Our strategy is to provide robust anti-money laundering supervision through a risk-based regime. We focus our efforts on firms where the risk that they will be used to enable money laundering is highest. At the same time we offer help and support to our firms where appropriate.

While ICAEW is the named supervisory authority, all our regulated functions are delegated to the Professional Standards Department (PSD) which is overseen by an independent regulatory board, the ICAEW Regulatory Board (IRB). By separating our membership and regulatory functions, we can independently monitor, support or take steps to ensure change if these standards are not met.

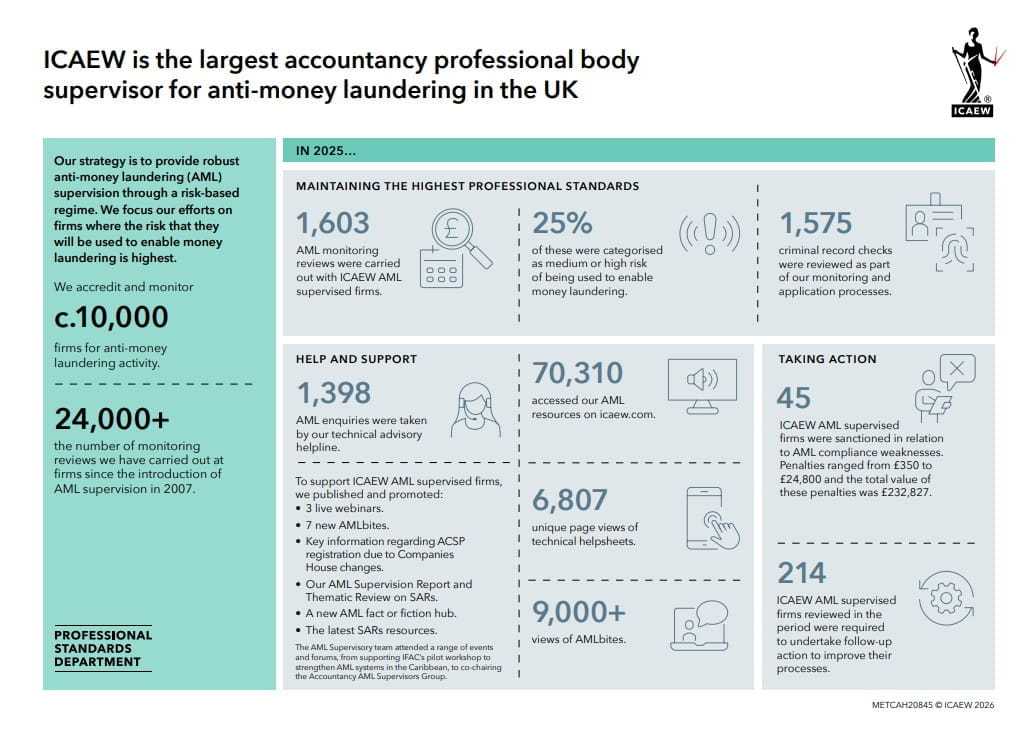

On average, we perform around 2,000 monitoring reviews a year. Since the introduction of anti-money laundering supervision in 2007, we have performed in excess of 22,000 monitoring reviews.

Raise an AML concern

If you believe a firm supervised by ICAEW is breaching the Money Laundering Regulations 2017, you can raise your concern confidentially.

AML monitoring information

2025 AML monitoring activity

Previous reports:

Our approach to AML supervision

Our approach to AML supervision ensures we can effectively monitor our firms and take measures when necessary to secure compliance with the Money Laundering Regulations 2017. To deliver effective monitoring we:

- adopt a risk-based approach to supervision, informed by the firm risk assessments we have carried out, basing the frequency and intensity of our monitoring reviews on the risk profiles prepared;

- take disciplinary action against firms who are not meeting the requirements of the Money Laundering Regulations 2017;

- establish a single point of contact within each ICAEW supervised firm (the money laundering compliance principal), for the exchange of anti-money laundering information and intelligence;

- provide our reviewers, case managers and AML intelligence team with up-to-date information on the domestic and international risks of money laundering and terrorist financing which affect our AML supervised firms. We provide regular training to all our professional conduct staff to continue to embed our supervisory strategy and to ensure they are equipped to take appropriate decisions on the suitability of anti-money laundering policies and procedures;

- ensure the integrity of the accountancy sector is not compromised by allowing criminal funds to be used in the ownership or control of our supervised firms, or by allowing the firms to be managed in a way that facilitates money laundering;

- encourage our supervised firms and the general public to report actual or potential breaches of the Money Laundering Regulations, providing a confidential channel for those wishing to remain anonymous;

- provide information on the money laundering and terrorist financing practices that apply to the accountancy sector and a description of the circumstances in which we think there is a high risk of money laundering and terrorist financing;

- publish formal guidance for accountancy firms which is designed to help firms understand what is expected of them, particularly in relation to taking a risk-based approach; and

- publish other guidance and materials that explain the responsibilities of accountancy firms under the Proceeds of Crime Act 2002 (POCA) and the Money Laundering Regulations 2017, and what we consider is best practice.

Our work is subject to oversight by the Office for Professional Body Anti-Money Laundering Supervision (OPBAS) and to a number of internal quality assurance processes.

