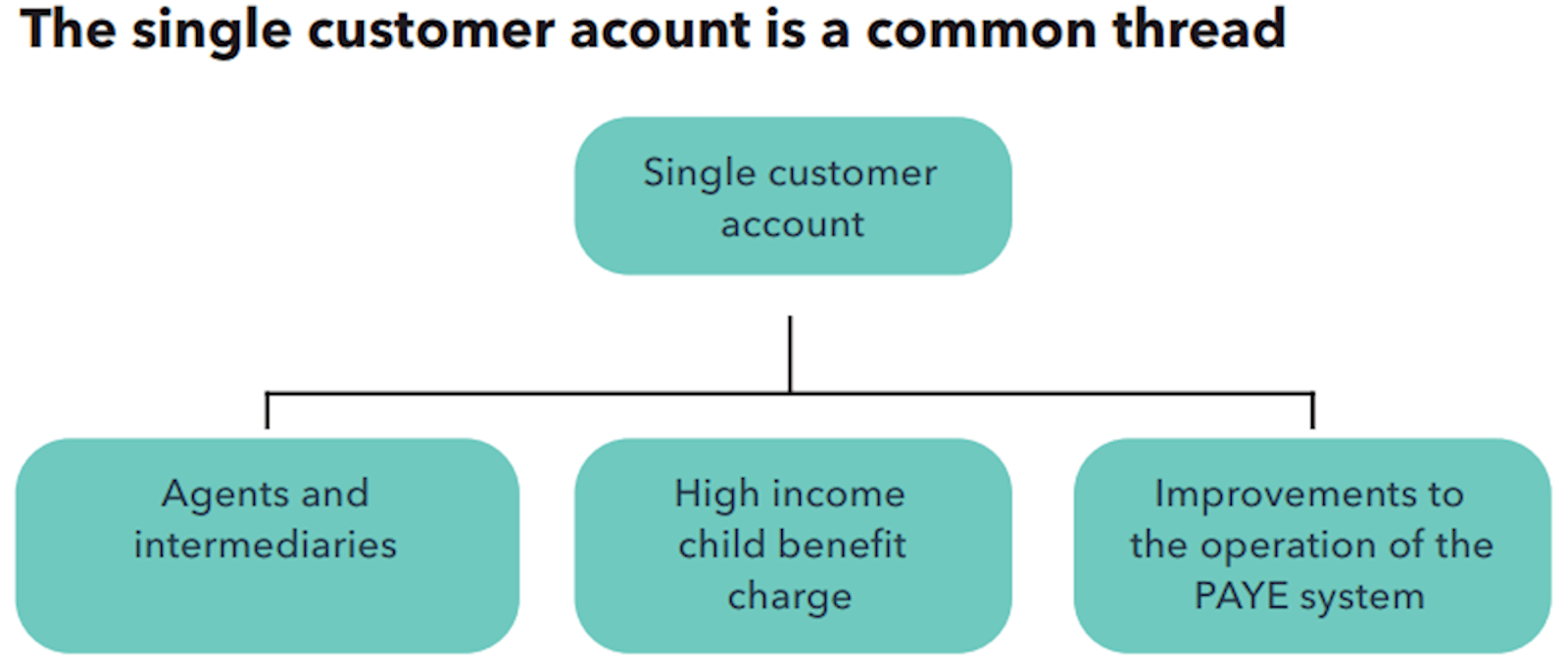

As the Office of Tax Simplification evaluates progress on four areas – the single customer account, agents and intermediaries, the high income child benefit charge, and PAYE – Caroline Miskin and Peter Bickley share their perspectives.

A regular part of the Office of Tax Simplification’s (OTS) work is to take stock of how its recommendations have been received and responded to, by producing evaluation and update notes to inform stakeholders about progress made and to flag up specific recommendations for refreshed consideration.

