In this series of articles on successful finance transformation, we have so far looked at the ‘GAME’ sequential part of our GAME PLAN framework, but we cannot ignore the ‘PLAN’ perspective. This provides us with our change management foundations. So let’s look at the ‘P’: project management. We will need to understand the principles of good project management if our transformation project has a hope of getting off the ground.

A robust project management approach is the critical foundation of successful transformation. But time and again I’ve seen finance leaders with huge experience in leading and delivering operations taking on projects without understanding – or grasping the importance of – the principles of project management. After years of seeing this play out, I realised there were key skills which finance lacked that needed to be addressed.

What is project management?

Let’s start with the basics: the Association for Project Management (APM) defines project management as “the application of processes, methods, skills, knowledge and experience to achieve specific project objectives according to the project acceptance criteria within agreed parameters. Project management has final deliverables that are constrained to a finite timescale and budget.”

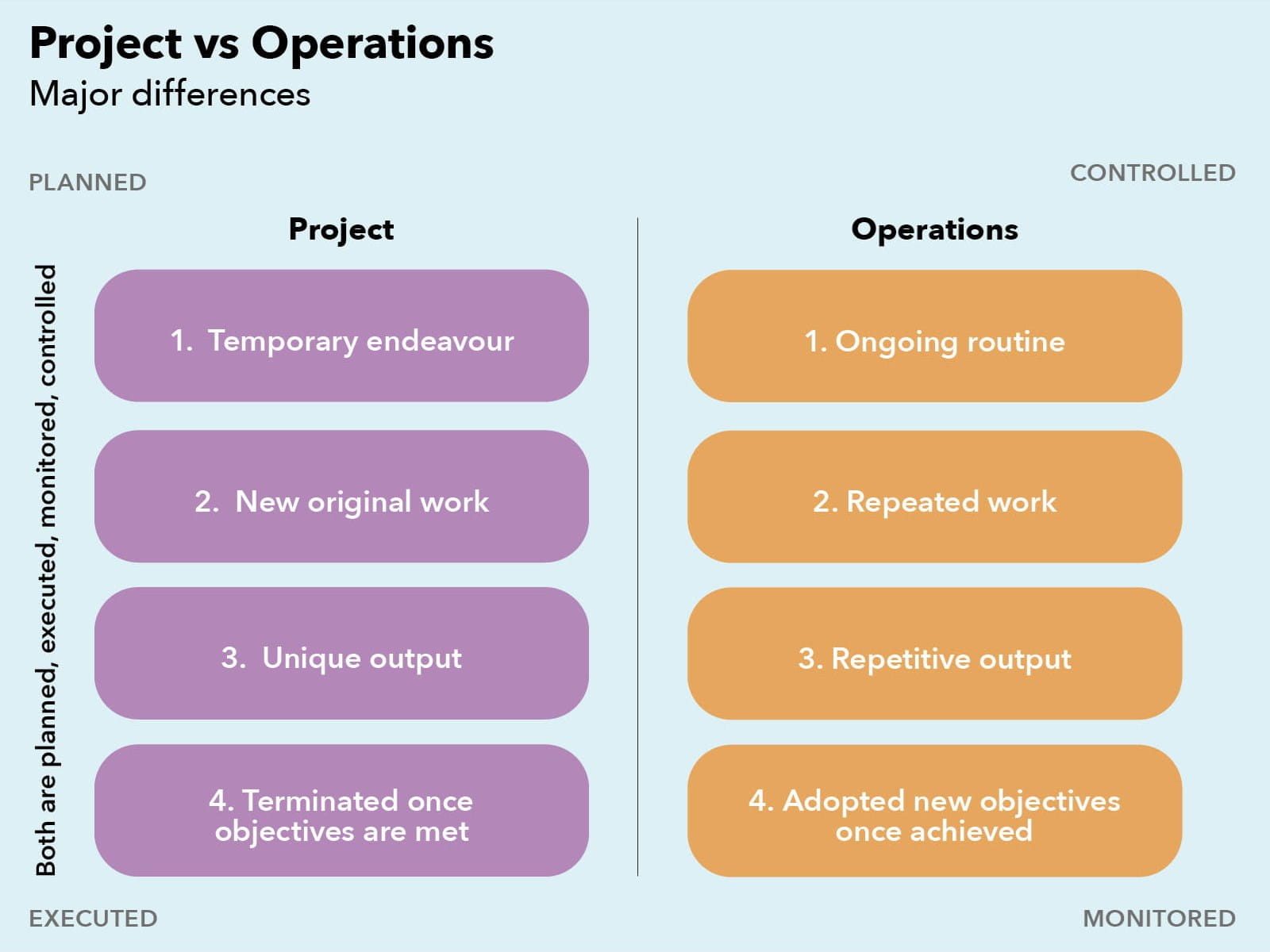

Finance professionals are experts in owning and delivering operational processes. Each of these are ongoing (not time-bound), repeatable processes, with a repetitive output that evolves and develops over time. In contrast, a project is a temporary (time-bound) activity; a new piece of work with a unique output. A project is terminated once its objectives are achieved. However, both operations and projects need to be planned, controlled, executed and monitored. This is illustrated in the Project.PM visual below:

