This TAXguide analyses the corporate tax impact of Brexit on the typical cycle of outbound and inbound business operations within the UK and the EU as from 1 January 2021. It analyses them from the viewpoint of both the UK and the member states of the EU.

This TAXguide written by Allan Cinnamon, Cintax Ltd, author of Practical International Tax Planning published by Croner-i, and Tax Faculty volunteer, analyses the impact of Brexit on those main areas of UK corporate tax law that are derived from EU legislation enacted while the UK was a member of the European Union. These laws have been effectively transposed into UK law and the body of law is known as ‘Retained EU Law’.

As well as discussing the UK implications of Brexit, the TAXguide necessarily also considers the corresponding situation in the jurisdictions of the EU member states.

This TAXguide originally appeared as an article in Issue 64 of Croner-i’s Tax Update on 10 March 2021 and is reproduced with the consent of the publishers.

A brief review of the background

The European Union (Withdrawal) Act 2018 converts the body of EU law existing at the end of the transition period into UK domestic law (Retained EU Law). This body of law includes those UK tax laws made for the purposes of implementing EU obligations (principally, freedom of establishment and, to a lesser extent, free movement of capital). While the UK was a member state, these obligations were fulfilled through UK transposition of Directives (such as the Parent Subsidiary Directive) and through direct tax laws (such as controlled foreign company rules and group relief for terminal losses of EEA subsidiaries).

The Taxes (Amendments) (EU Exit) Regulations 2019

By far the most relevant piece of legislation relating to the retention of EU tax laws and regulations is The Taxes (Amendments) (EU Exit) Regulations 2019 made on 26 March 2019 (The Regulations). While continuing the Retained EU Law concept, these Regulations make amendments to UK legislation in order to adjust it where necessary.

So far as the topics covered by this article are concerned, the only relevant amendments made by the Regulations are the amendments to s140A onwards, Taxation of Chargeable Gains Act 1992 (TCGA 1992) which transposed the EU Merger Directive into UK tax law. In short, the amendments retain the merger legislation by making it applicable to the UK as well as the member states (see Mergers and Reorganisations at paragraphs 22 and 23 below).

In continuing the Retained EU Law concept, no amendments have been made to legislation covering other areas such as CFCs, group relief, intra-group transfers of assets and exit taxes. This legislation therefore continues to apply to EU-related transactions.

So all in all, EU-inspired legislation, directives and regulations remain enshrined in UK tax law for now. But with two exceptions: s758, Income Tax (Trading and Other Income) Act 2005 (ITTOIA 2005), which freed the 20% UK withholding tax on interest and royalties paid to an EU associated company, has been repealed as from 1 June 2021. The UK has also decided to opt out of most of the reportable hallmarks under the DAC6 reporting requirements.

It is possible that further amendments will be made to UK tax law in the future to reflect the fact that the UK is no longer bound by EU law. However, the commentary below is based on the existing UK laws and any changes announced to date.

It remains to be seen whether the EU Commission or the member states will amend their EU-derived tax laws to admit the UK into them now it is no longer a member state. A sample of four jurisdictions, namely Belgium, Germany, Italy and Netherlands, indicates that they have made no amendments so far to extend their EU-related corporate tax legislation to the UK. The fifth, Ireland, is the exception having extended its group relief treatment to Irish groups directly owned by a UK parent company (see paragraph 15).

Practical impact on business transactions

This TAXguide analyses the corporate tax impact of Brexit on the typical cycle of outbound and inbound business operations within the UK and the EU as from 1 January 2021. It analyses them from the viewpoint of both the UK and the member states of the EU. The relevant transactions are considered in logical sequence, beginning with setting up a branch in an EU member state (see paragraph 1) and concluding with mergers and reorganisations involving an EU member state (see paragraph 23).

There is necessarily some repetition since each step in the business cycle is separately considered.

1. UK company transfers assets to EU branch

Since the branch is not a separate entity, there is no asset disposal for UK tax purposes. Even if an election has been made for the branch profits and gains to be exempt from UK tax, a gain is deferred until the branch has disposed of the asset (s18A(6), Corporation Tax Act 2009 (CTA 2009)).

The deferral does not arise from EU law and there are therefore no EU implications to the transaction.

