“The description ‘chartered accountants’ is not one that just any firm can adopt,” explains Dean Neaves, Senior Manager in the Quality Assurance Department at ICAEW. “There are strict rules around use of the title.”

These rules (the Use of the ‘Chartered Accountants’ description) set out when firms can describe themselves as ‘chartered accountants’.

If you’re a chartered accountant engaged in public practice as a sole practitioner, you can automatically use the term. However, outside these parameters, the regulations get a little more complex.

The most common mistake people tend to make is failing to take account of the ownership structure of their firm.

“There might be a firm where a chartered accountant for all intents and purposes runs that firm, but there are other shareholders and directors who don’t have an active role,” explains Dean.

“The chartered accountant might think: ‘I run the firm; therefore, we can describe ourselves as ‘chartered accountants’, but what they’ve omitted to consider is that there are other people in the background – other directors or shareholders.”

“This is where they could fall foul of the regulations,” he says. “And that's probably where most firms get caught out.”

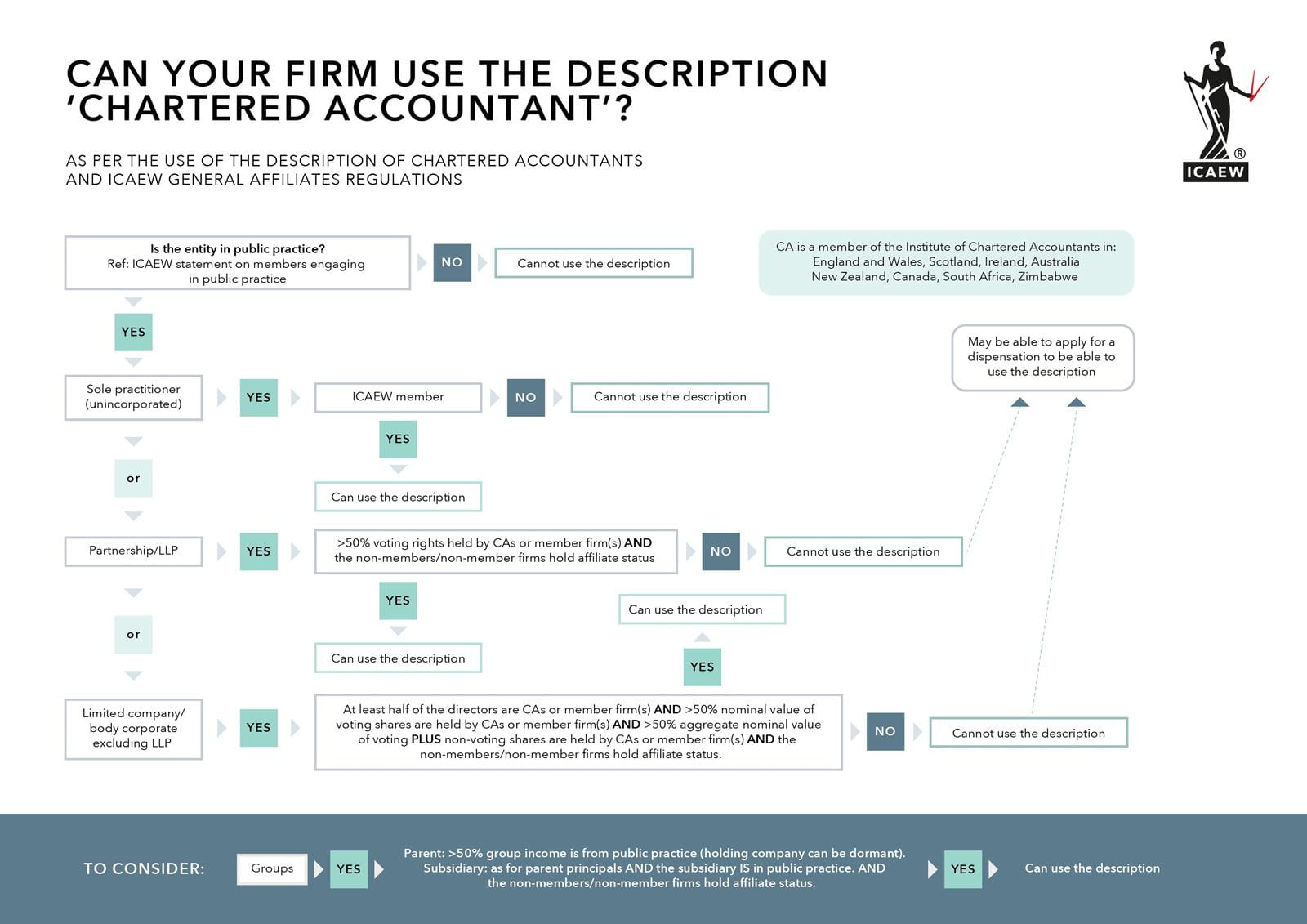

To help you understand how your firm’s ownership structure affects its use of the description, ICAEW has produced a simple flow chart. There is also a technical helpsheet explaining what the regulations mean for your firm.

Falling foul

To use the ‘chartered accountants’ description, a partnership or limited liability partnership (LLP) must be engaged in public practice and chartered accountants must hold more than 50% of the voting rights.

