On 23 June, HMRC published its annual estimates of the difference between the total tax expected to be paid and the amount actually paid. The reduced £32bn figure for 2020/21 still equates to 5.1% of theoretical tax liabilities.

As this year was affected by the COVID-19 pandemic, three specific adjustments have been made to the data used in the estimation process to maintain consistency. These include:

- the compliance yield relating to income tax self assessment;

- non-payment relating to self assessment; and

- VAT receipts deferred under the deferral scheme.

Furthermore, the latest random enquiry programme data for self assessment and small business corporation tax is for 2017/18. In addition, the survey data for alcohol and tobacco tax gaps have been projected, as various surveys were paused or delayed during the pandemic.

It is worth noting that these figures exclude estimates of error and fraud in the COVID-19 support schemes.

As the tax gaps estimates for 2020/21 are subject to more uncertainty than usual, the estimates could be subject to revisions in future years.

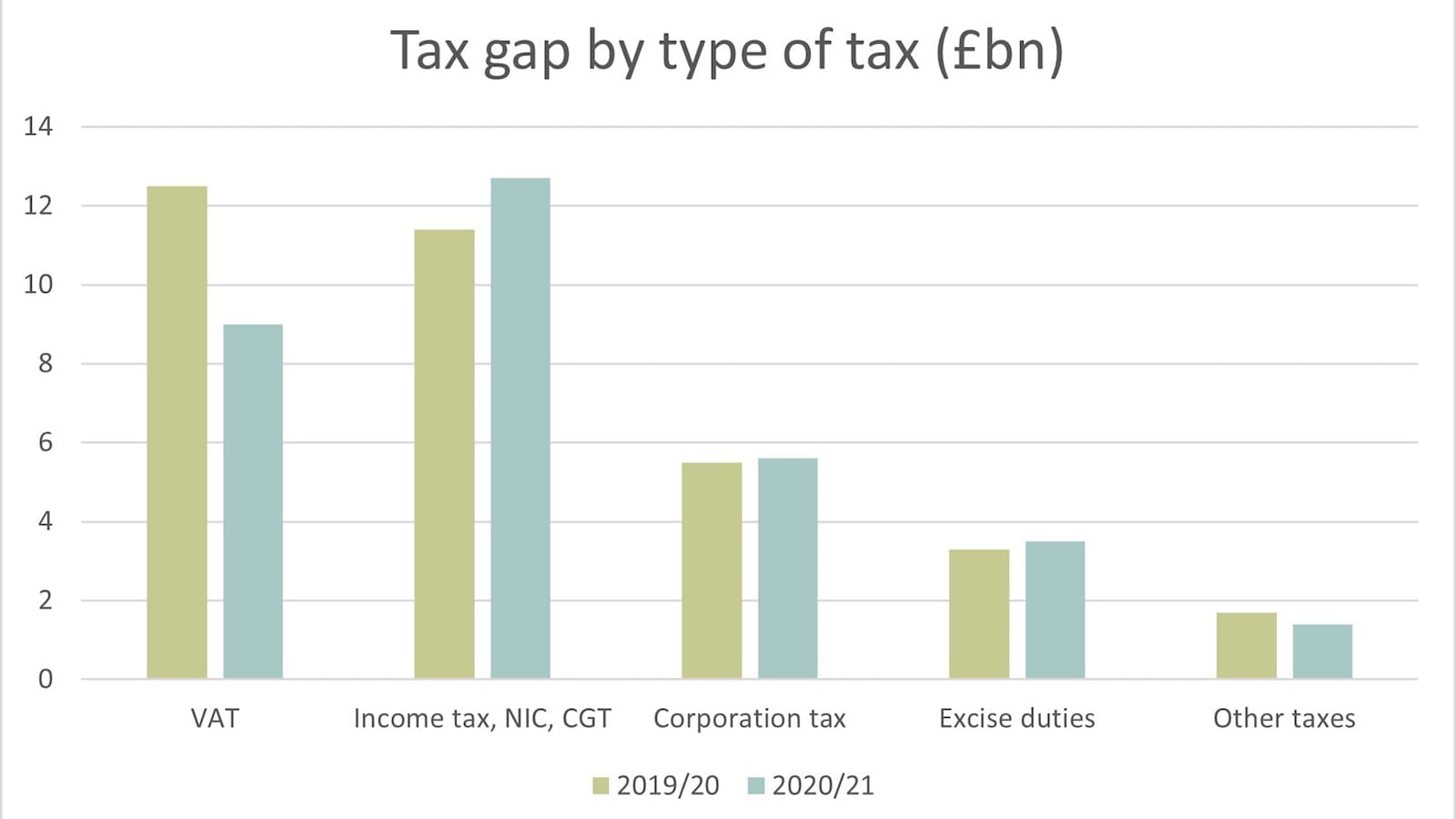

Tax gap by type of tax

The estimated tax gap has fallen in real terms for VAT, and also in percentage terms (from 8.5% in 2019/20 to 7.0% in 2020/21). By contrast, most other taxes are estimated to have a small increase in the gap in real terms.