In December 2021, the OTS published an update on reports about simplifying everyday tax for smaller businesses and individuals. This covered certain aspects of its two reviews:

- Simplifying everyday tax for smaller businesses (published in May 2019); and

- Life Events review: Simplifying tax for individuals (published in October 2019)

In late February and early March 2022, the OTS issued a further four separate update notes dealing with other specific areas covered by those two reviews, namely:

- the single customer account;

- simplification issues relating to agents and other intermediaries;

- the high income child benefit charge and its wider implications; and

- improvements to the operation of the PAYE system.

These latest updates highlight the significance that the OTS places on HMRC’s delivery of the single customer account and it is a common thread through all four papers.

The single customer account

The OTS evaluation paper highlights the following:

- HMRC should provide an indicative roadmap for this project setting out key development stages at which additional functionality or areas of tax would be added, and target dates over, say, the next five years;

- the project should go well beyond a simple merger of the current personal tax and business tax accounts to handle all taxpayer interactions with HMRC;

- as much of the data used is PAYE data, HMRC should overhaul the PAYE system at the same time to ensure that the PAYE and single customer account systems are properly aligned;

- appropriate agent access to data should be built in from the beginning, with HMRC officers able to see the same data and views as taxpayers and their agents;

- the development should be hand in hand with future policy developments (eg, timely payment and taxpayer registration for self assessment); and

- over time, the single customer account should include functionality to:

- facilitate the use of and access to third-party data;

- act as a hub for claims and elections and to deal with capital gains tax; and

- include the state pension and possibly other social security benefits.

The evaluation paper says: “At each stage in this process there should be actions to make many more people aware of their Account, help with registration (where the Government Gateway proves challenging for some), and reminders to help people access the Account regularly.”

The OTS also suggests that HMRC should consider whether there are any immediate short-term improvements that could be made to the personal tax account ahead of the introduction of the single customer account (eg, prompts relating to the high income child benefit charge).

Reviewing these suggestions, Caroline Miskin comments: “Before developing the single customer account, HMRC needs to develop a single customer record, which connects up all relevant records across different HMRC back-end systems. In many ways, that is a bigger challenge than developing the front-end dashboard. Agent access is critical and will need to be based on a sound process for ensuring client consent where work is also needed.”

PAYE

The OTS identified a number of issues in its two 2019 reports. The key ones include:

- the lack of strategic direction for the PAYE regime;

- the need for a fresh review of the PAYE real time information (RTI) system to identify areas of improvement;

- the need for improved external engagement with payroll professionals and agents;

- the practical issues faced by taxpayers that arise from interactions with the PAYE system when starting work, changing jobs or taking on additional jobs; and

- various issues with PAYE codes and coding notices issues faced by employees when claiming expenses.

The OTS considers that the key priority for HMRC and the government is to ensure that there is the commitment and funding in place to sustain continuous improvement and development of the PAYE system and to enable the effective operation of the single customer account in relation to PAYE as well as other areas of tax.

Another area, referred to in a number of previous OTS reports, is the potential for improvements to the tax coding system. This would include further work to improve the explanatory notes around tax coding notices and ways that taxpayers can change codes through their single customer account. Not only could this benefit millions of taxpayers, but it should also cut down on levels of customer contact received by HMRC and the associated costs of making manual corrections.

The OTS highlights: “It is essential that when the single customer account launches that errors within the current personal tax account are not carried forward and that the internal processing of taxpayer data behind the scenes is quicker, better and provides a much more complete and accurate picture of a taxpayer’s tax affairs in one place, for both the taxpayer and HMRC.”

Peter Bickley comments: “The OTS evaluation paper includes many recommendations that we consider should be pursued. In response to the evaluation paper, the Tax Faculty has also shared its own recommendations with the OTS, most of which it has raised with HMRC or ministers in the past.”

Faculty recommendations

The Tax Faculty’s recommendations include the following:

- To create and successfully maintain a digital tax system, policy development and legislation-making needs to consider the mechanics of implementation and practical issues, including software updates, from the start.

- Thresholds, allowances, rates, repayment percentages, etc, need to be announced at least six months before the start of the tax year, to enable payroll software to be updated.