If the firm is a limited company, it must be engaged in public practice and at least 50% of its directors must be chartered accountants. In addition, chartered accountants must hold more than 50% of the nominal value of the voting shares and more than 50% of the aggregate nominal value of both the voting and non-voting shares.

“One of the main areas where we see firms falling down is where a chartered accountant and their spouse, who is not a chartered accountant, share ownership of a partnership or limited company 50:50,” says Dean.

“In that case, you’re not automatically allowed to use the term ‘chartered accountants’,” he explains. “You might think it’s okay because your spouse is not active or involved in the business, and you, as the chartered accountant, are in control. But you’re still falling foul of the regulations, so you need to think carefully about your ownership structure.”

“If you’re a limited company, it's not only the voting rights you must consider, but the aggregate of the voting and non-voting rights also needs to exceed 50% to allow you to use the description,” says Dean. “Not so many of our firms fall foul of that aspect, but some do, so it's important to understand the rules.”

“Also, if you’ve got a complex group structure with a number of holding companies, or a company or LLP with corporate members, we can help you decide whether you can use the term or need a dispensation to do so,” added Suzy Patmore, Senior Case Manager.

Affiliate status

In the scenario of the firm with a 50:50 split in the shareholding between a chartered accountant and non-chartered accountant spouse, one option might be to split the shareholding to 51:49.

“But, if the spouse is also, for example, a director, they will have to obtain ICAEW affiliate status to enable the firm to use the description,” says Dean.

“This is another common area where firms fall down,” he explains. “They don't apply for the affiliate status where they need it.”

If a principal in a firm is not a chartered accountant themselves, they need to obtain affiliate status. “Again, firms may think they’re okay, for example if the other director is a member of another accountancy body,” says Dean.

“But if the other director is not a chartered accountant, that director still requires general affiliate status with us to be able to use the description and it's a common area where firms get it wrong.”

“If you’re not sure of your firm’s position in meeting the criteria, or have any questions about the need to apply for affiliate status, please contact our technical helpline and they will be able to advise you." says Suzy.

Applying for a dispensation

If your firm does not satisfy the criteria to use the description, you may be able to obtain a dispensation. In such cases, you will need to submit an application form, together with relevant governance documents.

For structures with a parent and subsidiary, please also complete Appendix A in respect of the parent entity. If there are holding companies between the trading subsidiary and the ultimate parent, please complete an Appendix A for each entity. For LLPs with corporate principals, please complete a separate Appendix A for each principal.

In deciding whether to grant a dispensation, the ICAEW Regulatory Board will consider whether the firm’s accountancy or reserved services are under the direction and control of chartered accountants. The decision will be based on a firm’s specific circumstances.

“When considering a dispensation, we examine the firm/group structure and governance documents in detail” explains Suzy. “The key thing we’re looking at is to confirm that chartered accountants have control over the accountancy and reserved services and have control over decision making at directors’/members’ meetings, as well as meetings of shareholders and any management board.”

“So, it might be you don't strictly meet the requirements, but you can show that the chartered accountant always has control over the decisions being made, for example through the articles of association or a shareholder agreement.”

Also, firms need to remember that a dispensation is not a one-off arrangement. Firms often forget to tell us when they make changes after a dispensation has been granted, but this is no different to the requirement to notify us of any changes.

Changing circumstances

There are cases where firms have been using the title correctly for many years, but then change their structure and don’t realise this has consequences for their description as ‘chartered accountants’.

“When making any structural changes, you need to think about how that could affect your entitlement to use the description,” says Dean.

One example could be changes due to partners retiring and bringing in new partners who might not be chartered accountants.

“In your own mind, you might be thinking nothing has really changed,” explains Dean. “But if, for example, you had three ICAEW chartered accountant partners, and one retires and you bring in an unqualified principal, it might not occur to you that you need to do anything. But, to comply, the new principal needs affiliate status and if they haven't got that, you fall foul of the rules.”

“So, think about what that means for affiliate status and for your voting rights,” he advises. “Also consider your use of the title when you're acquiring, or merging with, new firms, or when you’re altering your structure to add corporate principals or holding companies.”

Ask for advice

The rules on using the description have been in place for a long time, and the consequences of getting it wrong can be serious.

“Under the Use of Description Chartered Accountants Regulations, firms do have a three-month grace period to fix any issues arising, as long as they meet certain specified conditions,” says Suzy.

“But, if your firm falls foul of the regulations and continues to use the description ‘chartered accountants’ when it shouldn’t, the case could be referred to the Practice Assurance Committee and be subject to a penalty,” emphasises Dean.

“We’re still seeing too many firms slipping up,” he says. “So, if you have any questions or doubts about your eligibility in this context, or are considering changes to your structure, get in touch with our helpline so we can help you address these in a timely way.”

Five common mistakes

- Failure to obtain affiliate status for an individual who is not a chartered accountant or a corporate principal that is not a member firm

- Equal split of voting rights between chartered accountant and non-chartered accountant principals

- Introduction of multiple layers of ownership resulting in non-compliance with the regulations

- Chartered accountant directors outnumbered by non-chartered accountant directors

- Failure to take into account both voting and non-voting shares