Risk assessing our firms

Criminals are attracted to the accountancy sector as a way of giving legitimacy to businesses that are a front for money laundering. Accountancy services may be used to create corporate structures or help to legitimise the movement of proceeds of funds.

Chartered accountants and ICAEW firms are particularly attractive for those seeking to engage in money laundering due to the credibility that their services can offer.

The UK National Risk Assessment of Money Laundering and Terrorist Financing (NRA) 2017 identified key areas where accountants are vulnerable.

- Company formation and other company services: These services are at highest risk of exploitation. The risk is greatest when company formation services are offered in conjunction with other accountancy services, to create complex corporate structures that conceal the true source of wealth and/or funds.

- Company liquidation and associated services: Criminals may mask the audit trail of money laundered through a company that has gone into liquidation.

- Accountants ‘badge’ used on financial statements based on falsified books and records: Underlying books and records have been falsified by criminals and the accountant has unwittingly legitimised the financial statements by preparing them the financial statements. Firms should also assess the risk associated with ‘incomplete records’ engagements where the accountancy firm is asked to use bank statements to prepare the accounts and not the underlying books and records.

- Misuse of client money accounts: There is a risk posed by accountants performing high value financial transactions for clients with no clear business rationale, allowing criminals to transfer funds through the client’s money account.

- The facilitation of tax evasion: Law enforcement agencies have found that accountancy services are used to facilitate tax evasion and VAT fraud.

Monitoring and assessing compliance in our firms

Our proactive monitoring approach ensures we regularly review all of our firms, on a risk-based cycle. The frequency with which we review our firms is determined by the risk profiles we prepare on our firms using annual return data, complaints information or intelligence from law enforcement. Visit cycles vary from annual to eight years, depending on risk.

We also use size as an indicator to determine the delivery method, within each risk banding, because the size of the firm directly correlates to impact (ie, through size of clients, activities of clients, geographical spread of client base, and the range and nature of services provided by the firm).

We make use of a range of tools when assessing the anti-money laundering compliance of our firms.

- Annual return: The annual return is an integral part of ICAEW’s regulatory relationship with firms. Through the annual return, we gather information on the structure, ownership and control of the firm as well as ‘variable’ data that act as risk indicators (eg, number of clients in particular risk categories, the types of services provided and the number of SARs submitted in the period).

- Information requests: We may write to firms to ask them questions about matters identified through the annual return, or for the firm to explain their approach to handling a matter we’ve identified through our media reviews.

- Thematic reviews: We engage with a small population of firms to perform a deeper review into a particular topic.

- Desk-based reviews: We use three desk-based methodologies (desktop, telephone and new firm webinar) where firms submit a completed questionnaire and other pieces of evidence in advance that we review to understand the firm’s compliance with the regulations. For the new firm webinar, we ask new firms to view a short webinar introducing them to the regulations we require firms to follow.

- Onsite reviews: We visit firm’s offices to perform a more detailed review of the firms policies and procedures, as well as reviewing client files and interviewing staff to see how the firm is using the procedures.

We have an experienced team of reviewers, all of who are chartered accountants. As well as keeping up to date with the latest guidance and best practice, we provide our reviewers, case managers and AML intelligence team with up-to-date information on the domestic and international risks of money laundering and terrorist financing which affect the accountancy sector. We provide regular training to all our professional conduct staff to continue to embed our supervisory strategy and to ensure they are equipped to take appropriate decisions on the suitability of anti-money laundering policies and procedures.

Investigation and enforcement

In cases where our monitoring review identifies serious concerns over compliance, we will prepare a report to the Practice Assurance Committee (PAC) setting out the key issue and our recommended course of action. The PAC has the power to award regulatory penalties to a firm where there have been breaches of the Money Laundering Regulations. The PAC does not have the power to apply ICAEW’s disciplinary sanctions. It will refer the case to the Conduct Committee if there are serious integrity or competency concerns or non-cooperation.

The Conduct Committee meets monthly and considers cases ICAEW's Conduct Department have referred to it. It can only impose disciplinary sanctions by consent. If the CC considers that the case is so serious that exclusion may be the only appropriate sanction, or the ICAEW member does not consent to an order offered committee, the matter will be referred to the Tribunals Committee.

The Tribunals Committee chair appoints a tribunal of three committee members to hear cases. An ICAEW member is entitled to attend and be represented before the tribunal.

The following sanctions are available for the Conduct and Tribunals Committees to use:

- Exclusion from ICAEW membership and the right to practice as a chartered accountant.

- Unlimited fines.

- Public reprimands.

- Conditions (usually from the Regulatory Committees, including follow-up review, recharged or not, and training).

Our Guidance on Sanctions provides a flexible and comprehensive framework to deal with a variety of non-compliance and poor conduct issues. There are no limits on the fines that we can impose but the sentencing guidelines do provide a ‘starting point’ for certain offences.

Publicity

When the Tribunals Committee makes an adverse finding and order, it also decides the most appropriate way to publish the decision. We will usually publish details from the record of decision on our website. ICAEW members can make an application for the decision not to be publicised. While such applications are very rarely granted they have been granted in the past, usually where there is a potential adverse effect on a third party or on the member’s health.

Examining non-compliance

Our 2024/25 anti-money laundering supervision report is now available.

Read moreTop compliance insights