2. EU company transfers assets to UK branch

In contrast, it is likely that a taxable gain on transfer of the assets will arise in a number of those EU jurisdictions where the UK branch profits are tax exempt. However, in this case the gain was deferrable following a number of ECJ cases on freedom of establishment principles including Commission v Portugal (Case C-38/10); Commission v Spain (Case C-64/11) and Commission v Denmark (Case C-261/11); as well as consequent EU-compliant legislation within the specific EU jurisdiction.

It is not yet known whether EU jurisdictions may continue to allow an EU company’s asset transfers to its UK branch to be deferable now that the UK is no longer a member state.

3. UK company: EU branch terminal losses

It was arguable that a UK company’s EEA branch terminal losses could offset its UK profits in cases where the UK company had elected for the foreign branch exemption and was therefore unable to offset foreign branch losses. This principle, following Marks & Spencer plc v C & E Commrs (Case C-309/06) was a upheld by the ECJ in the case of a Danish company's foreign branch, A/S Bevola & Jens W Trock ApS v Skatteministeriet (Ministry of Finance, Denmark) (Case C-650/16).

Now that the UK is no longer a member state, it seems unlikely that EU branch terminal losses incurred after 31 December 2020 could offset UK profits when a UK company has elected for the foreign branch exemption.

4. EU company: UK branch terminal losses

In the reverse situation, a claim to deduct post-Brexit UK branch terminal losses (in an EU jurisdiction where foreign branch profits are tax exempt) will be inapplicable now that the UK is no longer a member state.

It is not yet known whether EU jurisdictions may nevertheless allow UK branch terminal losses to be deductible from the domestic profits of a company in an EU member state.

5. UK company incorporates EU branch into EU company

UK aspects

The simplest process for an EU company’s tax-neutral EU branch incorporation gain on transfer of its assets to an EU company is under s140, TCGA 1992.

However, assuming that reliance on the Merger Directive is preferable, a UK company’s incorporation gains arising on transfer of its assets to an EU company may still be mitigated under s140C, which transposes Art 10.2 of the Merger Directive.

The Regulations have now amended s140C so that it refers to a UK company’s transfer of assets to a company resident in a (rather than another) member state. The transferee EU company will continue to be in that category and so s140C will continue to apply.

EU aspects

As far as mitigation in the EU branch’s jurisdiction is concerned, it is not yet known whether EU jurisdictions will reciprocally amend their equivalent transposition of the Merger Directive to include the UK now that it is no longer a member state.

A number of EU jurisdictions already permit a tax-deferred branch incorporation outside the ambit of the Merger Directive. Examples are Belgium, Germany, Ireland, Italy, Spain and Netherlands.

Article 6 of the Merger Directive provides that, in a merger between EU companies (which includes a branch incorporation), the foreign branch losses should be carried over to the transferee company on incorporation, provided a carry over would apply in a merger between two companies in the same jurisdiction where the EU branch is located. Should the specific EU jurisdiction provide for the carryover of losses through the ambit of the Directive (rather than in some other way), the loss carryover will no longer apply when a UK company incorporates its EU branch in that jurisdiction.

It is not yet known whether EU member states may reciprocally amend their loss carryover rules to include the UK as a non-member state.

Loss carryovers apply, for example, in Belgium, France, Ireland, Italy, Luxembourg, Netherlands, Poland, Spain and Sweden.

6. EU company incorporates UK branch into UK company

UK aspects

Section 171, TCGA 1992 provides the simplest deferral process for an EU company’s tax-neutral UK branch incorporation gains on transfer of its branch assets to a UK company.

However, assuming that reliance on the Merger Directive is preferable, an EU company’s incorporation gains arising on transfer of its branch assets to a UK company may be mitigated under s140A, which transposes Art 10.2 of the Merger Directive.

Again, the Regulations have been amended so that s140A now refers to transferors and transferees resident in a member state or the UK (rather than a member state as previously).

Section 140A therefore continues to apply to an EU company’s transfer of its UK branch assets to a UK company.

On incorporation, a UK branch’s accumulated losses carry over to the UK company under s944A, Corporation Tax Act 2020 (CTA 2010), section 944A, irrespective of whether the transferor company is resident in an EU member state.

This facility will therefore continue to the benefit of an EU company that incorporates its loss-making UK branches.

EU aspects

As far as the EU company’s jurisdiction is concerned, it is not yet known whether EU jurisdictions may reciprocally amend their equivalent transposition of the Merger Directive to include a UK branch incorporation now that the UK is no longer a member state.

Having said that, many EU jurisdictions allow for tax-neutral incorporation of all foreign (including UK) branches outside the ambit of the Merger Directive, or through a foreign branch exemption or a tax treaty.

