Adam Wyon (left), head of corporate finance, and Shaun Grady, head of business development at AstraZeneca, speak to Marc Mullen about doing deals to help transform a global pharma business.

AstraZeneca gets a lot of headlines, but the first to appear in Corporate Financier was last year – after its business development team collected the ICAEW Corporate Development Award at the faculty’s 2023 Annual Reception. For the pharma giant, business development is no afterthought, says Shaun Grady, senior vice president of business development operations: “Every year, for each therapy area – oncology, biopharmaceuticals and rare disease – there is an annual strategy and portfolio prioritisation review where business development is considered. We look at our own R&D and how to augment it through partnering, licensing or acquisition. There is a clear business development strategy and priorities that are integrated within the overall AstraZeneca strategy.”

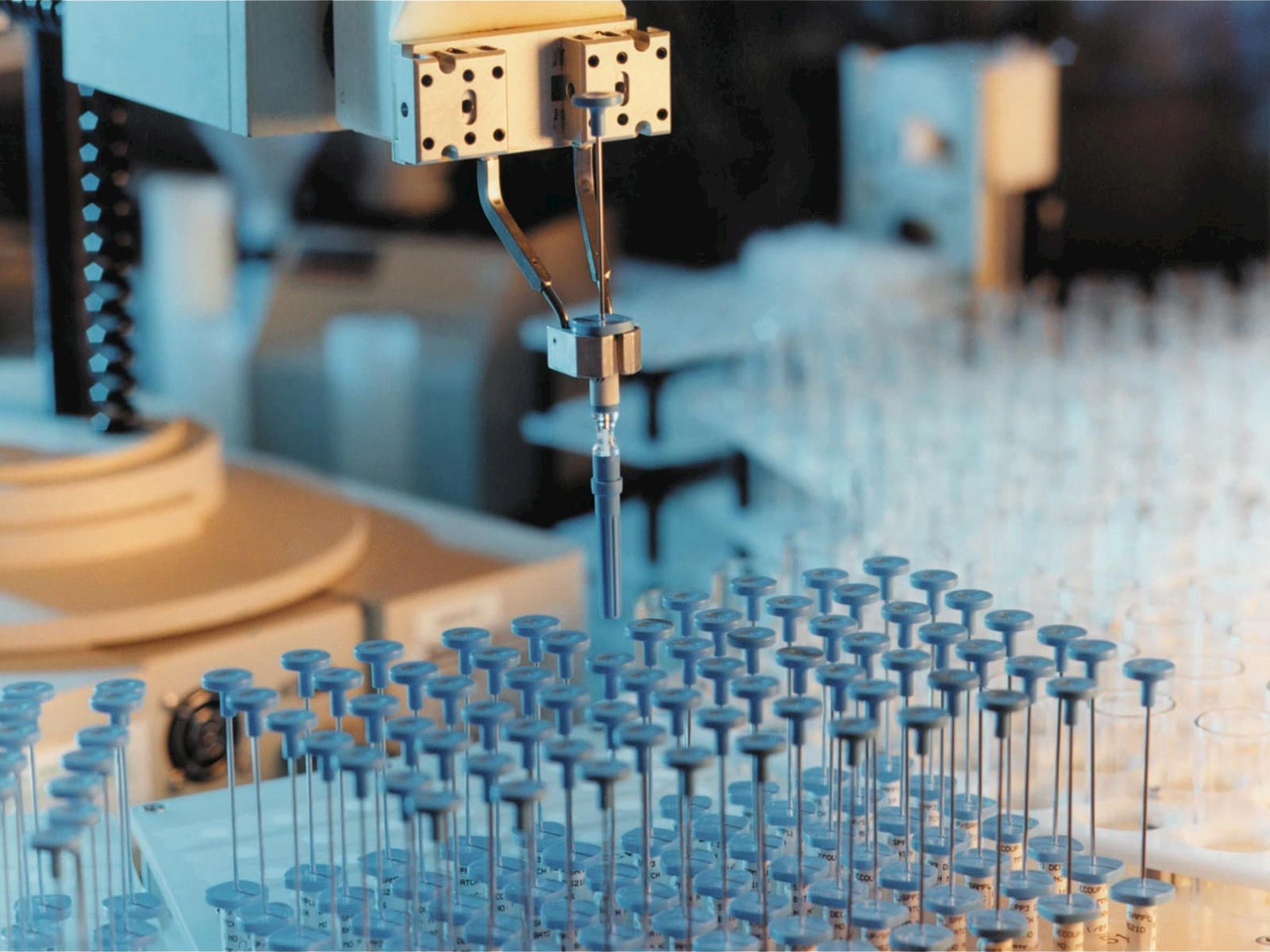

There are effectively three legs to the business development operating model at AstraZeneca: a central transaction execution group led by Grady, which incorporates due diligence; the transaction leads; and the alliance and integration management function. Each R&D therapy area also has a dedicated business development group. The R&D business development teams typically have very strong scientific backgrounds – many of them started their careers in the company’s labs: “These teams are constantly scanning, searching and reviewing the scientific landscape. They spend a lot of time at industry events outlining areas of interest for potential partnerships,” Grady says. “Typically deals are assets that the search and evaluation teams spotted and pursued rather than opportunities identified unsolicited. That said, people do come to us with ideas and proposals all the time, which are welcomed as it helps build a picture of the innovation landscape and some of these approaches do result in deals getting done.”