The problem is that finance leaders often treat a project like an operational responsibility. I know I did. Finance leaders have many of the required skills, but don’t always know how to apply them in the context of a project. Or as the old project management joke (yes, they have jokes) goes: “What’s the difference between a finance manager and a project manager? A project manager knows they are not a finance manager” (I didn’t say the jokes were funny.)

The role of the project manager

Project managers have evolved a number of frameworks and methodologies to help keep projects on track. One of the leading approaches to successful project management is PRINCE2. The following definitions of the role of the project manager, customer and project board are aligned with the PRINCE2 method.

The project manager is responsible for:

- organising and controlling the project;

- selecting people to do the project work and ensuring it’s done properly and on time; and

- drawing up the project plans that describe what the project team will be doing and when they expect to finish.

The customer, user and supplier

The customer pays for the project, while the user is the person who is going to use the results or outcome of the project. The supplier or specialist provides the expertise needed to do the project work. In our case, this would be the transformation subject matter expert.

These different groups all need to be organised and coordinated so that the project delivers the required outcome (scope) to schedule, on budget and up to quality.

The project board

Each project has a project board. It’s made up of the customer (or executive), someone who represents the users and someone who represents the supplier or specialist input. The project manager reports regularly to the project board, updating them on the project’s progress and any problems that have arisen during that progression. The project board provides the project manager with a set of necessary decisions. They determine how the project will proceed and overcome its problems. It is important for finance leaders to acknowledge that the project board membership is driven by the project and will often not reflect the usual finance function hierarchy.