7. UK company’s EU subsidiary: terminal losses

There has been no change to the group relief rules. Following Marks & Spencer plc v Halsey (C-446/03), the EU subsidiary’s terminal losses will continue to qualify for UK group relief under Ch 3, Pt 5, CTA 2010.

8. EU company’s UK subsidiary: terminal losses

In the reverse situation when the UK is no longer a member state, a claim to deduct terminal losses of a UK subsidiary following the ECJ decision in Marks & Spencer is likely to be inapplicable. Most EU jurisdictions follow the judgement in restricting the loss relief to EEA subsidiaries.

It is not yet known whether EU jurisdictions may reciprocally amend their laws so that a UK subsidiary’s terminal losses continue to be deductible in a consolidated return, fiscal unity, group relief claim or profit and loss transfer agreement.

9. Migrating UK company’s residence to EU jurisdiction

Following National Grid Indus BV (Case C-371/10), Sch 3ZB, Taxes Management Act 1970 (TMA 1970) complies with the Anti Tax Avoidance Directive (ATAD) requirements for removal of a UK company’s residence to an EEA state. Tax arising on deemed exit disposals is deferred with interest over a period of no later than five years and nine months from the end of the accounting period in which the exit occurs.

There has been no change to these rules so that the deferral option will continue to apply when a UK company migrates its residence to an EU member state.

10. Migrating EU company’s residence to UK

In the reverse situation when the UK is no longer a member state, deferral of tax is likely to be inapplicable. ATAD requires EU jurisdictions to defer the tax arising only when residence is migrated to an EEA jurisdiction.

It is not yet known whether EU jurisdictions may reciprocally amend their laws so that tax deferral applies when residence is migrated to the UK.

11. UK company finances EU subsidiary

In compliance with the Interest and Royalties Directive, freedom from withholding tax on the EU subsidiary’s payment of interest to the UK company will no longer apply since the UK is no longer a member state.

It appears unlikely that EU jurisdictions will amend their laws to continue freedom from withholding tax under the Directive in view of the UK’s repeal (see paragraph 12).

In the absence of any change, the downloadable Table indicates EU states’ rates of interest withholding tax under the UK’s treaties with all 27 EU member states. Most rates are zero but there are some exceptions.

12. EU company finances UK subsidiary

Section 758, ITTOIA 2005, which freed the 20% UK withholding tax on interest paid to an EU associated company, is repealed as from 1 June 2021.

As a result of the repeal of s758, it will be necessary for EU lenders to rely on the relevant treaty with the UK for reduction of withholding tax on the interest received.

13. UK company licenses EU subsidiary

Under the Interest and Royalties Directive, freedom from withholding on the royalties paid to the UK company will no longer apply since the UK is no longer a member state.

It appears unlikely that EU jurisdictions will amend their laws to continue freedom from withholding tax under the Directive in view of the UK’s repeal (see paragraph 14).

In the absence of any change, the Table indicates EU member states’ rates of royalty withholding tax under the UK’s treaties with all 27 EU member states. Most rates are zero but there are some exceptions.

14. EU company licenses UK subsidiary

Section 758, ITTOIA 2005, which freed the 20% withholding tax on royalties paid to an EU associated company has been repealed as from 1 June 2021.

As a result of the repeal of s758, it will be necessary for EU licensors to rely on the relevant treaty with the UK for reduction of withholding tax on the royalties they receive.

15. EU tax consolidation/ fiscal unity etc.: UK company as qualifying parent company

A number of EU member states permit tax consolidation/ fiscal unity etc. grouping for offsetting profits and losses when local subsidiaries are directly owned by a foreign EU company rather than by a domestic parent. Examples are Belgium, France, Ireland, Italy, the Netherlands, Spain and Sweden. This treatment often extends to tax-neutral asset transfers between fellow local subsidiaries owned by a foreign EU parent company (in cases where legislation does not permit EU ownership, a claim could nevertheless be made based on the ECJ decisions below).

This EU parent treatment follows from the decisions in Société Papillon v Ministère du Budget, des Comptes publics et de la Fonction publique (Case C-418/07); and Netherlands v SCA Group Holding BV (Cases C-39/13, C-40/13 and C-41/13).

A UK company will no longer qualify as a parent company for tax consolidation purposes as it is no longer resident in an EU member state. As well as grouping going forward, this disqualification may have other repercussions in that the underlying subsidiaries will leave the existing group.