- The starter checklist should be revamped so it provides employers – and deemed employers/fee payers under the off-payroll working regime – with all necessary information.

- HMRC’s liabilities and payments records should agree with those of employers.

- The form P11D and associated processes need to be made fit for purpose.

- Two examples where changing the rules for allocating tax code numbers would result in a more accurate amount of tax being paid via PAYE are:

- Week 1/Month 1 codes are issued in the first half of the tax year where known income values (eg, pensions) should mean that cumulative codes are issued.

- Where an employee with another job returns a duly completed starter checklist to their new employer, the employer must allocate code BR. If the employee is a higher rate taxpayer, deducting tax only at basic rate leads to an underpayment of tax. A better code would be 0T.

- HMRC’s instructions that the personal allowance must be divided by 52, 26, or 13 for employees paid weekly, fortnightly, or four-weekly respectively leads to underpayments. This could be avoided by using the actual number of paydays in the year.

- Given that all employers (unless exempt) must submit payroll returns online, it is surprising that there are still instances where employers and HMRC must communicate by post.

- HMRC’s check employment status for tax (CEST) tool does not cover all the tests that a court would use to determine employment status – in particular, specific mutuality of obligation and being in business on one’s own account. In too many cases CEST does not make a status determination.

Agents and intermediaries

The OTS makes numerous suggestions to improve the agent experience. These include:

- building on the increased acceptance by HMRC during the pandemic of modern ways of communicating, such as greater acceptance of digital or scanned signatures;

- HMRC seizing the opportunity to build in proper agent access to all new systems as they develop;

- HMRC working to understand the challenges and limitations of registering as an agent with HMRC and to work with agents and others, such as software providers, to overcome or minimise the challenges;

- HMRC reviewing and updating the complex and confusing processes for a taxpayer to authorise an agent or another person to act on their behalf – particularly those processes in relation to the new digital systems;

- addressing issues concerning taxpayers who wish or need to appoint multiple agents;

- providing guidance on how a power of attorney can be lodged or registered with HMRC;

- reviewing the trusted helper service;

- overhauling legacy IT systems to ensure that HMRC can meet its strategic vision ‘for agents to be able to see and do what their clients can’; and

- involving agents in the development of new digital systems from the very beginning.

“HMRC now generally builds agent access into new systems as they are developed,” says Miskin, “but in doing so has added additional ways for clients to authorise their agent, including the unsatisfactory ‘digital handshake’. Rationalisation into two authorisation processes (one digital and one paper-based) that can be used for all HMRC services is important.

“The development of the agent services account and the road map for transferring all online agent services to that account needs greater attention, both to improve agent services, but also to give HMRC a single view of all its interactions with each agent firm and better data for the raising standards agenda.”

The high income child benefit charge (HICBC)

The OTS suggests that HMRC and the government should consider reviewing the following:

- the language used on the form and guidance, which is confusing, as a ‘claim’ for child benefit is required even when opting out of receiving the payments;

- the need to claim child benefit (even if opting out of receiving payments) in order that the child can automatically receive their national insurance number at 16;

- allowing those who didn’t claim child benefit to receive national insurance credits to which they would have been eligible if they had claimed;

- how HMRC can improve awareness of the charge – this should include considering adding HICBC adverts to the personal tax account;

- improving the guidance available to help people understand their responsibilities in relation to reporting and paying the HICBC; and

- including child benefit and the HICBC in the single customer account in the future.

“Rather than trying to fix HICBC,” says Miskin, “the Tax Faculty suggests that the policy be reconsidered and the government finds another way to achieve the objective. The policy is fundamentally unfair as it favours households where there are two people both earning less than £50,000 over households, earning less in total, where there is a single earner earning more than £50,000.”

About the authors

Caroline Miskin, Senior Technical Manager, Digital Tax, Tax Faculty

Peter Bickley, Technical Manager, Employment taxes and NIC, Tax Faculty