The VAT gap is measured predominantly by reference to a top-down method of comparing tax receipts to the estimated tax due based on consumer spending data.

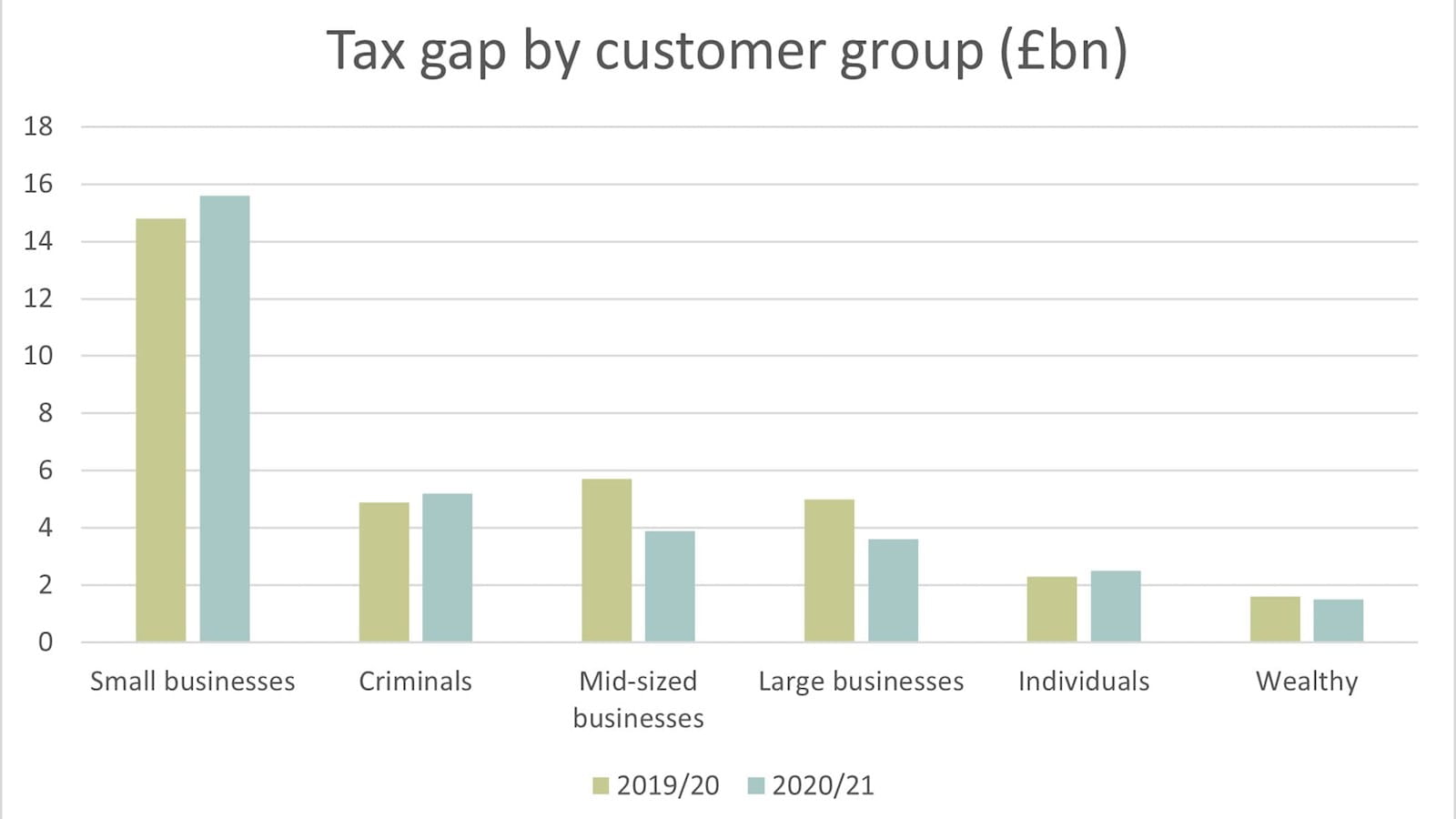

Tax gap by customer group

The breakdown of the tax gap by customer group highlights some changes over the breakdown for the previous year. The small business share is increasing, and the mid-sized and large business shares are decreasing. This change from the previous year was driven by a decrease in the VAT gap and an increase in the self assessment gap.

Delving further into the report, the tax gap from business taxpayers (sole traders and small partnerships) contributed most of the self assessment tax gap estimated at £4.6bn.