AstraZeneca dealmakers |

Adam Wyon trained as an ACA with PwC. After qualifying in 2005, he joined GSK, and swiftly moved into a business development finance support role. In 2015, he joined AstraZeneca as business development finance director. In February 2024 he was promoted to head of deal finance.

|

Grady leads the deal execution team. The due diligence group will mobilise its teams for each deal, comprising up to 20 internal staff, largely scientific specialists with experience of due diligence acting like a scientific auditor.

“Fundamentally they look at the scientific data but also, depending on the deal, other areas including manufacturing, IP, finance, legal, patient safety, clinical, privacy and IT. Their task is to identify the expertise we need for review of the asset – select the people needed to do the work, mobilise and onboard the team, manage and monitor them. Usually in a relatively short timeframe, they need to produce a due diligence report that senior management can review and will inform negotiations if we decide to proceed with a transaction.”

Adam Wyon is head of deal finance at AstraZeneca. “A lot of the due diligence is on non-financial items – hugely technical, scientific reports, reams and reams of scientific data,” he says. “In essence, in a number of deals you’re paying a lot of money for assets that still require significant investment to become revenue generative. What you’re really paying for is potential to back up a business case for new medicines.”

Grady’s team reports into CEO Sir Pascal Soriot, who has been AstraZeneca CEO since 2012 and has watched over its transformation after seeing off an attempted takeover by Pfizer in 2014. “Reporting to Pascal, we’ve got some independence, impartiality and a separate voice, and we can move at speed,” says Grady.

A legal group and Wyon’s deal finance group, both of about a dozen people, are dedicated to supporting transactions. “When we get fully into the deal dynamics, the deal lead, the finance lead and the lawyer are like the Holy Trinity who then factor in other functional specialists as needed,” says Grady. “It’s all about being confident, knowing what you’re doing, giving people clear purpose and timelines, roles and responsibilities, and enthusing the people you bring in to the process to deliver.”

Value added

The annual Corporate Development Award (awarded to AstraZeneca last November) recognises a London-listed company for its successful use of M&A to increase growth and shareholder value, and outperform the market. It uses a methodology devised by the ICAEW Corporate Finance Faculty in partnership with Bayes Business School.

AstraZeneca was given the award for the value it added for shareholders through the acquisitions of TeneoTwo in August 2022 (for $100m plus up to $805m in R&D-related milestone payments), Neogene Therapeutics in January 2023 (for up to £320m in total) and CinCor Pharma in February 2023 (for up to $1.8bn in total). The British-Swedish company, which together with Oxford University developed the first COVID-19 vaccine in the UK, is now also investing, partly by acquisition, to develop future jabs.

Macclesfield to Cambridge |

In 2013, AstraZeneca announced it was moving much of its R&D from Alderley Park, just outside Macclesfield, to the biotech and life sciences innovation hub of Cambridge. The move took longer than planned and the state-of-the-art office and Discovery Centre facility reportedly cost $1bn.

|

AstraZeneca conducts a rough average of 15 major deals per calendar year – transactions of more than $300m, which require board approval – as well as partnership, co-promotion, co-development and licensing deals. “Where it’s a preclinical asset, it’s largely a science-based decision – normally following a licensing structure,” says Wyon. “Our deal finance team will still support and advise on structure and look to factor in value step-ups linked to divestment of risk, but for something launching in more than 10 years’ time, you’re not going to have a big discussion about a precise forecast.”

How AstraZeneca approaches deal structuring is very much horses for courses. A cancer clinical phase programme from a large biotech will likely be a license deal because its business model is to license it out, get cash and repeat. However, AstraZeneca has seen an uptick in M&A because the company has been building capability and capacity in new areas such as cell and gene therapy over the past few years.

To help identify cutting-edge research collaborations, the company locates itself in life science ecosystems near universities including in Cambridge and Gothenburg, and the Johns Hopkins University in Baltimore. “Locality and proximity matter for early stage,” says Grady. “Beyond that, global considerations and competition are key.” AstraZeneca has an increasing amount of IP located in Ireland, where the rare disease unit has a base.

Deal climate

Like any business, for AstraZeneca the focus on business development and acquisitions can be cyclical. A period of buy-side and acquisitions was followed in 2016 with a period of divestments and out-partnering to help fund the R&D that had resulted from acquisitions. From 2016 to 2019, AstraZeneca completed $12bn of divestments. “Then we returned to growth and the pipeline started to deliver,” says Grady. “We weaned ourselves off those divestments, and we are now in a more balanced buy-side and sell-side position.

One deal they are particularly proud of is the partnership with Daiichi Sankyo for the Enhertu breast cancer medicine, which was in phase one at the time of the deal. Although there was still only a relatively small number of patients, AstraZeneca agreed to pay $1.3bn upfront to be 50:50 partner. The total deal package was $6bn for a 50:50 cost share-risk share. “If you look at Enhertu, it’s clear we have a very special medicine that is potentially transformative for cancer patients.

“At the risk of sounding like an old timer, I’ve done this a long time,” says Grady. “I’ve never bought into buyers’ markets and sellers’ markets. If you have good science in a hot area, you’re probably going to attract four or five big pharma businesses to a process. At the moment, share prices are depressed; licensing terms might mean being asked for more than the entire company valuation currently. So it can quickly become about finding a suitable premium everybody can live with and then building in some equitable contingent value rights if the data delivers.”

China differentiator |

AstraZeneca’s truly global footprint is a differentiator from other pharma giants, says Grady: “A lot of pharmaceutical companies say they are global, but they’re in fact international, with a significant presence regionally. But we’re in around 120 countries and have a particularly distinctive strength in China, where we are the largest multinational.”

|