It is not yet known whether EU jurisdictions will amend their laws so that ownership by a UK parent company continues to permit tax consolidation/ fiscal unit etc. One exception is Ireland, which has extended its group relief treatment (for domestic loss offsets and asset transfers) to Irish groups directly owned by a UK parent company.

However, not all EU jurisdictions restrict group treatment to EU-owned subsidiaries. For example, the Netherlands permits ownership by a partner country with a treaty non-discrimination article. Spain permits ownership by a company resident in any country that is not a tax haven. A UK company’s direct ownership of EU subsidiaries in those jurisdictions should therefore continue to allow for tax consolidation, etc.

However, where direct ownership by a UK company disqualifies consolidation, the non-discrimination article of a UK tax treaty with the EU regime in question may still permit tax-consolidation of subsidiaries without the interposition of a local holding company. The claim could arise under a tax treaty based on Art 24.5 of the OECD Model Treaty, which prevents discrimination arising from foreign ownership. This principle was established in R & C Commrs v FCE Bank plc [2012] EWCA Civ 1290 where disqualification of group relief because of foreign ownership was held to be discriminatory. (That was because pre 2000, UK group relief rules required UK subsidiaries to be owned by a UK parent, whereas the FCE subsidiaries were owned directly from the US).

A contrary ruling was given by the Netherlands Supreme Court in the case of the Dutch fiscal unity regime (Verdrag Nederland Israel NL Fiscaal (16/02919)). This ruling arose as a result of the specific wording of the Dutch regime.

Clearly, each tax consolidation/fiscal unity regime needs to be closely analysed in determining whether a UK-parented EU group qualifies as a result of a non-discrimination article.

16. UK group relief: EU company as qualifying parent company

There is no change in the group relief position. Sections 131 and 152, CTA 2010, allow for foreign (and not just EU) ownership of a UK group in establishing qualification for group relief. Section 171, TCGA 1992, similarly allows for tax-neutral asset transfers between fellow UK subsidiaries owned by a foreign parent company (whether or not EU resident).

17. EU subsidiary pays dividends to UK parent company

Freedom from withholding on the dividends paid to the UK company under the Parent Subsidiary Directive will not apply since the UK is no longer a member state.

It is not yet known whether EU jurisdictions may reciprocally amend their laws so that freedom from withholding tax continues to apply.

In the absence of any change, the Table indicates rates of dividend withholding tax under the UK’s treaties with all 27 EU member states. Most rates are zero but there are some exceptions.

At the UK level, dividends received are generally exempt from UK tax on a worldwide basis.

18. UK subsidiary pays dividends to EU parent company

There is no UK withholding tax on outbound dividends.

At the EU level, some EU jurisdictions give preference to dividends received from EEA subsidiaries. For example, Poland exempts from corporate income tax only dividends from EEA (and Swiss) subsidiaries. France exempts 95% of dividends, but increases this to 99% for dividends from EEA subsidiaries. These EEA benefits will no longer apply. A Polish company receiving dividends from its UK subsidiary will then be taxable (but with a credit for the underlying UK corporation tax). A French company will then be exempt on only 95% of dividends received from its UK subsidiary.

It is not yet known whether these and any other relevant EU jurisdictions may reciprocally amend their rules to give continuing preference to dividends received from UK companies now that the UK is no longer a member state.

19. UK foreign holding company: dividends from US subsidiaries

It is assumed that a UK company owns a holding company in Luxembourg that receives dividends from its US subsidiaries. It will suffer the full 30% US withholding tax rate. That is because, unless the treaty is amended, the Luxembourg company will fail the Limitation on Benefits equivalent beneficiary test of Art 24.4 Luxembourg–US treaty which requires it to be 95% owned, inter alia, by a resident of the EU (or in some cases the EEA)).

The same equivalent beneficiary provision is included, for example, in the US’s treaties with Belgium, France, Germany, Ireland, Luxembourg, Netherlands, Spain and Sweden.

It is not yet known whether these countries’ treaties with the US will be amended to extend the 95% ownership test to UK companies.

20. UK company transfers assets to EU group member

The First-tier Tribunal’s (FTT’s) 25 March 2019 decision in Gallaher Limited [2019] UKFTT 0207 (TC) held that immediate UK tax should not apply to a UK company’s transfer of shares to a Dutch group member. It would violate the right to EU freedom of establishment since a transfer to a UK group member would have been tax-neutral under s171, TCGA 1992.

