Cutting the basic rate of income tax to 19% in 2024 could come at a cost, as Lindsey Wicks, Technical Editor, Tax Faculty, explains.

Conservative party leadership candidates have announced competing plans to cut tax rates. In the Spring Statement on 23 March, former Chancellor Rishi Sunak announced his plan to cut the basic rate of income tax from 20% to 19% from 2024. Table 3.1 in the Spring Statement estimates this policy measure will cost £5.3bn in 2024/25, rising to around £6bn in 2025/26 and 2026/27.

The Spring Statement Tax Plan, published the same day, says:

- alongside tax cuts, we want to make the tax system simpler, fairer and more efficient;

- there are more than 1,000 tax reliefs and allowances in the tax system;

- they play an important role, but can also be costly and complex; and

- we have already reformed some reliefs and allowances and will look to go further ahead of 2024.

History of reducing reliefs

One of the first roles of the Office of Tax Simplification (OTS) when it was established in July 2010 was to undertake a Tax reliefs review. The review identified 1,042 reliefs and examined 155 in detail. Of the 155 reliefs examined, the OTS recommended that:

- 54 remain unchanged;

- 37 be looked at in more detail;

- 47 be abolished on the basis that they were either time expired, there was no ongoing policy rationale, the value was negligible, or the benefit was outweighed by the administrative burden; and

- 17 be simplified.

The government responded by setting out to abolish a total of 43 reliefs at Budget 2011. In a letter to the OTS dated 9 May 2011, Exchequer Secretary David Gauke wrote: “The above decisions in the Budget draw a line under the OTS’s work on reliefs and the Chancellor and I will not be expecting further work in this area.”

The OTS published another list of tax reliefs as at July 2014. By that time, the number of reliefs had grown to 1,140. As several taxes have been added to the tax code since 2014, the number of tax reliefs will also have grown.

The current position

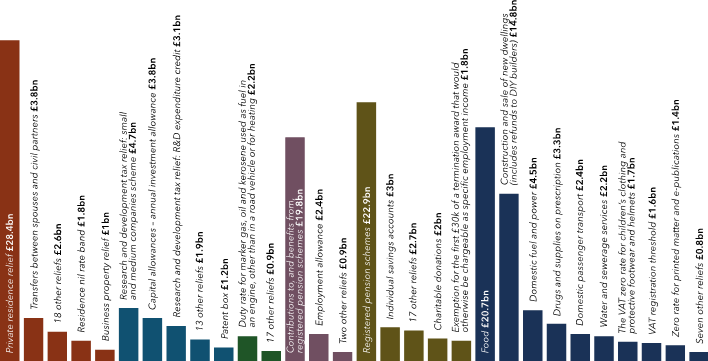

HMRC publishes statistics about tax reliefs. The latest main report is dated December 2021. The December 2021 release showed the largest value reliefs within each tax head in 2020/21 (see graph).

The presentation of the data reported by HMRC is also evolving in response to recommendations made by the Public Accounts Committee (PAC) in its July 2020 report Management of tax reliefs. PAC concluded: “HMRC and HM Treasury need to markedly improve their reporting on the cost, beneficiaries, and impact of tax reliefs in order to give Parliament the information it needs to scrutinise the value for money of these schemes.”

In response, HMRC published a list of all non-structural tax reliefs available to taxpayers at November 2021 together with the policy objective for each relief. Non-structural tax reliefs are those designed to achieve economic or social objectives. Structural reliefs are integral parts of the tax structure, like the personal allowance.

In addition to the cost and complexity mentioned in the Tax Plan, hopefully any upcoming review of tax reliefs will also consider their impact and value for money.

Editor’s note: On 22 July 2022, the Treasury Committee launched an inquiry to examine the tax reliefs available to both individuals and businesses, with a focus on the overall impact of tax reliefs on the UK economy.

About the author

Lindsey Wicks, Technical Editor, Tax Faculty