With the pace of change constantly accelerating, EY’s Joseph Eloi, Manager, Tax and Trade Strategy, explains the need for a roadmap from HMRC, so that businesses can start planning.

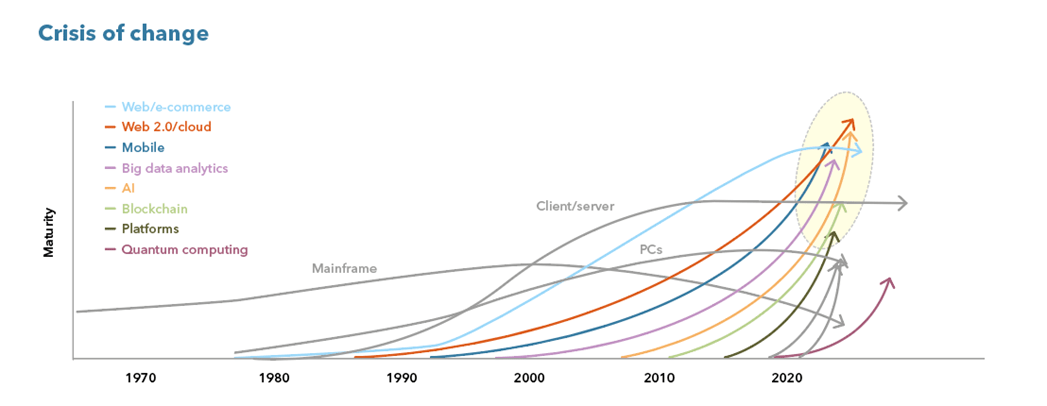

Information technology has developed rapidly over the past 30 years. The past five years have seen the rapid advance of numerous technologies simultaneously, potentially leading to them all maturing over the next five years. All these technologies, from big data to blockchain, have the potential to bring significant value to businesses and the government.

Understanding how these technologies work, interact and add value can be daunting. With multiple options, choosing which, and what, combination of technologies to invest in to remain competitive can become a point of stress. While multiple technologies maturing at the same time presents a great opportunity, the overwhelming level of choice could be viewed as a ‘crisis of change’ (as represented by the graph, below).

This impacts decision-makers across all areas of life. Tax is no exception. Tax is fundamentally rules-based and lends itself extremely well to automation.

In areas where subjective interpretation of the rules is required, emerging technologies such as artificial intelligence (AI) and machine learning can play a significant role in supporting decision-making. Since the pace of change is constantly accelerating, businesses need to start planning now, or risk being left behind. Businesses can anticipate the type of technology they will need for future compliance. But the sooner tax authorities decide the future requirements, the sooner businesses can optimise their own technological decisions.

HMRC’s ambitions

HMRC has a vision to further digitise the tax system by 2030, driven by three elements:

- policy – the extension of HMRC’s Making Tax Digital (MTD) initiative;

- systems – appropriate timing and frequency for the payment of different taxes, and the investment in technology infrastructure needed to support them; and

- law and practice – reform of the tax administration framework itself.

MTD VAT is considered the first phase of HMRC’s 10-year strategy to transform VAT into a digital tax. This strategy culminates in introducing some sort of real-time reporting for VAT by 2030. Since April 2022, MTD VAT has applied to all VAT-registered businesses. It requires businesses to store digital records, submit returns through an application programming interface (API) and ensure that an electronic audit trail exists from digital records through to the submission of VAT returns.

HMRC’s ambition – real-time reporting – requires businesses to send transaction-level information to HMRC in real time. Similar systems already exist in countries such as Spain, where transactions should be reported within four days, and Hungary, where transactions should be reported in real time. In Chile, 93.7% of businesses submit pre-filled VAT returns using real-time information sent to the authorities.

If HMRC is to introduce a form of real-time reporting and utilise technologies maturing in the next five years, businesses need a clear roadmap. Little information has been published on how HMRC seeks to meet its 2030 ambition. Businesses need clarity to optimise their own decisions.

EY’s Future of VAT (EYFoV) campaign undertook a deep dive into the future of UK VAT as a digital tax. It explores whether businesses have a clear understanding of HMRC’s ambitions or clear views on how VAT should be transformed. This article details some of the results.

Benefits of real-time reporting

According to HMRC, MTD has seen a reduction in the scope for error and improved accuracy in VAT reporting. There is a hope that real-time reporting could achieve similar success. It would allow HMRC to detect suspicious transactions early, enable better use of digital prompts to eliminate potential errors in real-time, and help ensure businesses register the same invoices as counterparties.

International examples show how successful it can be. In Estonia, the mandatory reporting of business-to-business transactions in 2014 allowed a more strategic audit of transaction chains. This reduced the VAT gap from 14% to 5% in 2017. Chile and Hungary have combined real-time reporting with e-invoicing requirements, leading to similar success.

Real-time reporting opens the opportunity for ‘split payments’. This involves the real-time remittance of VAT to the tax authorities. This has a clear cash-flow benefit for tax authorities and helps prevent fraudulent activity, such as missing trader fraud.

Why stop there?

HMRC could leverage several technologies maturing in the next few years to improve the VAT system. Blockchain has clear potential to revolutionise VAT reporting. It provides immutable, distributable, time-stamped, public or private record of all transactions occurring in a transaction chain in real-time. This could reduce information deficits, increase the reliability of documentation, increase supply-chain visibility and help prevent fraud.