The Upper Tribunal has now referred the case to the ECJ (Gallaher Limited [2020] UKUT 354 (TCC)), which will retain jurisdiction since the referral was made before the end of the transitional period on 31 December 2020.

Following the FTT decision, Sch 3ZC was added to TMA 1970 and allows UK companies making asset transfers to group companies in EEA states to defer payment of corporation tax with interest over a period of no later than five years and nine months from the end of the accounting period in which the asset transfer takes place.

There has been no change to these rules.

The Gallaher disposal took place when no instalment plan existed. The FTT therefore ruled that the entire gain should be deferred. Taxpayers in a similar situation could make the same assertion, subject to the outcome of the ECJ decision. However, this may depend on whether the relevant claim has been made before 1 January 2021.

21. EU company transfers assets to UK group member

Subject to the ECJ’s decision in Gallaher (see above), it may be possible in principle for an EU company to transfer assets to a UK group member without immediate taxation.

This seems unlikely to apply now that the UK is no longer a member state. However, it is not yet known whether EU states may reciprocally permit deferral of tax on assets transferred to a UK group member.

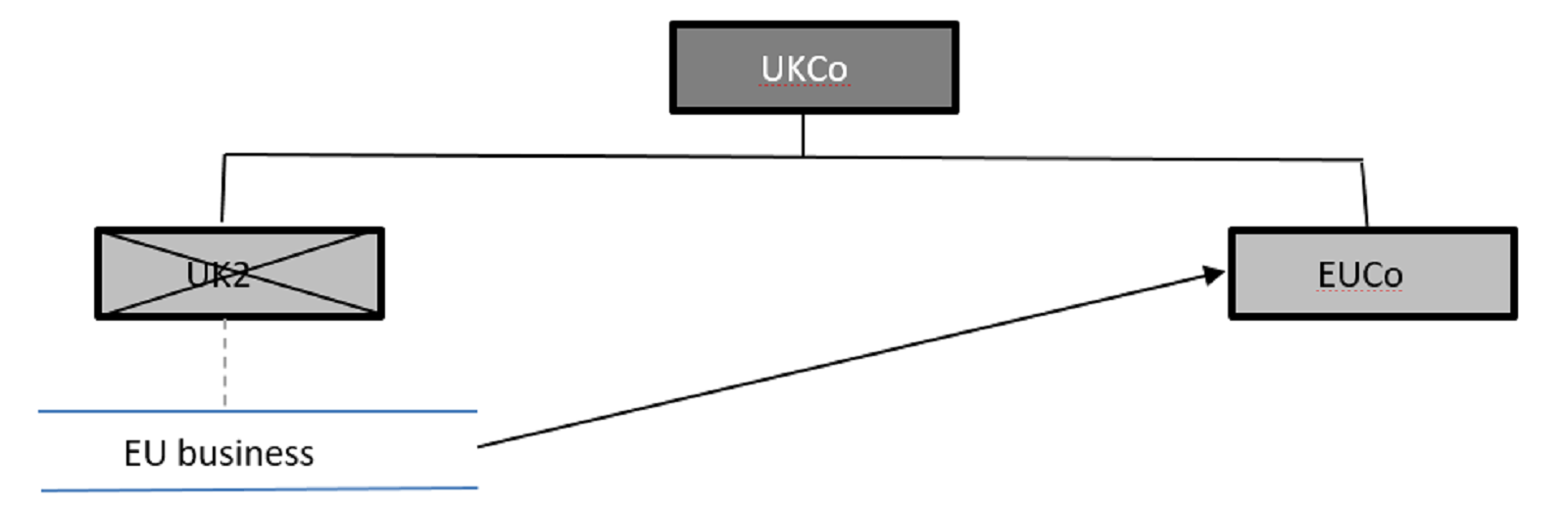

22. Mergers and reorganisations: UK outbound to EU

UK aspects

Article 2(a) of the EU Merger Directive broadly defines a merger as the dissolution of a company, with the transfer of its assets and liabilities to another company in exchange for its shares issued to the dissolved company’s shareholders.

Assuming the foreign branch exemption does not apply, s140F, TCGA 1992, which transposes Art 10.2 of the Merger Directive, provides that the gains arising on UK2’s transfer of its EU branch assets to the EU company may be mitigated. Naturally, this is the same treatment that applies under s140C to a UK company’s EU branch incorporation (see para 5).

