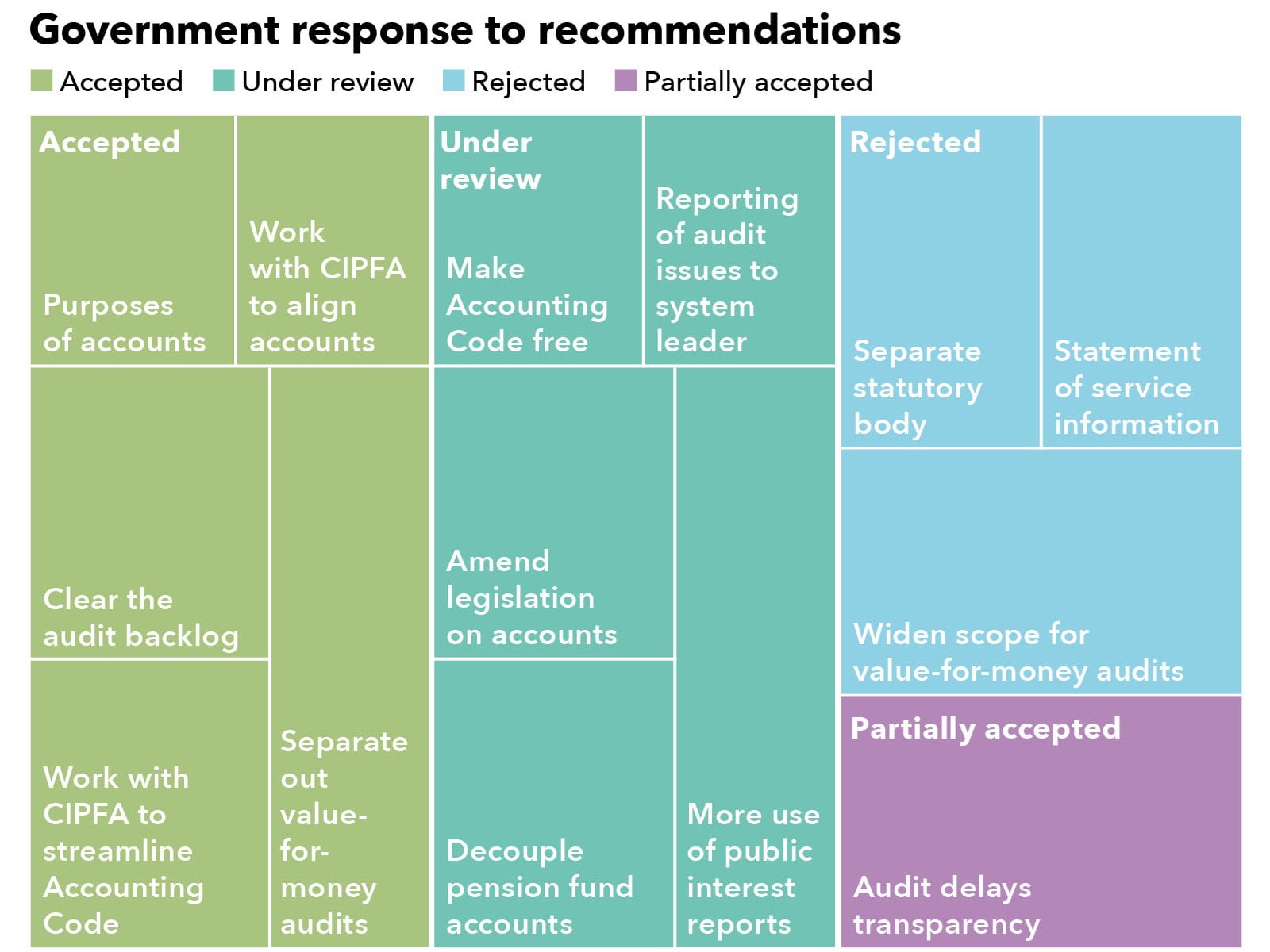

The government response to the recommendation can be summarised as follows:

Accepted Recommendations 1, 2, 4, 9 and 13 to establish the purposes of local authority accounts, to work with CIPFA to align accounts with those purposes, to clear the audit backlog, to work with CIPFA to streamline the Accounting Code, and to separate out value-for-money audits from financial audit work.

Partially accepted Recommendation 5 to introduce backstops to help clear the backlog of local audits (accepted) and for more transparency by requiring finance officers to report audit delays.

Under review Recommendations 3, 7, 8, 11 and 14 to make the Accounting Code free, to require audit issues to be reported to the system leader, to amend legislation to reduce statutory overrides and streamline requirements, to decouple pension fund accounts, and to encourage auditors to make more use of public interest reports.

Rejected Recommendations 6, 10 and 12 to establish a separate statutory regulator, to introduce a statement of service information and costs for local residents, and to widen the scope of value-for-money audits.

Our vision for local audit

Read ICAEW's vision for local audit, making the case for better financial reporting, more timely audits, stronger financial management, and a thriving profession that is highly valued.