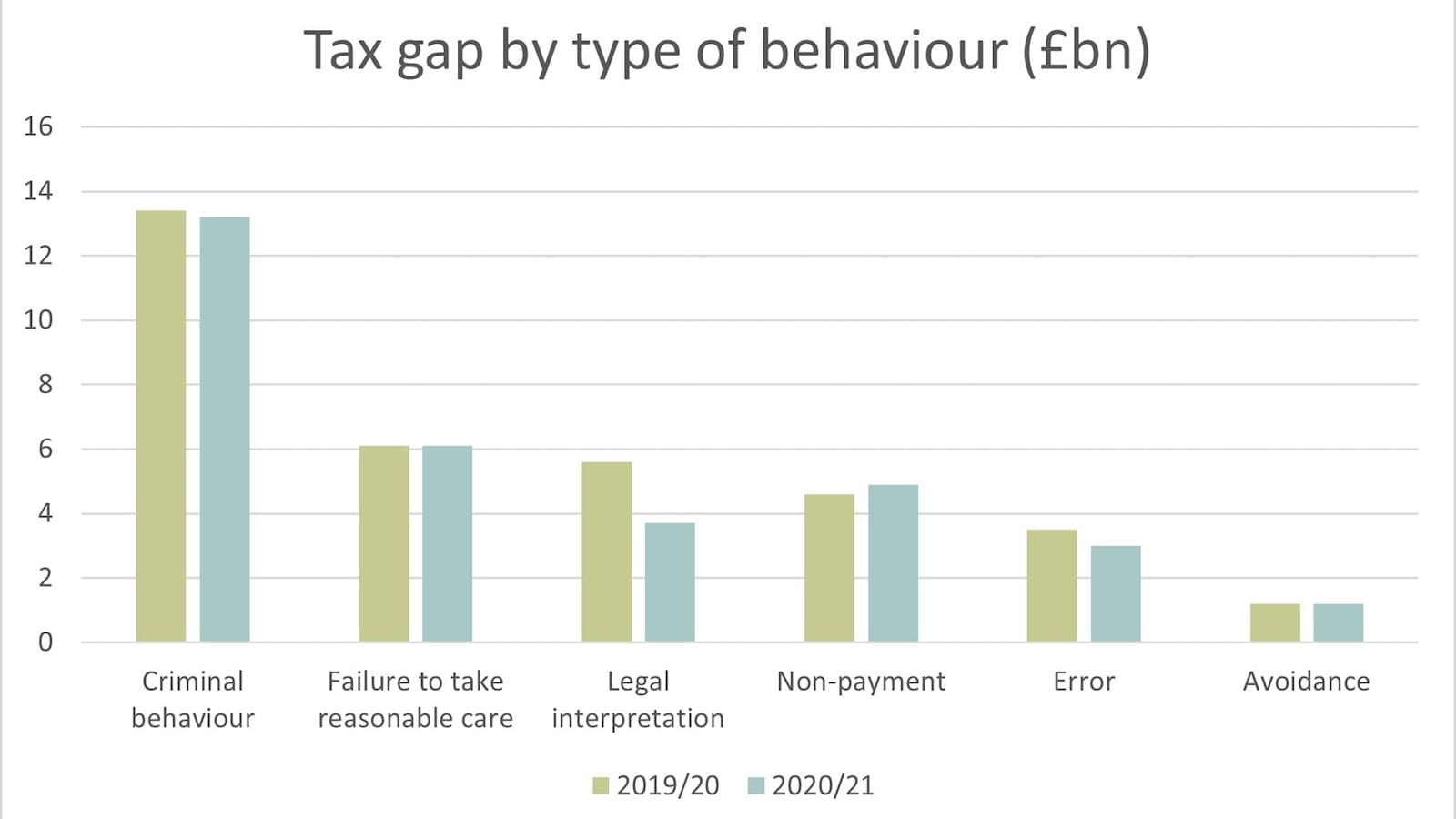

Tax gap by behaviour

What ICAEW views to be criminal behaviour is subdivided by HMRC into evasion, criminal attacks, and the hidden economy (in table 3 below, these have all been combined). Between them, they account for over 40% of the tax gap.

Failure to take reasonable care remains consistently around 19% of the tax gap. ICAEW notes that the figures do not reveal the estimated population of taxpayers that are represented by professional agents, so it is difficult to assess what role agents play in helping to reduce this figure.

Further, there is no more granular data about the areas where taxpayers are failing to take reasonable care. Of course, failure to take reasonable care and errors are the two elements of the tax gap that HMRC hopes to reduce with the Making Tax Digital programme. However, in the absence of better data, it remains unclear exactly how that will be achieved.

The tax gap due to avoidance remains low, at less than 4% of the total. This suggests that HMRC’s drive to curb avoidance has achieved results.

Read more

- Tax gap remains steady at 5.1%

- Measuring tax gaps 2022 edition: tax gap estimates for 2020 to 2021

- Measuring tax gaps tables

Tax Faculty

This guidance is created by the Tax Faculty, recognised internationally as a leading authority and source of expertise on taxation. The Faculty is the voice of tax for ICAEW, responsible for all submissions to the tax authorities. Join the Faculty for expert guidance and support enabling you to provide the best advice on tax to your clients or business.

More support on tax

ICAEW's Tax Faculty provides technical guidance and practical support on tax practice and policy. You can sign up to the Tax Faculty's free enewsletter (TAXwire) which provides weekly updates on developments in tax.

Sign up for TAXwireJoin the Tax FacultyThe future of tax after COVID

As digital technologies transform society, the UK government is grappling with balancing the books while ensuring its tax system is fit for purpose. Join us as we take a look at the issues and challenges facing the tax system.

Read more