The Regulations have now amended s140F so that it refers to each of the merging companies being resident in the UK or a member state (rather than only in a member state). The merging EU company will continue to be in that category and so the sections will continue to apply.

UKCo will have disposed of its shareholding in UK2 as a result of the merger. The gain arising, based on the market value of the shares, would normally be covered by the substantial shareholding exemption. If not, s140G, TCGA 1992, which transposes Art 7 of the Merger Directive, would apply to exempt the gain.

Once again, the Regulations have been similarly amended so that s140G continues to apply to exempt a UK company’s gains on dissolution of its shareholding in the EU company.

EU aspects

As far as mitigation in the EU branch’s jurisdiction is concerned, the position is outlined in paragraph 5 in relation to a UK company’s incorporation of its EU branch.

It is not yet known whether EU jurisdictions will reciprocally amend their equivalent transpositions of the Merger Directive to include the UK now that it is no longer a member state.

23. Mergers and reorganisations: EU outbound to UK

The merger process is the opposite of the diagram above, namely: An EU company (EU1) owns an EU subsidiary (EU2) whose sole activity is carrying on a branch business in the UK. EU2 is dissolved with its UK branch assets and liabilities transferred neutrally to a UK company in exchange for an issue of shares or debentures by the UK company to EU1.

UK aspects

The simplest process for a tax-deferred transfer of EU2’s transfer of its UK branch assets to the UK company is under s171, TCGA 1992.

However, assuming that reliance on the Merger Directive is preferable, the relevant Art 4 Merger Directive transposition is s140E, TCGA 1992. Again, the Regulations have amended s140E so that it refers to transferors and transferees resident in a member state or the UK (rather than only a member state as previously).

The section therefore continues to apply to an EU company’s dissolution of its UK branch into a UK company.

EU aspects

Assuming the EU jurisdiction does not apply a foreign branch exemption to the gain on transfer of the UK branch assets, its transposition of Art 10.2 of the Merger Directive might provide relief in theory. In practice, it appears to be ineffective because Art 10.2 provides a hypothetical credit for the UK tax that would have been payable but for the Merger Directive. Even before Brexit, this relief appears to be ineffective. UK neutrality applies to the branch transfer as a result of s171, TCGA 1992 (below), not as a result of the Merger Directive.

EU ATAD

Under the terms of the Trade and Cooperation Agreement, the UK has committed to implementing BEPS deliverables and not to dilute UK provisions on automatic exchange of information, interest limitation, controlled foreign companies and hybrid mismatch below the OECD minimum standards in place on 31 December 2020.

In compliance with ATAD, the UK has where necessary amended or implemented its rules relating to the ATAD requirements, namely; controlled foreign companies, interest limitation, exit taxation, general anti abuse rules and double tax switchover.

Conclusion

At this stage, the UK has made two meaningful changes to its corporate tax rules as a result of Brexit.

On the one hand, there has been a UK continuation into the Merger Directive (see paragraph 22). On the other hand, legislation implementing the Interest and Royalties Directive is to be repealed (see paragraphs 12 and 14). And as mentioned, the UK has withdrawn from most of DAC6.

It remains to be seen whether EU member states will reciprocate the UK’s continuing tax reliefs for EU-related areas such as group relief (where Ireland has made changes – see paragraph 15), exit tax, and merger rules. And whether the UK may make further amendments to its rules to exclude the EU should reciprocity not be forthcoming.

Acknowledgements

The author would like to thank the following colleagues for their contributions to the article:

- Frank Behrenz, Managing Director, Crowe Kleeberg gmbh

Behrenz@crowe-kleeberg.de - Kevin Doyle, Partner - Tax, BDO Ireland

kdoyle@bdo.ie - Hans.Nordermeer, Partner International Tax Services, BDO BV, Rotterdam

hans.noordermeer@bdo.nl - Marc Verbeek, Tax Partner, Crowe Brussels

marc.verbeek@crowe.be - Ambrogio Picolli, Senior Partner, Picolli, Difino & Associati

ambrogio.picolli@pdatax.com

Tax Faculty

This guidance is created by the Tax Faculty, recognised internationally as a leading authority and source of expertise on taxation. The Faculty is the voice of tax for ICAEW, responsible for all submissions to the tax authorities. Join the Faculty for expert guidance and support enabling you to provide the best advice on tax to your clients or business.

TAXguide 09/21

PDF (21kb)

Download EU withholding taxes on payments to UK affiliates post-Brexit

Download