China, Brazil and India have introduced government invoicing systems, where invoices are issued by governments and not businesses. This helps eradicate VAT fraud by restricting an input tax deduction in situations where output tax has not been paid.

HMRC could utilise AI in verifying VAT compliance and businesses could prepare the invoices and data using it. With AI winning competitions worldwide in chess, art and music composition, there is no obvious reason it cannot help detect VAT fraud or prepare returns.

The use of these types of technology could also enable greater personalisation and more flexibility in VAT policy. HMRC stated that it has the ambition for more personalised tax services for taxpayers through technology. Real-time information enables the government to design more targeted tax reliefs.

One of the main challenges of VAT is its regressive nature. Instead of applying reduced or zero rates to necessities, technology could apply reliefs on purchases made by low-income taxpayers, allowing VAT to become a truly progressive tax. Suppose transactions are reported and paid for in real-time, with blockchain verification of those involved. Certain individuals on low incomes could then receive a real-time VAT rebate on qualifying purchases. Similar principles could apply to purchases by start-ups or SMEs.

Impact on businesses of technology requirements

Taking MTD as an example, less than a quarter of the businesses surveyed as part of EYFoV were satisfied with its roll-out. Businesses referenced HMRC’s lack of awareness of the commercial consequences of having to meet these requirements. One respondent claimed that MTD has more than doubled the resources required to complete a VAT return.

Challenges with the MTD roll-out are likely to be exacerbated in meeting HMRC’s digital ambitions. The 2022 EY Tax and Finance Operations Survey (TFO) indicated that 83% of respondents expect to spend at least $5m to comply with emerging digital tax filing requirements over the next five years. Furthermore, 70% said they intend to invest more than $2m or more in the next three years on tax technology specifically.

While investing in systems can be costly, respondents to the EYFoV survey saw the biggest problem as the time to plan system investment to avoid building exception solutions later. The level of investment required necessitates business cases and sign-off from key internal stakeholders, which takes time. The lack of a sustainable plan for data and technology was cited by 37% of the EY TFO survey respondents as the biggest barrier to achieving their tax and finance vision. This rises to more than 50% for businesses greater than $30bn. Only 6% of those surveyed saw a lack of budget as the issue.

This is also important for SMEs that are likely to require off-the-shelf solutions to meet requirements. To support SMEs with MTD, many providers looked to bring solutions to the market as soon as possible; a clear roadmap from HMRC on its plans for a digital future will help providers more fully develop their offering.

Barriers to real-time reporting

Respondents to the EYFoV survey saw enterprise resource planning system changes as the biggest barrier to meeting potential real-time reporting requirements. These changes can be costly and, with a substantial proportion of costs being upfront costs, this could have an acute impact on SMEs. A number of respondents cited SMEs transforming systems as a specific barrier.

While these changes are likely to be expensive, most viewed the time to implement them as the largest barrier. Using multiple legacy systems is commonplace. Many companies need bespoke software to bring all systems together to meet digital reporting requirements. According to 60% of EYFoV respondents, it would take more than two years to prepare for real-time reporting. With many technological developments maturing simultaneously, it is more important than ever for businesses to be given sufficient time to plan and invest.

Some respondents viewed complex areas of the VAT system as a barrier to the implementation of real-time reporting. Partial exemption special methods and capital goods scheme adjustments are examples of some areas of the VAT rules that HMRC has struggled to incorporate into MTD. Similar challenges would be encountered with real-time reporting. Rules could be simplified to make these areas of VAT more conducive to real-time reporting.

In Singapore, financial services have been simplified by mandating that businesses in the industry are only entitled to credit a given proportion of input tax, instead of completing complex partial exemption calculations. With the UK no longer having to align with European Union VAT, it can make significant unilateral adaptations to the VAT system to support real-time reporting.

The impact on international businesses is more pronounced given that adhering to these requirements may have to be duplicated globally. Some EYFoV respondents viewed aligning UK real-time reporting rules with other countries as crucial to efficiently achieving HMRC’s ambitions.

The UK could work with the Organisation for Economic Co-operation and Development to define common IT and software standards and a common set of data fields that governments can include in data requirements. Unilateral action could result in businesses requiring different software solutions for different jurisdictions. Multilateral action could significantly reduce compliance costs and increase efficiency and accuracy.

Conclusion

The level of choice in technology available to HMRC when setting a roadmap for real-time reporting is daunting. Still, the sooner HMRC sets out this roadmap, the better able businesses will be to make optimal investment decisions. The wealth of technology maturing in the next five to 10 years is an opportunity for governments worldwide to revolutionise VAT systems to create a progressive, accurate, real-time taxation system.

A quick and clear articulation of a roadmap to 2030, incorporating multilateral agreement on software and data requirements, could support businesses and software providers make investments and develop software solutions to realise HMRC’s vision of VAT as a digital tax.

EY’s Future of VAT

EY’s Future of UK VAT campaign brings together the views of more than 340 organisations across a wide range of sectors with the aim of informing policy in a way that reflects the needs of businesses while recognising the regime must deliver the government’s policy objectives. The future of UK VAT as a digital tax is just one of four deep dives, the full list being:

- the future of UK VAT as a digital tax;

- how UK VAT can be used to promote sustainability;

- the alignment of the UK VAT system with other global tax regimes; and

- HMRC relationships, communication, and collaborative policy development.

The full report will be published in the autumn.

About the author

Joseph Eloi, Manager, Tax and Trade Strategy, EY