Project management responsibilities

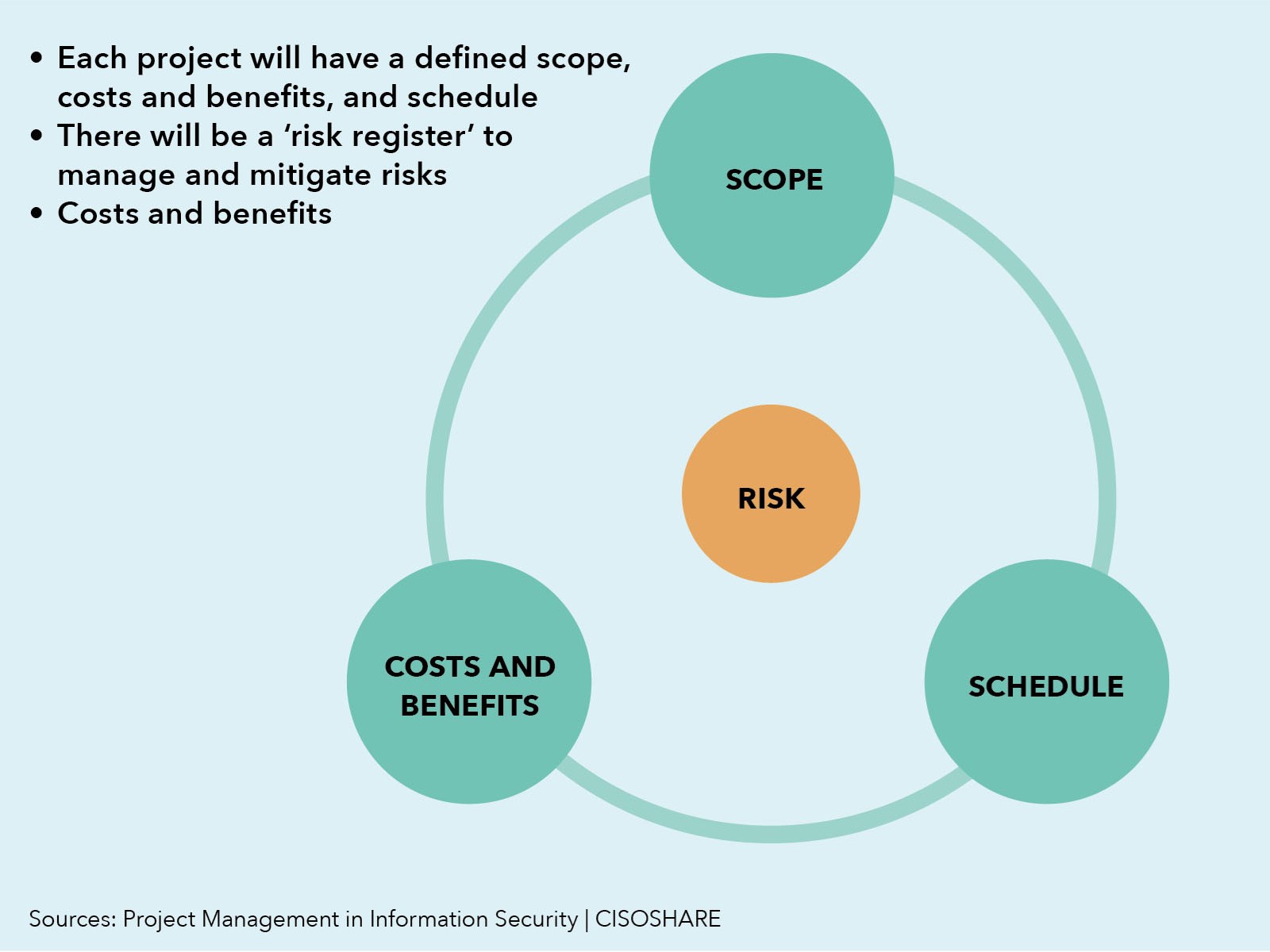

In order to deliver on their responsibilities, the project manager must organise and control the scope, schedule and the cost/benefit of the project, and encircle this with a strong risk management process.

You’ve probably come across the project management triangle, which derives from the common law of business practice usually attributed to the 19th-century thinker John Ruskin: “Good, fast and cheap. You can choose two of these.” Or in other words, you get what you pay for. That is essentially at the heart of what the project manager is doing. They need to balance the scope, budget and schedule and deliver the best version of the project they’ve been assigned.

Let’s look at each of these elements in more detail.

1) Scope management

Project scope is the work required to ensure a project meets its deliverables. Scope management includes a process to manage scope changes and make sure the project will still come in on time and within budget. Scope is often defined by a work breakdown structure, and changes should take place only through formal change control procedures.

2) Schedule management

Once a project manager has defined the scope of the project, outlined quality requirements and risks, and has estimated how long it will take, the next step is to put together a schedule. This is usually expressed in the form of a Gantt chart, which compiles activities and responsibilities in a timeline format.

Two common scheduling techniques in project management are critical path and critical chain. Critical path is about analysing the activities required to deliver a project, determining the shortest amount of time to complete each activity and putting them in a logical order. Critical chain is particularly useful for short turnaround projects and is about ensuring the optimal utilisation of resources. Critical chains are protected groups of activities that keep the project focused. This sounds complicated, but is one of the areas finance folk usually excel at (apologies for the pun), since we usually have deep experience in planning for repetitive processes.

It is really important to keep an agile “learn as you go” approach during a transformation; we will cover this in the “L” part of the GAME PLAN framework.

3) Cost/benefit management

Project cost/benefit management is split into two distinct areas.

Project cost management may be a bit more in the average finance professional’s comfort zone. It is about estimating and allocating financial resources to any given project. It’s the process of managing and controlling costs, ensuring that you can fully understand your project’s financial status. Good project cost management will help project managers track and foresee expenses. They can also make adjustments to the project as needed to fulfil its requirements.

Project benefits management defines what makes a project successful. The success of a project is ultimately measured by the benefits it delivers (both planned and unplanned). It is important for the finance team to understand that these may be financial (flowing directly to the financial statements) or non-financial (such as improving governance or risk environment).

Project managers need to ensure that everyone involved in a project, throughout the process, is focused on achieving the benefits it has been created to provide.

This benefits perspective will be covered further in “Always focus on the end goal” – the A in PLAN, which we’ll look at in a future article.

The project management checklist step by step:

1) Define and assign the roles:

a. Project manager

b. Users

c. Customers

2) Project board (which includes risk management):

a. Define an escalation path for difficult strategic decisions or a pathway to remove transformation blockages

b. This will often need to be defined all the way to the board

3) Define scope/schedule – covered in the “action planning” part of the GAME PLAN framework.

4) Define costs and benefits – covered in the “always focus on the end goal” part of the GAME PLAN framework.

- The next part of this series will be the ‘A’ in ‘GAME’: Action Planning.

Neil Cutting has held many CFO and transformation leadership roles with complex global organisations. Most recently he was Vice-President of Finance at Jacobs Solutions Incorporated, a $15bn Fortune 250 organisation. He is also a member of ICAEW’s Business Committee, which represents global business members, and is a guest lecturer on strategic performance at the University of Bath.

Related articles

Read related articles by Neil Cutting on finance transformation and the finance team toolkit: